Aerospace & Defense Industry

The aerospace and defense industry is involved in the manufacturing and services associated with aircraft, ships, spacecraft, weapon systems, and defense equipment. The aerospace and defense industry has undergone a significant transformation owing to several technological innovations, including AR/VR, big data, the Internet of Things (IoT), AI, and the implementation of stricter environmental regulations.

The aviation industry is driven by various factors including growing passenger traffic, growth in emerging markets, and innovation in airline business models. The space sector is experiencing heightened demand with increasing demand for small satellite networks. The defense industry has also grown significantly owing to the rising geopolitical unrest and rising global defense spending.

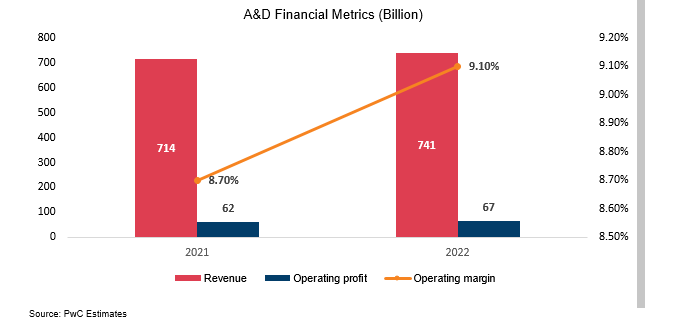

According to the PwC estimates, in 2022, the aerospace and defense industry generated a revenue of USD 741 billion, about 3% higher than in 2021, and an operating profit of USD 67 billion, 8% more in comparison to 2021. Furthermore, the world’s top ten defense companies accounted for USD 485.5 billion in 2021, with an average revenue growth of 7.1%.

Increasing Number of Satellite Launches

There has been a significant rise in the number of satellite launches owing to the development of new technologies, such as reusable launch vehicles, SmallSats, and CubeSats. According to NASA, there was an average of about 140 SmallSats launched per year from 2013 to 2017. In contrast, there were around 1700 SmallSats per year from 2017 to 2021.

A significant increase in satellite launches is due to the decline in the cost associated with the launch of the satellites as well as robust advances in the miniaturization of powerful satellites. According to McKinsey research, the price of heavy launches to low-Earth orbit (LEO) has fallen from USD 65,000 per kg to USD 1,500. According to the United Nations Office for Outer Space Affairs (UNOOSA), 11,330 satellites were orbiting the Earth as of June 2023, 37.94% more compared to January 2022.

Satellite internet has become a viable substitute for broadband services and communication in recent years. There have been significant investments made by private companies to establish satellite internet networks. For instance, Amazon teamed up with Blue Origin, Arianespace, and United Launch Alliance (ULA) in April 2022 to launch up to 83 broadband satellites as part of its Project Kuiper initiative.

Increasing Popularity of Space Tourism

There has been a meteoric evolution in space tourism in recent years, owing to the emergence of private companies investing in the space tourism market. Several companies such as SpaceX (USA), Orbital Assembly Corporation (USA), Voyager Space (USA), Nanoracks (USA), Axiom Space (USA), Zephalto (France) have ventured into commercial space tourism in recent years. SpaceX successfully conducted its first space tourism mission to the International Space Station in April 2022. In another case, a Russian film crew shot the first movie in orbit in October 2022 during a 12-day filmmaking session aboard the International Space Station (ISS).

In August 2021, Battleface, a travel insurance company, launched a civilian space insurance plan. This further signifies the increasing popularity of space tourism. The popularity of space hotels and stratospheric balloon trips has grown in the last several years. Above Space (USA), a space station manufacturing company, is currently building two space hotels that will orbit Earth, called Pioneer Station and Voyager Station. In September 2022, Voyager Space came in partnership with Hilton to design astronaut facilities for the private space station.

Furthermore, there have been increasing investments by NASA to develop commercial space stations as well. NASA has funded about four companies to develop commercial space stations. This includes Blue Origin with USD 130 million, NanoRacks with USD 160 million, Northrop Grumman Systems Corporation with USD 125.6 million, and Axiom Space with USD 140 million contracts. Thus, the increasing popularity of space tourism is anticipated to drive the growth of the aerospace industry.

A Shift Towards Sustainable Aviation Fuel (SAF)

SAF is a liquid fuel used in commercial aviation to reduce CO2 emissions. It is anticipated that SAF can reduce emissions by up to 80%. It can be produced from several sources including waste oil and fats, green and municipal waste, and non-food crops. According to the International Air Transport Association (IATA), SAF could contribute around 65% of the reduction in emissions needed by aviation to reach net zero in 2050.

In recent years, there has been exponential growth in the production of SAF. According to the IATA, the SAF output in 2022 accounted for about an estimated 300 million liters (240,000 tonnes). Furthermore, according to the IATA, as of June 2023, over 130 relevant renewable fuel projects have been announced publicly across 30 countries. These projects represent an estimated total renewable fuel capacity of over 69 billion liters (55 million tonnes) by 2028, from which SAF output will be derived.

Rising Adoption of 3D Printing in the A&D Industry

Technological advances in 3D printing capabilities have led to a significant rise in adoption for its application in the A&D industry. 3D printing can significantly enhance the defense industry by speeding up the pace of moving from the prototype to the assembly.

3D printing has immense potential for military applications ranging from the production of weapons, parts, tools, and more. For instance, in September 2021, the US Army awarded a contract to General Lattice (USA), a computational design and digital manufacturing company, to develop a 3D-printed combat helmet with improved energy absorption. 3D manufacturing has also found a rise in application in manufacturing replacement parts and tools for military equipment.

Despite the potential benefits of Additive Manufacturing (AM), there are several challenges including size and scalability, high material costs, a narrow range of materials, limited multi-material printing capabilities, and consistency of quality. However, advancing 3D printing technology and materials science are likely to address these limitations and further drive the adoption of 3D printing in the A&D industry.

Our consultants at Intent Market Research can combine market data and businesses in the aerospace & defense industry to offer a holistic view of the market to make data-driven strategic decisions.