Packaging

The global packaging industry has experienced consistent growth in the past decade due to various factors such as the use of different packaging materials, expansion into new markets, and changes in customer dynamics. Packaging plays a crucial role in how consumers perceive and purchase products. Flexible and rigid plastics holding 63% of the overall market share in 2022. The industry is set to grow as it adapts to consumer and regulatory demands for sustainability, safety, and convenience.

Eco-friendly products are more demanding and drive market growth

The market for packaging materials is witnessing a surge in demand for eco-friendly products that have a minimal environmental impact. This trend is driven by growing awareness of the need for recyclable, biodegradable, non-toxic, and reusable packaging solutions. Paper-based products like bags, cartons, and pouches are witnessing the fastest growth among sustainable packaging materials.

The popularity of online retail and environmental regulations on non-recyclable and non-biodegradable packaging solutions are fueling the demand for eco-friendly paper packaging solutions. For instance, Coca-Cola recently tested 2,000 bottles made of extra-strong paper shells with thin plastic liners, resulting in a fully recyclable, plastic-free bottle.

Smarties and Nestlé have already transitioned their products to recyclable paper packaging, and Nestlé aims to make all its packaging paper-based and recyclable or reusable by 2025. Huhtamäki Oyj, a food packaging company, is at the forefront of developing innovative and sustainable paper packaging solutions through their Huhtamäki Blue Loop platform.

Innovation in paper packaging technology is leading to new and exciting products that are more sustainable and have a reduced environmental impact. For instance, TetraPak partnered with the District Model Center of Muhammadiyah in Jeddah to recycle used carton packages, promoting sustainable practices.

Sustainability and Environmental Concerns are the major challenges of the market

The packaging industry faces challenges driven by consumer preferences, technology, and sustainability concerns. The industry must take a proactive approach to tackle these challenges and ensure long-term success. Single-use plastics, over-packaging, and non-renewable resources contribute to waste, which poses a significant threat to the environment and wildlife.

The industry is actively working on reducing packaging waste by adopting sustainable alternatives, implementing Extended Producer Responsibility (EPR) programs, and complying with regulations. Apart from those the industry is facing key challenges such as regulatory compliance, need for innovation, waste reduction, and competition to remain profitable and maintain market share. As a result, major industry players are being proactive and vigilant to overcome these challenges to avoid reputational damage and loss of profitability to ensure long term success.

Rising geographical penetration & product line extension are thriving the growth of the market

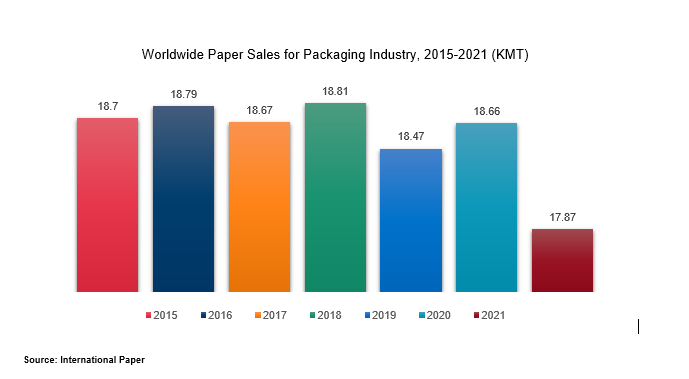

The global packaging market is influenced by various factors such as sustainable competitive advantages due to innovation, market penetration levels, barriers to exit, advertising expenses, power of competitive strategy, and firm concentration ratio. The market is dominated by key players like International Paper Company, Mondi, Smurfit Kappa, DS Smith, WestRock Company, UFlex, Huhtamaki, Amcor, Coveris, Sealed Air, Greif, and Gerresheimer, who have a competitive edge through innovation.

Plastic Packaging: A Popular Choice in Asian Countries

Plastic packaging materials have been widely used in Asia, especially in India and China. China announced in its 2021-2025 “five-year plan” that it would improve its plastic recycling and incineration capacities, promote “green” plastic products, and combat the misuse of plastic in packaging and agriculture. Merchants and delivery services would be required by the new five-year plan to curtail “disproportionate” plastic wrapping, and city waste cremation rates would rise to around 800,000 tons per day by 2025, from 580,000 tons the previous year.

Flexible packaging is gaining intensive popularity

Flexible packaging is gaining popularity and could replace rigid formats like metal tins and glass jars. Several flexible plastic packaging providers are offering packaging solutions for sweets and confectionery, driving their sales and revenues higher. The Indian food and grocery market is the world’s sixth-largest, with retail accounting for 70% of sales. The Indian food processing industry contributes to 32% of the country’s overall food market.

Companies are focusing on innovating their products and are expanding their market presence by constructing new production facilities. The low-carbon, recycle-ready options provide high barrier and performance requirements while supporting recyclability agendas.

In Intent Market Research, our consultants analyze packaging industry to offer potential market share, trends, opportunities, and competitive scenarios to formulate market entry and expansion strategies.