Agriculture and Agri Inputs

Agriculture and agri inputs are some of the core sectors that support the growth of the global economy. According to the World Bank, agriculture accounts for 4% of the global GDP and in some countries such as Ethiopia, Mali, Liberia, etc., it accounts for more than 25% of GDP. The agriculture and agri inputs encompass a wide array of sectors including farming, animal husbandry, poultry, fisheries, dairy market, cold chain, apiculture, seeds, animal feed, bio-agriculture, floriculture, sericulture, pesticides, food processing, fertilizers, equipment, and warehousing among several others.

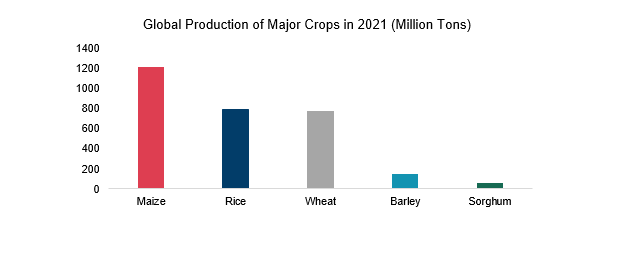

Population growth is the major driver shaping food demand at the global level, driven predominantly by the increasing consumption of rising populations in India, Sub-Saharan Africa, and the East and North Africa region. It is projected to drive the food commodities consumption by 15%. Asia, driven by China and India plays a major role in shaping global food demand thereby driving the agriculture and agri inputs industry growth. Global crop production growth is driven by increased productivity rather than increased land use due to ongoing technological advancements across the sector. As a result, investments in raising yields and improved farm management are essential.

Industry 4.0 and Startups Leading in the Agriculture Sector

The advances in the agricultural sector have been driven by mechanical improvements and genetic advances in the past. However, since the beginning of Industry 4.0 in 2011, substantial advances have been driven by digital tools such as IoT, robotics, AI, agri-drones, precision agriculture, and big data & analytics. There is a significant increase in the use of robots, drones, and autonomous tractors for efficient crop and livestock management and precision farming to optimize crop yield and quality.

The development of robust sensors to handle diverse tasks like tracking soil temperature, humidity, and livestock, monitoring the growth of plants, and detecting disease stress will boost the agriculture industry’s growth. For instance, start-ups like Agrila (Bulgaria), Farmer’s Hive (Canada), and MaxBotix (USA) have developed IoT-based sensors to facilitate sensing of vital parameters such as soil moisture and temperature, wind speed and direction, rain, humidity, and solar irradiation.

Moreover, several companies such as Advanced.Farm (USA), Nexus Robotics (Canada), and Ibex Automation (UK) are developing robots designed to assist with various tasks. Likewise, increasing adoption of AI and big data in agriculture is also empowering farmers with real-time insights and promoting proactive decision-making. For example, Arwa Intelligence (USA) utilizes artificial intelligence to provide farmers with customized crop planning recommendations. Thus, robust advancements in digital tools in the agricultural sector are anticipated to drive the market.

A Shift Towards Precision Farming

Precision farming helps farmers reduce the amount of inputs they use, which can help reduce the risk of environmental pollution. Recent technological developments in high-resolution satellite imagery and rapid development of unmanned aerial vehicle technology (UAV), are driving the adoption of remote-sensing data sources in precision agriculture. An array of digital tools helps farmers monitor and manage their crops more effectively, which can help reduce the risk of pests and diseases and improve soil health. In recent years, hydroponic farming has also gained significant popularity. Considering the limited water reserves and shrinking land areas, several countries have begun to explore and expand urban hydroponic farming practices.

Increasing Adoption of Agri-Drones

Drone technology is a rapidly evolving field and the adoption of drone technologies in agriculture has a vast potential to revolutionize the agriculture sector. In recent years, there have been tremendous developments in drone technology leading to an increase in adoption of the agri-drones globally. For instance, DJI, a key drone manufacturer, reportedly had over 200,000 units of agri-drones in operation up till the end of 2022. Drone has its application in large-scale agricultural operations. Thus, an increasing number of product launches and rapid evolution in drone technology are anticipated to drive the agri-drone market.

Innovation is Driving Market Competitiveness

The companies in the agriculture & agri inputs sector are highly competitive and are constantly innovating newer technologies to gain a competitive advantage to capture the market share. The industry’s growth is driven by several macro factors such as rising population, growing income, and easing trade barriers.

Key Companies in the Agriculture & Agri Inputs Sector:

- Agriculture Seed and Chemicals Companies: Corteva, Syngenta, Andersons, Simplot, Gruma, Chiquita Brands Intl, Prairie Farms Dairy, Murphy-Brown, BASF, and Taylor Fresh Foods

- Agriculture Technology Companies: DJI, John Deere, CNH Industrial, AGCO, Harvest Automation, AgEagle, Mahindra, Caterpillar, and Kubota

At Intent Market Research, we offer detailed studies to assist agri-businesses in understanding their strengths, opportunities, and challenges to take actionable insights.

Population growth is the major driver shaping food demand at the global level, driven predominantly by the increasing consumption of rising populations in India, Sub-Saharan Africa, and the East and North Africa region. It is projected to drive the food commodities consumption by 15%. Asia, driven by China and India play major role in shaping global food demand thereby driving the agriculture and agro-inputs industry growth. Global crop production growth is driven by increased productivity rather than increased land use due to ongoing technological advancements across the sector. As a result, investments in raising yields and improved farm management are essential.

Industry 4.0 and Startups Leading in the Agriculture Sector

The advances in the agricultural sector have been driven by mechanical improvements and genetic advances in the past. However, since the beginning of Industry 4.0 in 2011, substantial advances have been driven by digital tools such as IoT, robotics, AI, agri-drones, precision agriculture, and big data & analytics. There is a significant increase in the use of robots, drones, and autonomous tractors for efficient crop and livestock management and precision farming to optimize crop yield and quality.

Development of robust sensors to handle diverse tasks like tracking soil temperature, humidity, and livestock, monitoring the growth of plants, and detecting disease stress will boost agriculture industry growth. For instance, start-ups like Agrila (Bulgaria), Farmer’s Hive (Canada), and MaxBotix (USA) have developed IoT-based sensors to facilitate sensing of vital parameters such as, soil moisture and temperature, wind speed and direction, rain, humidity, and solar irradiation.

Moreover, several companies such as Advanced.Farm (USA), Nexus Robotics (Canada), and Ibex Automation (UK) are developing robots designed to assist with various tasks. Likewise, increasing adoption of AI and big data in agriculture is also empowering farmers with real-time insights and promoting proactive decision-making. For example, Arwa Intelligence (USA) utilizes artificial intelligence to provide farmers with customized crop planning recommendations. Thus, robust advancements in digital tools in the agricultural sector are anticipated to drive the market.

A Shift Towards Precision Farming

Precision farming helps farmers reduce the amount of inputs they use, which can help reduce the risk of environmental pollution. Recent technological developments in high-resolution satellite imagery and rapid development of unmanned aerial vehicle technology (UAV), are driving the adoption of remote-sensing data sources in precision agriculture. An array of digital tools helps farmers monitor and manage their crops more effectively, which can help reduce the risk of pests and diseases and improve soil health. In recent years, hydroponic farming has also gained significant popularity. Considering the limited water reserves and shrinking land areas, several countries have begun to explore and expand urban hydroponic farming practices.

Increasing Adoption of Agri-Drones

Drone technology is a rapidly evolving field and the adoption of drone technologies in agriculture has a vast potential to revolutionize the agriculture sector. In recent years, there have been tremendous developments in drone technology leading to an increase in adoption of the agri-drones globally. For instance, DJI, a key drone manufacturer, reportedly had over 200,000 units of agri-drones in operation up till the end of 2022. Drone has its application in large-scale agricultural operations. Thus, an increasing number of product launches and rapid evolution in drone technology are anticipated to drive the agri-drone market.

Innovation: Driving Market Competitiveness

The companies in the agriculture & agro-inputs sector are highly competitive and are constantly innovating newer technologies to gain a competitive advantage to capture the market share. The industry’s growth is driven by several macro factors such as rising population, growing income, and easing trade barriers.

Key Companies in the Agriculture & Agro-Inputs Sector:

- Agriculture Seed and Chemicals Companies: Corteva, Syngenta, Andersons, Simplot, Gruma, Chiquita Brands Intl, Prairie Farms Dairy, Murphy-Brown, BASF, and Taylor Fresh Foods

- Agriculture Technology Companies: DJI, John Deere, CNH Industrial, AGCO, Harvest Automation, AgEagle, Mahindra, Caterpillar, and Kubota

At Intent Market Research, we offer detailed studies to assist agri-businesses in understanding their strengths, opportunities and challenges to gain major market share