Computer-Aided Design (CAD) Market

- November, 2023

- Technology, Media, and Telecom

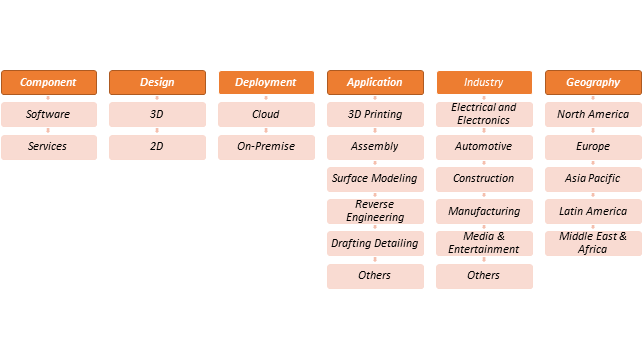

Computer-Aided-Design (CAD) Market Size Analysis, by Component (Software and Services), by Design (3D & 2D), by Deployment (Cloud, On-Premise), by Application (3D Printing, Assembly, Surface Modeling, Reverse Engineering, Drafting, Detailing), by Industry (Electrical and Electronics, Automotive, Construction, Manufacturing, Media & Entertainment) and by Region); Growth Trends and Forecasts (2024 - 2030)

As per Intent Market Research, the Computer-Aided-Design (CAD) Market size is expected to grow from USD XX billion in 2022 to USD XX billion by 2030, at a CAGR of XX% during the forecast period (2024-2030). The Computer-Aided-Design (CAD) Market is segmented by Component, Design, Application, Deployment, Industry, and Region.

Computer-Aided Design is a technology that utilizes computer software and hardware to assist in the creation, modification, analysis, and optimization of designs and drawings for various applications, such as engineering, architecture, manufacturing, and product development. CAD software allows designers, engineers, and architects to create detailed and precise two-dimensional (2D) or three-dimensional (3D) models of objects, structures, or systems. CAD software offers a wide range of tools and features for drawing, drafting, and modeling, to improve the design process by increasing accuracy, reducing errors, and saving time. In conclusion, CAD plays a crucial role in various industries, helping professionals create and refine designs with greater precision and flexibility than traditional manual drafting methods.

Computer-Aided-Design (CAD) Market Dynamics

The CAD market is witnessing robust growth due to the increasing adoption of 3D printing technology. This innovative approach revolutionizes product design and prototyping, making CAD software an indispensable tool for engineers and designers. The market for CAD software experiences additional

momentum through its widespread adoption across diverse industries such as automotive, aerospace, and architecture. This adoption is driven by its capacity to enhance precision, efficiency, and creativity in both design and manufacturing processes.These factors collectively drive the CAD market’s prominence and continued advancement. Technological advancements, such as the integration of artificial intelligence in the CAD market, drive its growth. Despite this, the high cost of the software serves as a hindrance to the CAD market.

Computer-Aided-Design (CAD) Market Segment Insights

Computer-Aided-Design (CAD) Component Insights

Computer-Aided-Design (CAD) market segmentation based on components, includes software and services. The CAD software market held the majority of the share in FY2023 as it serves as a sophisticated tool for creating design documentation and mechanical design. It automates the process of mechanical design, streamline and enhance the manufacturing and development processes. The CAD software generates comprehensive product diagrams and provides vital information about materials, tolerances, dimensions, and other essential details.

Computer-Aided-Design (CAD) Design Insights

Computer-Aided-Design (CAD) market segmentation based on design, includes 3D and 2D. The 3D design market held the majority of the share in FY2023. As 3D design precisely represents and visualizes objects using a collection of points in three dimensions on the computer, it finds applications for architects, mechanical engineers, electrical engineers, interior designers, and civil engineers.

Computer-Aided-Design (CAD) Deployment Insights

Computer-Aided-Design (CAD) market segmentation based on deployment, includes cloud and on-premise. The cloud market held the majority of the share in FY2022 due to the growing adoption of cloud solutions as compared to on-premise segment. Cloud solutions save significant hardware buying costs and ensure automatic updates for software installed in the cloud, enabling users to work on the latest CAD software versions.

Computer-Aided-Design (CAD) Application Insights

Computer-Aided-Design (CAD) market segmentation based on application, includes 3D printing, assembly, surface modeling, reverse engineering, drafting and detailing. The 3D printing segment held the majority of the share in FY2023 due to its pivotal role in designing 3D printable components. CAD is an essential component of 3D printing as CAD file tells the 3D printer how much material it needs to deposit and where the material should be deposited. Without a CAD file, a 3D printer won’t have the instructions it needs to build a prototype or product.

Computer-Aided-Design (CAD) Industry Insights

The Computer-Aided Design (CAD) market is segmented by industry, including electrical and electronics, automotive, construction, manufacturing, healthcare, media and entertainment, among others. There is a wide variety of sectors in which CAD is used on a very regular basis, especially in engineering, civil, or aeronautics, architects of the automotive industry. CAD allows companies to preview the final product and play interactively with different designs, without the need to create a large number of prototypes, thereby improving efficiency and productivity.

Computer-Aided-Design (CAD) Geography Insights

Computer-Aided-Design (CAD) market segmentation based on geography, includes North America, Europe, Asia-Pacific, Latin America, Middle East and Africa. North American market is anticipated to register high growth throughout the forecast period. The market growth is attributed to the rising adoption of cloud-based CAD software by various industries. The market growth in the region is fueled by the presence of key players such as Autodesk, PTC, Dassault Systemes, and SolidWorks.

Key Developments

The market for Computer-Aided-Design (CAD) is characterized by intense competition due to the presence of numerous international and domestic players. The CAD market, in particular, is dominated by key players such as PTC, Nanosoft, VariCAD, Siemens, Autodesk, Fujifilm, Trimble, Dassault, Graebert GmbH, Cadonix, and Caddie Software, amongst others. These industry leaders are primarily focused on acquiring smaller players and innovating their product lines to cater to changing consumer preferences and needs. The success of players in the CAD market is heavily dependent on their ability to adapt to changing market trends and consumer preferences.

- In May 2023, PTC announced its Creo software as a service (SaaS) CAD solution and the release of the tenth version of its Creo CAD software.

- In November 2023, Toray Advanced Computer Solution introduced a fashion CAD software package with 2D and 3D capabilities into the US market.

- In April 2021, Autodesk, Inc. acquired Up Chain, Inc., a Product Data Management (PDM), Product Lifecycle Management (PLM), instant-on, and cloud-based solutions provider, to offer value for suppliers, manufacturers, engineers, and other product stakeholders.

- In November 2020, R2021x introduced the new 3DEXPERIENCE WORKS portfolio, bringing cloud benefits to the market and SOLIDWORKS customers.

- In March 2023, VariCAD 2023-“2.0” a new version of VariCAD that contains updates in OpenGL settings. The company also updated the behavior of 2D objects, print settings, 3D object dragging, and configuration of usage of two monitors.

Computer-Aided-Design (CAD) Market: Scope of the Report

The report provides key insights into the computer-aided design (CAD) market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The focus extends to market drivers, restraints, opportunities, and the analysis of key players and the competitive landscape within the Computer-Aided Design (CAD) Market.

Computer-Aided-Design (CAD) market are segmented by Component (Software and Services), by Design (3D & 2D), by Application (3D Printing, Assembly, Surface Modeling, Reverse Engineering, Drafting Detailing and Others), by Deployment (Cloud, On-Premise), by Industry (Electrical and Electronics, Automotive, Construction, Manufacturing, Media & Entertainment, and Others), and Geography (North America, Europe, Asia- Pacific, Latin America ,Middle East and Africa). The report offers the market size and forecasts for the Computer-Aided Design (CAD) Market in value (USD billion) for all the above segments.

Report Scope

Report Features | Description |

Market Value (2023) | USD XX Bn |

Forecast Revenue (2030) | USD XX Bn |

CAGR (2024-2030) | XX % |

Base Year for Estimation | 2023 |

Historical Period | 2022 |

Forecast Period | 2024-2030 |

Report Coverage | Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

Segments Covered | By Component (Software and Services), by Design (3D & 2D), by Application (3D Printing, Assembly, Surface Modeling, Reverse Engineering, Drafting Detailing), by Deployment (Cloud, On-Premise), by Industry (Electrical and Electronics, Automotive, Construction, Manufacturing, Media & Entertainment) |

Regional Analysis | North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

Competitive Landscape | Bentley Systems, PTC, Nanosoft, VariCAD, Siemens, Autodesk, Fujifilm, Trimble, Dassault, Graebert GmbH, Cadonix, and Caddie Software, amongst others |

Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

Purchase Options | We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

Table of Contents

- Introduction

- Study Assumptions and Market Definition

- Scope of the Study

- Research Methodology

- Executive Summary

- Market Dynamics

- Market Growth Drivers

- Increasing Adoption of 3D Printing Technology

- Widespread Use of CAD Software Across Various Industries

- Market Growth Challenges

- High Cost of CAD Software

- Market Growth Opportunities

- Technological Innovations

- Market Growth Drivers

- Market Outlook

- Overview (Industry Snapshot)

- Value Chain Analysis

- Supply Chain Analysis

- Porter’s Analysis

- PESTLE Analysis

- Regulatory Framework

- Technology Roadmap

- Patent Analysis

- Computer-Aided-Design (CAD) Trends

- Computer-Aided-Design (CAD) Market Opportunity & Funding Analysis

- Market Segment Outlook

- Segment Synopsis

- By Component Type

- Software

- Services

- By Design Type

- 3D

- 2D

- By Deployment Type

- Cloud

- On-Premise

- By Application Type

- 3D Printing

- Assembly

- Surface Modeling

- Detailing

- Others

- By Industry Type

- Electrical and Electronics

- Healthcare

- Automotive

- Manufacturing

- Media & Entertainment

- Others

- Regional Outlook

- Global Market Synopsis

- North America

- North America Computer-Aided-Design (CAD) Market Outlook

- USA

- USA Computer-Aided-Design (CAD) Market, By Component

- USA Computer-Aided-Design (CAD) Market, By Design Type

- USA Computer-Aided-Design (CAD) Market, By Deployment Channel

- USA Computer-Aided-Design (CAD) Market, By Application Channel

- USA Computer-Aided-Design (CAD) Market, By Industry Channel

*Note: Cross-segmentation by segments for each country will be covered as shown above.

- Canada

- Europe

- Europe Computer-Aided-Design (CAD) Market Outlook

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- Asia-Pacific Computer-Aided-Design (CAD) Market Outlook

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

- Latin America

- Latin America Computer-Aided-Design (CAD) Market Outlook

- Mexico

- Brazil

- Rest of Latin America

- Middle East & Africa

- Middle East & Africa Computer-Aided-Design (CAD) Market Outlook

- Saudi Arabia

- UAE

- Rest of MEA

- Competitive Landscape

- Market Share Analysis

- Volume Output Analysis

- Company Strategy Analysis

- Competitive Matrix

- Company Profiles

- Autodesk

- Company Synopsis

- Company Financials

- Product/Service Portfolio

- Recent Developments

- Analyst Perception

- Autodesk

*Note: All the companies in the section 9.1 will cover same sub-chapters as above.

- Bentley Systems

- Caddie Software

- Cadonix

- Dassault

- Fujifilm

- Graebert

- Nanosoft

- PTC

- Siemens

We specialize in providing syndicated market research reports that are highly sought after. We can also provide tailored customization to meet unique requirements. Our commitment exceeds limits as we empower clients with tactical and strategic support for well-informed business decisions and consistent success. Our experienced team continuously pushes the boundaries in market research, focusing on emerging markets with unwavering dedication. We provide comprehensive insights into global, regional, and country-level data, leaving no aspect hidden in any target market. Our market forecasts will benefit you in the following ways:

- Grasp the market opportunity for new products and services.

- Distinguish between emerging, maturing, and declining market opportunities.

- Build your business plans and strategies on factual data, not conjecture.

We place a strong emphasis on ensuring that each step of the research process is executed with meticulous attention to detail, aiming for minimal errors, and maintaining complete transparency throughout. We leverage multiple research methodologies to conduct our studies:

Data Collection and Interpretation

As research analysts, we prioritize accuracy and in-depth analysis, employing a diverse array of sources. These sources can be categorized into three main channels:

After collecting data from secondary and primary sources, we carefully examine the following to establish base numbers:

- Analyzing company revenues and their corresponding market share (involving the analysis of revenue data released by publicly listed manufacturers)

- Deriving market estimates by inspecting the primary market as well as its complementary markets

- Presenting key findings based on major segments and outlining top strategies by major players

- Analyzing the dynamics of the market, including drivers, opportunities, restraints, and challenges

- Assessing macro-economic factors and the regulatory framework influencing the market

- Evaluating market investment feasibility, conducting PEST and PORTER’s Five Force analyses

- Performing impact analysis of drivers and restraints, and conducting industry chain and cost structure analyses

- Creating opportunity maps, analyzing market competition scenarios, and conducting product life cycle analysis

- Identifying opportunity orbits and manufacturer intensity maps

- Analyzing major companies’ sales by value to gain comprehensive insights into the market

Market Sizing & Forecasting

We use both bottom-up and top-down approaches to segment and estimate quantitative aspects of the market. Our research reports also present data triangulation, which examines the market from three different perspectives.

- In the Bottom-Up Approach, we begin by collecting data at the micro-level, which includes individual data points and small samples. We aggregate and analyze the data to form broader conclusions and insights. We also include the market share of the vendors, which provides a granular view of the key players in the market, starting from the ground up. This approach is useful for industries with diverse segments and varied customer preferences. It is effective in exploratory research when we have little pre-existing knowledge and allows unexpected patterns and trends to emerge from data, leading to the creation of new theories.

- In the Top-Down Approach, we start with a macro-level view of the market, including the overall market size and industry trends. We analyze large-scale data and market indicators to make general assumptions. This approach provides a broader perspective and identifies the main market drivers and trends. We then narrow down the focus as data is scrutinized and specific segments are explored. This approach is effective for quickly assessing overall market potential and opportunities in various regions.

Value Chain-Based Sizing & Forecasting:

Consumer Behavior:

- Usage Rates and Patterns: Collect and analyze data on current product usage. It assists in product development and marketing strategies. Moreover, it also helps determine substitute rates.

- Market Penetration by User Base: Estimate the total market size and assess success in engaging potential consumers. Identify unmet needs and growth opportunities to enhance market penetration.

- Analyze market share, customer satisfaction, and preferences, providing insights into competitive positioning.

Historical/Empirical Data:

- Set initial figures to examine upcoming trends and to make well-informed decisions..

- Utilize exponential smoothing to forecast how a product might perform in the future, considering its trends and patterns over time.

Trend Analysis:

Conduct trend analysis using year-trending models to study historical data and identify patterns and trends that can influence future product penetration. This analysis aids in making proactive decisions and adapting strategies to capitalize on emerging opportunities and overcome challenges in the market.

Data Validation:

- Engage with in-house market analysts and industry experts to validate all collected data and cross-check it through calls or face-to-face interviews.

- Conduct thorough quality checks to validate the data included in the report and contact various members of our network to verify the data’s authenticity, resulting in error elimination and eradication of doubtful information.

- Correlate with standard KIPs to gain insights into future trends.

- Conduct multi-tier data validation through external thought leaders, market analysts, subject matter experts, comparative analysis, and review data collection instruments.

Continuous Monitoring: Final Report and Presentation

- Our team collaborates with industry experts to finalize and validate data. We utilize advanced data analysis models to generate valuable insights. Our integrated report comes with robust analytics and advanced visualization capabilities to ensure consistency and efficiency. We implement a standardized content management approach, common tagging, and taxonomy structure for seamless information connectivity. We offer comprehensive market and company views to facilitate easy and accurate comparisons. Our goal is to provide our clients with exceptional analytical resources for a competitive edge. We empower them to transform data into strategic insights for innovation and growth.