Energy & Power

The energy sector produces, refines and transports fossil fuels such as coal, oil and gas. The power industry covers the generation, transmission, distribution of electric power to the public and industry. These companies also convert hydro, geothermal, wind and solar energy to electricity.

The growing emphasis on industrialization for the economic growth of the countries and regions, energy & power sector plays a critical role. World electricity demand remains resilient in 2022 amid the global energy crisis triggered by Russia’s invasion of Ukraine. Post the invasion, the demand increased by mere 2% whereas during the period 2015 – 2019, the electricity demand was increased by 2.4% average growth rate.

As per IEA, Global electricity generation from both natural gas and coal expected to remain broadly flat between 2022 and 2025. Renewables and nuclear energy will dominate the growth of global electricity supply over the next three years, together meeting on an average more than 90% of the additional demand. The rising prices of electricity and greater focus on clean energy are transforming the energy & power industry.

In 2022, the global power generation was dominated by China (8,833 TWh), India (1,802 TWh) and the United States (4,510 TWh), with significant increases in Indonesia (+7.9%) and Saudi Arabia (+5.9%).

Greater Focus on Clean Energy Sources

The energy security concerns sparked by Russia’s invasion of Ukraine mounted; doubts arose regarding the feasibility of making meaningful progress on the energy transition. However, the several governments and industry stakeholders have promoted the adoption of clean energy. Global renewables generation reached a new high of 8.4 terawatt-hours in 2022, with an 8% jump in power demand compared to the previous year.

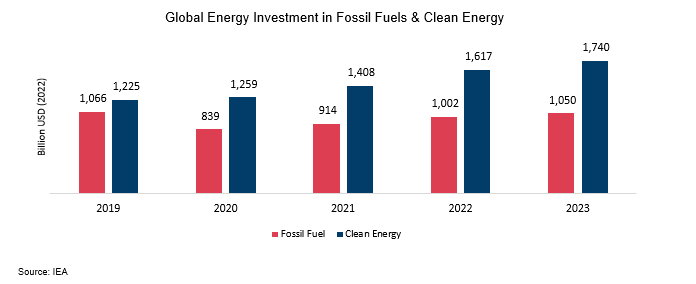

Zero-carbon technologies reached 46% of global installed capacity in 2023, up from 33% in 2012. Wind and solar accounted for 80% of the 424 GW of new capacity installed last year. As a result, these two forms of renewables now make up 12.5% of global generation and more than a quarter of global capacity. In addition, there is increasing investment in clean energy to achieve IEA’s “The Net Zero Emissions by 2050 Scenario (NZE Scenario)” with the total investment expected to cross over USD 1.7 trillion by the end of 2023, as per IEA.

According to IEA, renewables estimated to be the largest source of global electricity generation by early 2025, surpassing coal. In the power mix, renewable energy’s market share is projected to increase by 10% over the forecast period (2022-2027), reaching 38% by 2027.

In 2022, global electricity generation by hydropower was accounted at 4334.19 TWh, a mere 1.1% higher than in 2021; whereas wind accounted for 2,104.84 TWh (+13.5%), solar TWh 1,322.62 (+24.9%) and other renewables 776.86 TWh (+3.4%).

Digital Twin Transforming Operational Effectiveness of Oil & Gas Sector

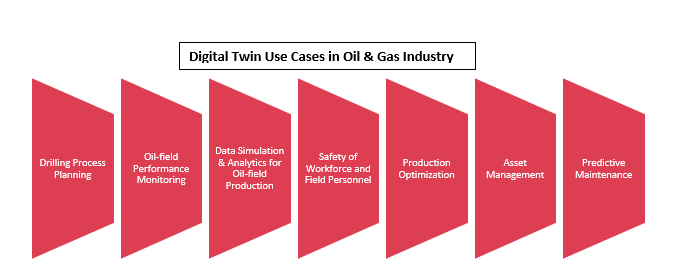

Digital twin, a virtual model designed to accurately reflect a physical object, provides significant leverage to the oil & gas companies. It provides a real-time view of the operational parameters of the equipment and the equipment operator working in the field. Oil & gas is the asset and operation intensive industry with monitoring, maintaining, and managing the equipment and processes is of utmost importance. With digital twin and smart data systems, oil & gas industry players can potentially save from 10% to 15% on total decommissioning project cost.

Digital Transformation of Upstream & Midstream Sectors

COVID-19 has enforced oil & gas sector to invest in digital transformation. Upstream oil exploration, drilling, and excavation are capital sensitive processes and failure in machinery impacts badly to the project. Hence, growing number of oil & gas companies are investing in AI, cloud, and IoT. With such integration, oil companies have hugely reduced their risk of machinery failure, oil or gas leakage.

Midstream transport is the crucial link between upstream and downstream processes. Transparency and speed are important factors for oil & gas transport. With the growing interest in clean hydrogen that can be used in power generation, energy storage, and for decarbonization, midstream companies are adopting automation such as IoT, real-time remote monitoring, and reduced downtime.

Advancement in Energy Storage Technology to Improve Productivity

Long-duration energy storage (LDES) technologies are essential for harmonizing fluctuating electrical facilities with unpredictable consumer demand and fortifying the power system against adverse weather conditions. Liquid air energy storage (LAES) is a scalable thermo-mechanical preservation method. When wind and solar renewable energies are abundant, LAES technologies conserve energy and discharge it when electricity demand is high.

Moreover, research institutes are designing supercapacitors for higher energy storage capacity. Biodegradable polymers show promise for future green supercapacitors. MIT engineers create an energy-storing supercapacitor from cement, carbon black, and water that could provide cheap and scalable energy storage for renewable energy sources.

Decarbonization for Sustainable Future

Decarbonization is the reduction of carbon dioxide emissions with low carbon power sources, achieving a lower output of greenhouse gasses into the atmosphere. Decarbonization is crucial for attaining global climate change challenge. The world achieved a decarbonization rate of just 2.5% in 2022, which means a year-on-year decarbonization rate of 17.2% is now required to limit average global warming to 1.5°C above pre-industrial levels. That is seven times faster than at present. Emission intelligence plays a big role in decarbonization and enterprises are leveraging AI to build carbon emission tracking software for organizations to monitor their CO2 emissions.

Our consultants at Intent Market Research possess understanding of the evolving energy & power sector and can provide holistic view on the future industry growth scenarios.