Upcycled Animal Feed Market

- December, 2023

- Animal Nutrition & Health

Upcycled Animal Feed Market Size Analysis by Source (Agricultural Waste (Animal By-Products, Plant By-Products), Industrial Waste, and Food Waste), By Animal Type (Pet (Dog, Cat} and Livestock {Cattle, Poultry, Swine, Aquaculture}), By Distribution Channel (Online and Offline), and By Region | Market Forecast (2024-2030)

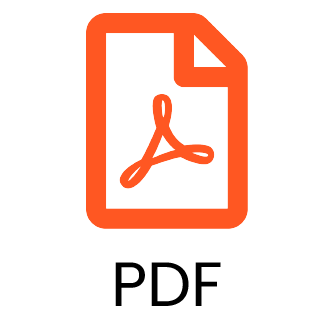

The upcycled animal feed market was estimated at USD 26.2 billion in 2023-e and is expected to reach USD 42.7 billion by 2030, growing at a CAGR of 7.2% during the forecast period (2024–2030). A strong need for sustainable animal feed and rising food waste across the globe are projected to drive upcycled feed demand. The growing awareness and acceptance of upcycled animal feed are expected to contribute significantly to market growth. Technological advancements in food processing and adoption of AI in quality control & food safety assurance are anticipated to provide significant growth opportunities for the upcycled animal feed market.

Upcycled Animal Feed Market Overview

Upcycling is an emerging trend in the food industry aimed at being environmentally responsible. Upcycled animal feed are sustainable animal feed alternative that uses ingredients derived from waste and by-products from various sources. These ingredients are re-purposed into animal feeds after being procured from different supply chains. The food waste & by-products are treated by various processes including sorting, screening, grinding, dewatering, heating, and drying.

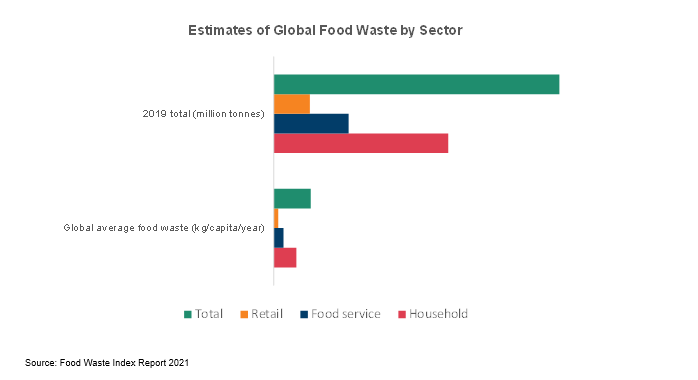

Rising Food Waste is Driving the Upcycled Animal Feed Market

According to the World Food Programme, about 1.3 billion tons of food produced for human consumption is lost or wasted globally every year, worth approximately USD 1 trillion. Animal feed manufacturers are expanding their portfolios to include products with lower environmental footprints as consumers are increasingly looking for more environmentally responsible products. The upcycled animal feed market is driven by the rising food waste and a strong need for sustainable animal feed. According to the United Nations, globally, around 13% of food produced is lost between harvest and retail, while an estimated 17% of total global food production is wasted in households, food service, and retail. In addition, food waste is one of the leading contributors to climate change, nature biodiversity loss, and pollution. It also burdens waste management systems, increases food insecurity, and indicates an imperative need to reduce food losses and waste.

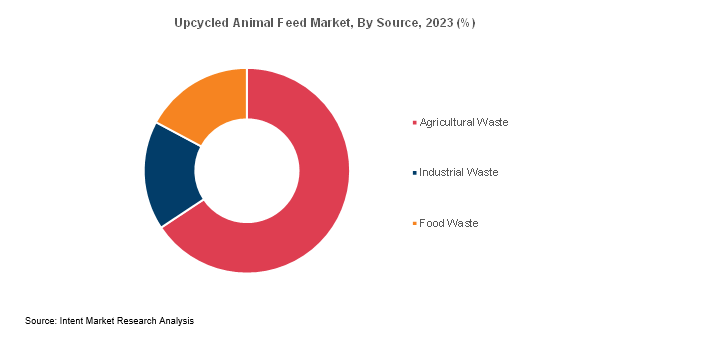

Strong Need to Reduce and Reuse Agricultural Waste Is Driving the Agricultural Waste Segment

Agricultural waste is unwanted or unsalable materials produced from agricultural operations directly related to the growing of crops or the raising of animals. One of the largest sources of food waste is in the production phase owing to things like crop pests and ineffective harvesting and irrigation. In recent years, agricultural waste has been rising rapidly all over the world which is further negatively impacting the environment. There is a strong need to adopt proper approaches to reduce and reuse agricultural waste and upcycled animal feed is one such approach that has gained significant popularity. Thus, the agricultural waste segment is anticipated to be the major segment in the upcycled animal feed market.

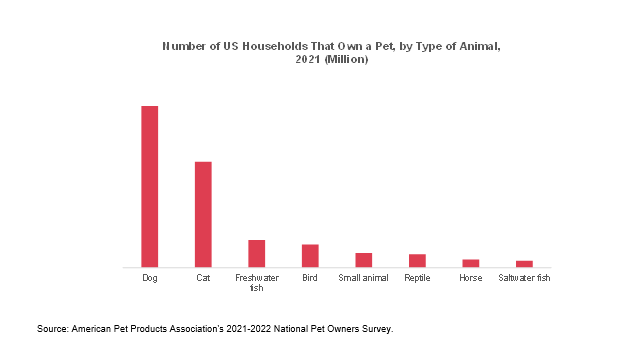

The Pet Segment is Anticipated to be the Fastest-Growing Segment Owing to the Rising Pet Adoption

There is a growing consumer inclination toward the adoption of pets and rising household expenditure towards pet food that are anticipated to drive the upcycled animal feed market. According to the Europe Pet Food Industry Federation (FEDIAF), in 2022, the European pet food market grew to USD 31.1 billion with an average 5.1% annual growth rate during the last three years. It accounted for 10.5 million tons of pet food by volume in 2022. According to the 2022-2023 National Pet Owners Survey conducted by the American Pet Products Association (APPA), about 86.9 million homes accounting for about 66% of US households, own a pet. In recent years, especially post-COVID-19 pandemic, several countries experienced a huge uptake in pet adoption. Thus, the growing pet food market and increasing consumer inclination towards sustainable animal feed are driving the demand for upcycled pet food.

Uptake in E-Commerce is Driving the Online Segment

Online shopping has become increasingly popular in recent years driven by the easy availability and changing consumer behavior. It has globally transformed the way consumers shop and is reshaping the retail industry. The COVID-19 pandemic led to a significant change in consumer behavior leading to an upsurge in e-commerce. According to the US Annual Retail Trade Survey release, e-commerce sales increased by USD 215.8 billion or 44% in 2020, rising from USD 491.7 billion in 2019 to USD 707.6 billion in 2020. This further increased from USD 820.8 billion in 2021 rising by 16%. This uptake in e-commerce is anticipated to drive the online segment to be the fastest-growing segment in the upcycled animal feed market.

Regional Analysis

Asia-Pacific is the fastest-growing region owing to Strong Food Waste Initiatives Undertake by the Government and NGOs in the Region

Upcycled animal feed is witnessing a surge in growth in Asia-Pacific, specifically in countries such as China, Japan, and South Korea. Asia-Pacific is one of the leading regions in terms of food waste. According to the UNEP’s (United Nations Environment Programme) food wastage index report, about 68.7 million tons of food is wasted annually in Indian homes. China and India produce more household food waste than any other country worldwide every year.

In recent years, there have been strong initiatives by the government and NGOs in the region for controlling food waste. Governments in countries such as Japan, South Korea, and Taiwan have developed laws, regulations, economic incentives, subsidies, and infrastructure required for the collection and recycling of all sources of food waste and promote upcycling to safe animal feed. South Korea has become one of the leading countries for attaining recycling of about 95% of its food waste.

In addition, there has been an increasing number of startups coming up in the region. For instance, in June 2022, Wastelink (India), a food upcycling startup, secured seed funding of USD 1.2 million led by Matterhorn Projects LLP, Indigram Labs Foundation, Sanjiv Rangrass, and other angel investors. Asia-Pacific stands out as the fastest-growing region in the upcycled animal feed market.

Competitive Analysis

The upcycled animal feed market is moderately fragmented with the presence of a few global market players having a significant market share and a large number of small regional and local players. The animal feed industry is constantly evolving and key companies in the upcycled animal feed market are continuously working to strengthen their product portfolio. Some of the key companies in upcycled animal feed market are Bond Pet Foods, Cargill, Do Good Foods, International Ingredient Corporation, Kipster Farm, Mycorena, Purina, Phelps Pet Products, Shameless Pets, and Tyson Foods.

Following are the key developments in the upcycled animal feed market:

- In October 2023, Tyson Foods came into partnership with Protix, a Netherlands-based insect ingredient formulator to upcycle its by-products such as Black Soldier Fly Larva (BSFL) into high-quality, sustainable insect proteins and lipids.

- In October 2023, Cargill came into partnership with Hershey for upcycling chocolate manufacturing waste into animal feed.

- In January 2022, Do Good Foods (US), came into partnership with Michael Foods, a subsidiary of Post Holdings and one of the largest food service suppliers of egg products in the US. Under the partnership, Do Good Foods will supply verified carbon-reduced eggs at venues nationwide.

Upcycled Animal Feed Market Coverage

The report provides key insights into the upcycled animal feed market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players and the competitive landscape within the market.

Report Scope

Report Features | Description |

Market Size (2023-e) | USD 26.2 billion |

Forecast Revenue (2030) | USD 42.7 billion |

CAGR (2024-2030) | 7.2% |

Base Year for Estimation | 2023-e |

Historic Year | 2022 |

Forecast Period | 2024 – 2030 |

Report Coverage | Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

Segments Covered | By Animal Type (Pet and Livestock), By Source (Agricultural Waste, Industrial Waste, and Food Waste), and By Distribution Channel (Online and Offline) |

Regional Analysis | North America (US, Canada), Europe (Germany, UK, France, Spain, Italy and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and Rest of Asia-Pacific), Latin America (Mexico, Brazil, and Rest of Latin America), and Middle East & Africa (Saudi Arabia, UAE, & Rest of MEA) |

Competitive Landscape | Bond Pet Foods, Cargill, Do Good Foods, International Ingredient Corporation, Kipster Farm, Mycorena, Purina, Phelps Pet Products, Shameless Pets, and Tyson Foods. |

Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

Purchase Options | We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

- Introduction

- Study Assumptions and Market Definition

- Scope of the Study

- Research Methodology

- Executive Summary

- Market Dynamics

- Market Growth Drivers

- Ring Food Waste and a Strong Need for Sustainable Animal Feed

- Increasing Awareness and Acceptance of Upcycled Animal Feed

- Market Growth Challenges

- Challenges Associated with Procuring a Steady Stream of Raw Materials

- Market Growth Opportunities

- Technological Innovations

- Porter’s Five Forces

- PESTLE Analysis

- Market Growth Drivers

- Market Outlook

- Supply Chain Analysis

- Animal Feed Industry Outlook

- Volume Output Analysis

- Regulatory Framework

- Pricing Analysis

- Patent Analysis

- Case Studies

- Consumer Behavior Analysis

- Market Segment Outlook

- Segment Synopsis

- By Source

- Agricultural Waste

- Animal By-Products

- Plant By-Products

- Industrial Waste

- Food Waste

- Agricultural Waste

- By Animal Type

- Pet

- Dog

- Cat

- Others

- Livestock

- Cattle

- Poultry

- Swine

- Aquaculture

- Others

- By Distribution Channel

- Online

- Offline

- Pet

- Regional Outlook

- Global Market Synopsis

- North America

- North America Upcycled Animal Feed Market Outlook

- US

- US Upcycled Animal Feed Market, By Source

- US Upcycled Animal Feed Market, By Animal Type

- US Upcycled Animal Feed Market, By Distribution Channel

*Note: Cross-segmentation by segments for each country will be covered as shown above.

- Canada

- Europe

- Europe Upcycled Animal Feed Market Outlook

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- Asia-Pacific Upcycled Animal Feed Market Outlook

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

- Latin America

- Latin America Upcycled Animal Feed Market Outlook

- Mexico

- Brazil

- Rest of Latin America

- Middle East & Africa

- Middle East & Africa Upcycled Animal Feed Market Outlook

- Saudi Arabia

- UAE

- Rest of MEA

- Competitive Landscape

- Market Share Analysis

- Company Strategy Analysis

- Competitive Matrix

- Company Profiles

- Bond Pet Foods

- Company Synopsis

- Company Financials

- Product/Service Portfolio

- Recent Developments

- Bond Pet Foods

*Note: All the companies in the section 9.1 will cover same sub-chapters as above.

- Cargill

- Do Good Foods

- Green Field Solutions (International Ingredient Corporation)

- Kipster Farm

- Mycorena

- Purina

- Phelps Pet Products

- Shameless Pets

- Tyson Foods

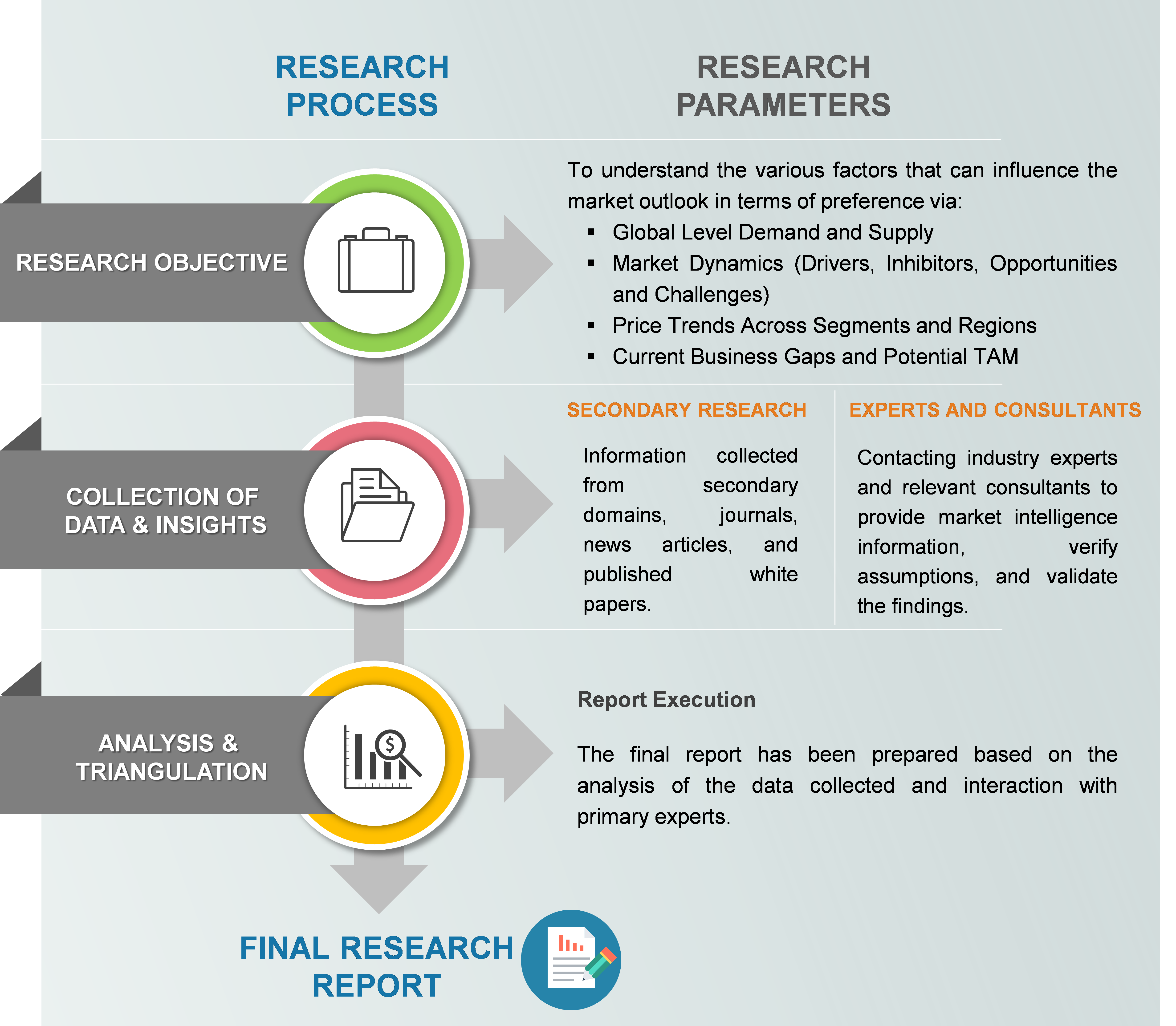

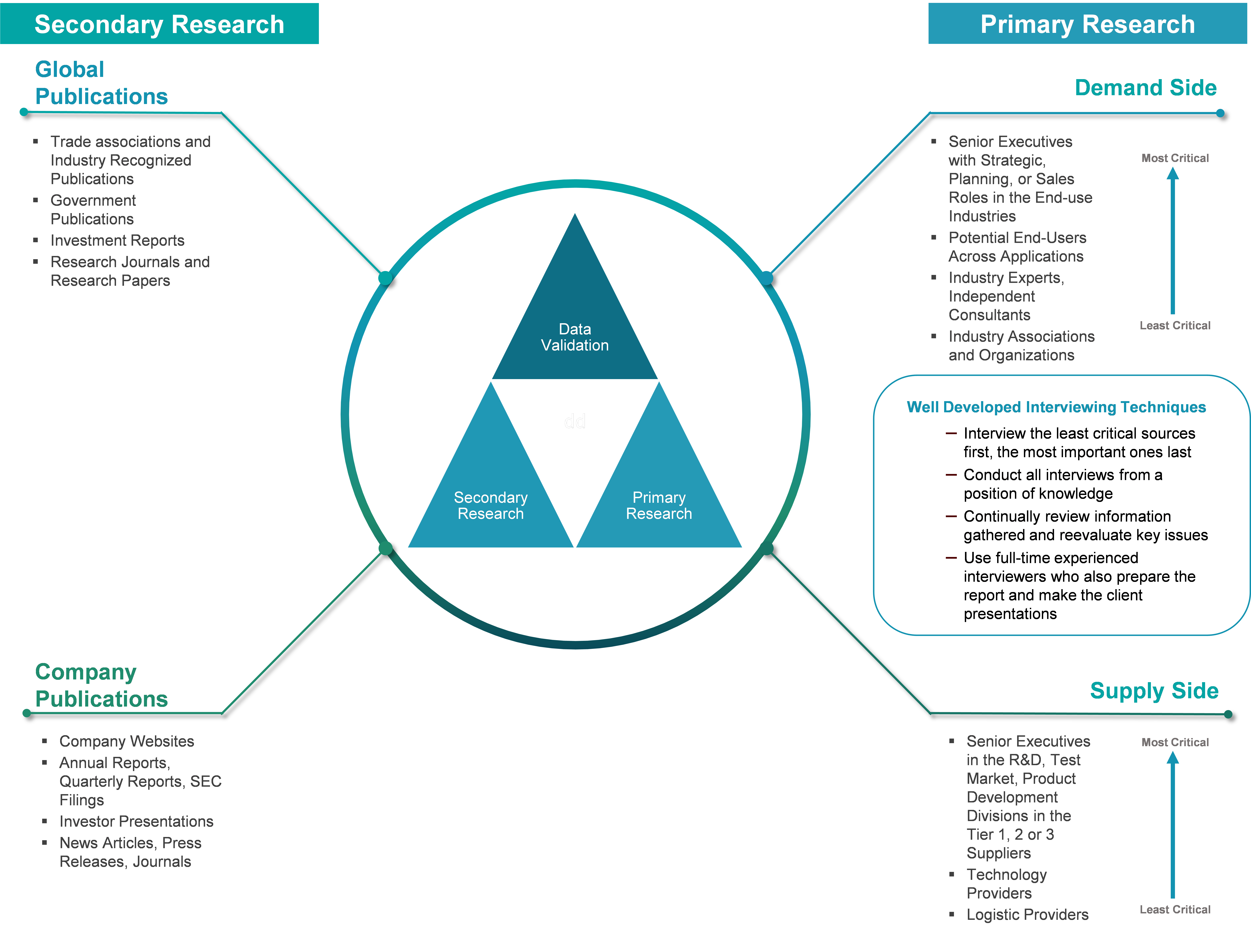

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.