Chemicals & Materials

Chemicals & Materials Industry Outlook

The chemicals & materials industry contributed USD 1.1 trillion to the global GDP, amounting to 8.3% of the gross value added (GVA) in the global manufacturing sector in 2023, according to the International Council of Chemical Associations (ICCA). The chemicals and materials industry is transforming with the introduction of new materials such as scratch-resistant materials, robust willow glass, ultra-thin display materials, flexible solar cells, and several others. In the chemical sector, automation, decarbonization, and digitalization are some of the key areas of advancement. Startups combine several technologies to automate and sustainably produce chemicals. The developments in the chemical sector indicate the path of industry innovation in the coming years.

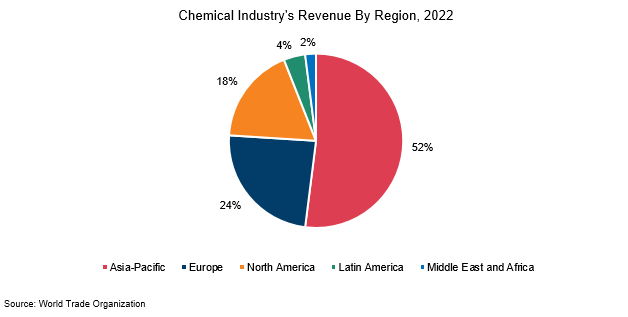

The global chemical industry’s revenue by region in 2022: Asia-Pacific: USD 2.98 trillion (52%), Europe: USD 1.40 trillion (24%), North America: USD 1.00 trillion (18%), Latin America: USD 0.21 trillion (4%) & Middle East and Africa: USD 0.13 trillion (2%). The Asia-Pacific region is the largest market for chemicals, and it is expected to continue to grow in the coming years. This is due to strong economic growth in the region, as well as rising demand for chemicals from the construction, automotive, and electronics industries. The chemical industry is a complex and diverse industry that plays an important role in the global economy.

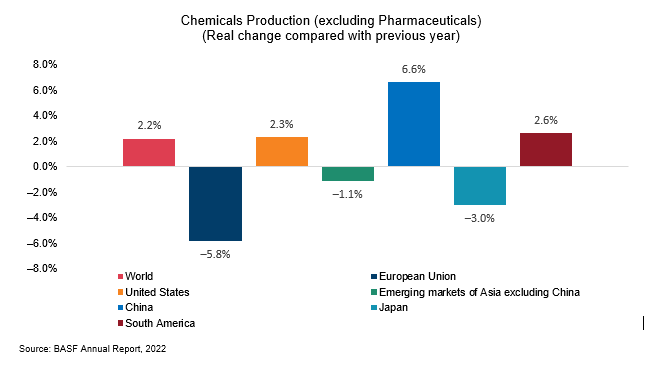

The global chemical industry’s total worldwide revenue in 2022 was USD 5.72 trillion. Global growth in the chemical industry in 2022 was slower than the industry as a whole, at 2.2%, significantly lower than the previous year (+6.1%). In the EU, production decreased significantly by 5.8% due to soaring natural gas prices. In Germany, this has fallen by around 12% due to the suspension of production of gas-guzzling basic chemicals. Chemical production in the UK also fell sharply.

Technological Advancements

According to the American Chemical Council (ACC), the novel chemical materials market is projected to grow at a faster pace than traditional markets, creating an estimated $150 billion opportunity by 2025. For instance, carbon-fiber reinforced concrete provides more design flexibility in construction projects with higher load-bearing capacity than traditional concrete, making it a better option for construction projects. Additionally, companies are now adopting green chemistry principles to develop more environment-friendly chemical processes and materials, including more efficient catalysts, lesser waste and residues, and safer chemical production.

Sustainability in the Chemicals & Materials Industry

The chemicals and materials industry is prioritizing sustainability to address environmental concerns and meet regulatory pressures. This has led to the adoption green chemistry and eco-friendly materials, which aim to minimize harm to the environment and human health. Additionally, circular economy principles are being embraced to reduce waste and emissions. The industry is leveraging renewable and sustainable resources for chemical and material production, and companies are setting ambitious carbon neutrality and net-zero emission goals, leading to comprehensive sustainability plans.

Eco-labels and certifications for products are also becoming more common, providing valuable information to consumers and contributing to market growth. This empowers consumers to make informed choices and support eco-friendly options. By adhering to eco-certification standards, companies are incentivized to reduce their environmental impact by minimizing energy and water consumption, waste, and greenhouse gas emissions. The demand for sustainable products is rising, and companies offering sustainable alternatives benefit from lucrative growth opportunities.

Stringent Regulatory Scenarios

Chemical and materials manufacturing companies face a major challenge when it comes to waste disposal. Manufacturers require cost-effective and eco-friendly methods of waste disposal to ensure that all semi-solid waste, wastewater, and gases are treated before disposal. In the US, the Environmental Protection Agency enforces the Resource Conservation and Recovery Act (RCRA) while the European Union includes directives like the Waste Framework Directive and the Hazardous Waste Directive for waste disposal processes.

Competitive Rivalry Amongst the Key Players: Thriving Industry Growth

The chemicals and materials market is highly competitive, and major manufacturers are adopting various growth strategies such as M&As to gain a competitive edge in the market. Innovation, pricing strategy, and customer-centricity are also helping chemical companies find new ways to thrive in a challenging outlook. For instance, in August 2021, LG Chem expanded its business portfolio by acquiring Chemical Electronic Materials (CEM), a business sector of LG Electronics Business (Business Solutions), for $460 million.

Key players in the industry include Mitsubishi, Dow Chemical, BASF, ExxonMobil, LG Chem, SABIC, Sinopec, Formosa Plastics, Ineos, DuPont, LyondelBasell, Bayer, Linde Group, Shell, AkzoNobel, Braskem, Mitsui Chemicals, Air Liquide, Sumitomo Chemicals, and Evonik, among others.

At Intent Market Research, we develop detailed studies to assist chemicals & materials industry participants in understanding their challenges and designing competitive strategies.