Semiconductor Chemical Market

- December, 2023

- Chemicals & Materials

Semiconductor Chemical Market Size Analysis By Type (Etchants, Deposition Chemicals, Photoresists, Dopants, Cleaning Chemicals), By Application (Semiconductor Manufacturing, Photovoltaics, LEDs ), By End-Use Industry (Electronics, Automotive, aerospace) & By Region; Growth Trends & Forecasts (2024 - 2030)

As per Intent Market Research, the semiconductor chemicals market size is projected to grow from USD 12.3 billion in 2023-e to USD 29.3 billion by 2030, registering a CAGR of 13.2% during the forecast period (2024-2030). The semiconductor chemical market is segmented by type, application, end-use industry, and region.

![]()

Semiconductor chemicals refer to a broad category of specialized chemicals used in the manufacturing processes of semiconductors. These chemicals are crucial for the production, processing, and modification of semiconductor materials. They play a vital role in various stages of semiconductor fabrication, including cleaning, etching, deposition, and doping. The semiconductor chemical market plays a crucial role in the electronics industry, providing materials essential for the production of semiconductors. These materials include photoresists, etchants, dopants, and more. With the continuous advancements in technology, the demand for high-performance semiconductors is ever-growing.

Rising demand for semiconductors is driving the need for semiconductor chemicals

Semiconductor chemicals are commonly used in the manufacture of semiconductors. Owing to the rapid growth of various advancements such as artificial intelligence (AI), quantum computing, and 5G networks, the production of semiconductors is growing rapidly and is expected to drive the semiconductor chemicals market during the forecast period. According to the World Semiconductor Trade Statistics, the global semiconductor market is worth USD 580 billion in 2022, compared to USD 555.

Additionally, global semiconductor sales increased by 3.2% in 2022, despite a slowdown in the second half due to economic slowdown and inflation, according to the Semiconductor Industry Association (SIA). Furthermore, according to a study conducted by the association, global demand for semiconductor manufacturing capacity is expected to increase by 56% by 2030. Thus, rising demand for semiconductors is estimated to increase the demand for semiconductor chemicals during the forecast period.

Stringent regulations coupled with higher investment costs are impeding market growth

The thriving semiconductor chemical market faces challenges from stringent environmental regulations and concerns about the industry’s environmental impact. The Semiconductor Industry Association (SIA) reports significant R&D investments, reaching USD 40 billion annually, to address environmental issues. Developing new chemicals and technologies requires substantial upfront and ongoing R&D costs, with the global semiconductor industry spending over USD 70 billion on R&D in 2021, according to the World Semiconductor Trade Statistics (WSTS). These restraints underscore the complexities faced by the semiconductor chemical market.

Rising demand for Etchants in semiconductors is thriving the market growth

Etchants lead the semiconductor chemicals market’s rapid growth, crucial for forming intricate patterns in advanced semiconductor devices. With the industry pursuing smaller and more complex components for technologies such as 5G, IoT, and artificial intelligence, precise and specialized etchants are essential. Innovations such as 3D NAND memory and FinFET transistors demand cutting-edge etching techniques, placing etchants at the forefront of the semiconductor chemicals market’s dynamic evolution.

![]()

Increasing adoption of semiconductors chemicals in semiconductors is enhancing the market growth

Semiconductors, encompassing diodes, transistors, and rectifiers, play a crucial role in various electronic applications, from power management to consumer electronics and automotive systems. Increasing demand stems from the ubiquity of electronic devices and emerging technologies such as electric vehicles, renewable energy, and IoT. The focus on energy efficiency and the demand for smaller, more powerful devices are fostering innovation and growth in the semiconductor sector.

Increasing demand for semiconductor chemicals in the electronics sector is driving the market growth

The semiconductor industry is the backbone of the tech world. The demand for semiconductors and their chemicals is rising continuously, especially with the rising electronics market. From smartphones to smart refrigerators, everything has a chip nowadays. The integration of semiconductors into electronics is driving the need for electronic chemicals for faster processing, better efficiency, and innovative functionalities. Thus, the demand just keeps soaring as technology continues to evolve.

Rising investments in R&D activities across the North American region are stimulating market growth

North America boasts a robust semiconductor ecosystem, housing major companies and cutting-edge manufacturing facilities, especially in the US. The US government, through the United States Innovation and Competition Act (USICA) and CHIPS and Science Act, has heavily invested in chip production and research, committing USD 52 billion for manufacturing incentives and research investments. This underscores North America’s significance in the semiconductor chemicals market, marked by a dedication to innovation, market expansion, and technological advancement.

Mergers & acquisitions by key players are driving the growth of the electronic chemicals market

The market growth is driven by rising mergers & acquisitions across the world. In May 2023, Fujifilm entered into a definitive agreement to acquire Entegris’ electronic chemicals business for USD 700 million. The transaction is expected to close by the end of 2023, subject to regulatory approvals and other standard closing conditions. Some prominent players in the global semiconductor chemical market are Air Products and Chemicals, Avantor ,BASF, Cabot Microelectronics, Eastman, Chemical Company, Entegris, FUJIFILM, JSR, Linde, Merck, Solvay, Sumitomo Chemical ,Tokyo Ohka Kogyo.

Semiconductor Chemical Market: Scope of the Report

The report provides key insights into the semiconductor chemical market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The analysis focuses on market drivers, restraints, and opportunities, and examines key players and the competitive landscape within the semiconductor chemical market.

Semiconductor chemical is segmented By Type (Etchants, Deposition Chemicals, Photoresists, Dopants, Cleaning Chemicals), By Application (Semiconductor Manufacturing, Photovoltaics, LEDs ), By End-Use Industry (Electronics, Automotive, aerospace) and By Region. The report offers the market size and forecasts for the semiconductor chemical market in value (USD billion) for all the above segments.

![]()

Report Scope

Report Features | Description |

Market Value (2023-e) | USD 12.3 billion |

Forecast Revenue (2030) | USD 29.3 billion |

CAGR (2024-2030) | 13.2% |

Base Year for Estimation | 2023-e |

Historic Year | 2022 |

Forecast Period | 2024-2030 |

Report Coverage | Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

Segments Covered | By Type (Etchants, Deposition Chemicals, Photoresists, Dopants Cleaning Chemicals), By Application (Semiconductor Manufacturing, Photovoltaics, LEDs), By End-Use Industry (Electronics, Automotive & Aerospace) & By Region (North America, Europe, Asia-Pacific, Latin America & Middle East & Africa). |

Regional Analysis | North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, and rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

Competitive Landscape | Air Products and Chemicals, Avantor, BASF, Cabot Microelectronics, Eastman, Chemical Company, Entegris, FUJIFILM, JSR, Linde, Merck, Solvay, Sumitomo Chemical, Tokyo Ohka Kogyo |

Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

Purchase Options | We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

1. Introduction |

1. 1. Study Assumptions and Semiconductor Chemical Market Definition |

1.2. Scope of the Study |

2. Research Methodology |

3. Executive Summary |

4. Semiconductor Chemical Market Dynamics |

4.1. Market Drivers |

4.2 Market Challenges 4.3 Market Opportunities |

5. Semiconductor Chemical Market Outlook |

5.1. Technological Advancements |

5.2 Regulatory Framework |

5.3. Supply Chain Analysis |

5.4 Patent Analysis |

5.5. Porter’s Five Forces Analysis |

5.6. Pestle Analysis |

5.7. Investment Analysis |

5.8. Semiconductor Grade Process Chemicals |

5.9. Production Process Analysis |

5.10. Pricing Analysis |

6. Global Semiconductor Chemical Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2030) |

6.1 Type |

6.1.1 Etchants |

6.1.2 Deposition Chemicals |

6.1.3 Photoresists |

6.1.4 Dopants |

6.1.5 Cleaning Chemicals |

6.2 Application |

6.2.1 Semiconductor Manufacturing |

6.2.2 Photovoltaics |

6.2.3 LEDs |

6.2.4 Others |

6.3 End-Use Industry |

6.3.1 Electronics |

6.3.2 Automotive |

6.3.3 Aerospace |

6.4 Geography |

6.4.1 North America |

6.4.2 Europe |

6.4.3 Asia-Pacific |

6.4.4 Latin America |

6.4.5 Middle East and Africa |

7. North America Semiconductor Chemical Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2030) |

7.1 Type |

7.1.1 Etchants |

7.1.2 Deposition Chemicals |

7.1.3 Photoresists |

7.1.4 Dopants |

7.1.5 Cleaning Chemicals |

7.2 Application |

7.2.1 Semiconductor Manufacturing |

7.2.2 Photovoltaics |

7.2.3 LEDs |

7.2.4 Others |

7.3 End-Use Industry |

7.3.1 Electronics |

7.3.2 Automotive |

7.3.3 Aerospace |

7.4 Country |

7.4.1 United States |

7.4.1.1 Type |

7.4.1.1.1 Etchants |

7.4.1.1.2 Deposition Chemicals |

7.4.1.1.3 Photoresists |

7.4.1.1.4 Dopants |

7.4.1.1.5 Cleaning Chemicals |

7.4.1.2 Application |

7.4.1.2.1 Semiconductor Manufacturing |

7.4.1.2.2 Photovoltaics |

7.4.1.2.3 LEDs |

7.4.1.2.4 Others |

7.4.1.3 End-Use Industry |

7.4.1.3.1 Electronics |

7.4.1.3.2 Automotive |

7.4.1.3.3 Aerospace |

7.4.2 Canada |

7.4.2.1 Type |

7.4.2.1.1 Etchants |

7.4.2.1.2 Deposition Chemicals |

7.4.2.1.3 Photoresists |

7.4.2.1.4 Dopants |

7.4.2.1.5 Cleaning Chemicals |

7.4.2.2 Application |

7.4.2.2.1 Semiconductor Manufacturing |

7.4.2.2.2 Photovoltaics |

7.4.2.2.3 LEDs |

7.4.2.2.4 Others |

7.4.2.3 End-Use Industry |

7.4.2.3.1 Electronics |

7.4.2.3.2 Automotive |

7.4.2.3.3 Aerospace |

8. Europe Market Semiconductor Chemical Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2030) |

8.1 Type |

8.1.1 Etchants |

8.1.2 Deposition Chemicals |

8.1.3 Photoresists |

8.1.4 Dopants |

8.1.5 Cleaning Chemicals |

8.2 Application |

8.2.1 Semiconductor Manufacturing |

8.2.2 Photovoltaics |

8.2.3 LEDs |

8.2.4 Others |

8.3 End-Use Industry |

8.3.1 Electronics |

8.3.2 Automotive |

8.3.3 Aerospace |

8.4 Country |

8.4.1 United Kingdom |

8.4.1.1 Type |

8.4.1.1.1 Etchants |

8.4.1.1.2 Deposition Chemicals |

8.4.1.1.3 Photoresists |

8.4.1.1.4 Dopants |

8.4.1.1.5 Cleaning Chemicals |

8.4.1.2 Application |

8.4.1.2.1 Semiconductor Manufacturing |

8.4.1.2.2 Photovoltaics |

8.4.1.2.3 LEDs |

8.4.1.2.4 Others |

8.4.1.3 End-Use Industry |

8.4.1.3.1 Electronics |

8.4.1.3.2 Automotive |

8.4.1.3.3 Aerospace |

8.4.2 France |

8.4.2.1 Type |

8.4.2.1.1 Etchants |

8.4.2.1.2 Deposition Chemicals |

8.4.2.1.3 Photoresists |

8.4.2.1.4 Dopants |

8.4.2.1.5 Cleaning Chemicals |

8.4.2.2 Application |

8.4.2.2.1 Semiconductor Manufacturing |

8.4.2.2.2 Photovoltaics |

8.4.2.2.3 LEDs |

8.4.2.2.4 Others |

8.4.2.3 End-Use Industry |

8.4.2.3.1 Electronics |

8.4.2.3.2 Automotive |

8.4.2.3.3 Aerospace |

8.4.3 Germany |

8.4.3.1 Type |

8.4.3.1.1 Etchants |

8.4.3.1.2 Deposition Chemicals |

8.4.3.1.3 Photoresists |

8.4.3.1.4 Dopants |

8.4.3.1.5 Cleaning Chemicals |

8.4.3.2 Application |

8.4.3.2.1 Semiconductor Manufacturing |

8.4.3.2.2 Photovoltaics |

8.4.3.2.3 LEDs |

8.4.3.2.4 Others |

8.4.3.3 End-Use Industry |

8.4.3.3.1 Electronics |

8.4.3.3.2 Automotive |

8.4.3.3.3 Aerospace |

8.4.4 Italy |

8.4.4.1 Type |

8.4.4.1.1 Etchants |

8.4.4.1.2 Deposition Chemicals |

8.4.4.1.3 Photoresists |

8.4.4.1.4 Dopants |

8.4.4.1.5 Cleaning Chemicals |

8.4.4.2 Application |

8.4.4.2.1 Semiconductor Manufacturing |

8.4.4.2.2 Photovoltaics |

8.4.4.2.3 LEDs |

8.4.4.2.4 Others |

8.4.4.3 End-Use Industry |

8.4.4.3.1 Electronics |

8.4.4.3.2 Automotive |

8.4.4.3.3 Aerospace |

9. Asia-Pacific Semiconductor Chemical Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2030) |

9.1 Type |

9.1.1 Etchants |

9.1.2 Deposition Chemicals |

9.1.3 Photoresists |

9.1.4 Dopants |

9.1.5 Cleaning Chemicals |

9.2 Application |

9.2.1 Semiconductor Manufacturing |

9.2.2 Photovoltaics |

9.2.3 LEDs |

9.2.4 Others |

9.3 End-Use Industry |

9.3.1 Electronics |

9.3.2 Automotive |

9.3.3 Aerospace |

9.4 Country |

9.4.1 China |

9.4.1.1 Type |

9.4.1.1.1 Etchants |

9.4.1.1.2 Deposition Chemicals |

9.4.1.1.3 Photoresists |

9.4.1.1.4 Dopants |

9.4.1.1.5 Cleaning Chemicals |

9.4.1.2 Application |

9.4.1.2.1 Semiconductor Manufacturing |

9.4.1.2.2 Photovoltaics |

9.4.1.2.3 LEDs |

9.4.1.2.4 Others |

9.4.1.3 End-Use Industry |

9.4.1.3.1 Electronics |

9.4.1.3.2 Automotive |

9.4.1.3.3 Aerospace |

9.4.2 Japan |

9.4.2.1 Type |

9.4.2.1.1 Etchants |

9.4.2.1.2 Deposition Chemicals |

9.4.2.1.3 Photoresists |

9.4.2.1.4 Dopants |

9.4.2.1.5 Cleaning Chemicals |

9.4.2.2 Application |

9.4.2.2.1 Semiconductor Manufacturing |

9.4.2.2.2 Photovoltaics |

9.4.2.2.3 LEDs |

9.4.2.2.4 Others |

9.4.2.3 End-Use Industry |

9.4.2.3.1 Electronics |

9.4.2.3.2 Automotive |

9.4.2.3.3 Aerospace |

9.4.3 India |

9.4.3.1 Type |

9.4.3.1.1 Etchants |

9.4.3.1.2 Deposition Chemicals |

9.4.3.1.3 Photoresists |

9.4.3.1.4 Dopants |

9.4.3.1.5 Cleaning Chemicals |

9.4.3.2 Application |

9.4.3.2.1 Semiconductor Manufacturing |

9.4.3.2.2 Photovoltaics |

9.4.3.2.3 LEDs |

9.4.3.2.4 Others |

9.4.3.3 End-Use Industry |

9.4.3.3.1 Electronics |

9.4.3.3.2 Automotive |

9.4.3.3.3 Aerospace |

9.4.4 South Korea |

9.4.4.1 Type |

9.4.4.1.1 Etchants |

9.4.4.1.2 Deposition Chemicals |

9.4.4.1.3 Photoresists |

9.4.4.1.4 Dopants |

9.4.4.1.5 Cleaning Chemicals |

9.4.4.2 Application |

9.4.4.2.1 Semiconductor Manufacturing |

9.4.4.2.2 Photovoltaics |

9.4.4.2.3 LEDs |

9.4.4.2.4 Others |

9.4.4.3 End-Use Industry |

9.4.4.3.1 Electronics |

9.4.4.3.2 Automotive |

9.4.4.3.3 Aerospace |

10. Latin America Semiconductor Chemical Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2030) |

10.1 Type |

10.1.1 Etchants |

10.1.2 Deposition Chemicals |

10.1.3 Photoresists |

10.1.4 Dopants |

10.1.5 Cleaning Chemicals |

10.2 Application |

10.2.1 Semiconductor Manufacturing |

10.2.2 Photovoltaics |

10.2.3 LEDs |

10.2.4 Others |

10.3 End-Use Industry |

10.3.1 Electronics |

10.3.2 Automotive |

10.3.3 Aerospace |

10.4 Country |

10.4.1 Brazil |

10.4.1.1 Type |

10.4.1.1.1 Etchants |

10.4.1.1.2 Deposition Chemicals |

10.4.1.1.3 Photoresists |

10.4.1.1.4 Dopants |

10.4.1.1.5 Cleaning Chemicals |

10.4.1.2 Application |

10.4.1.2.1 Semiconductor Manufacturing |

10.4.1.2.2 Photovoltaics |

10.4.1.2.3 LEDs |

10.4.1.2.4 Others |

10.4.1.3 End-Use Industry |

10.4.1.3.1 Electronics |

10.4.1.3.2 Automotive |

10.4.1.3.3 Aerospace |

10.4.2 Mexico |

10.4.2.1 Type |

10.4.2.1.1 Etchants |

10.4.2.1.2 Deposition Chemicals |

10.4.2.1.3 Photoresists |

10.4.2.1.4 Dopants |

10.4.2.1.5 Cleaning Chemicals |

10.4.2.2 Application |

10.4.2.2.1 Semiconductor Manufacturing |

10.4.2.2.2 Photovoltaics |

10.4.2.2.3 LEDs |

10.4.2.2.4 Others |

10.4.2.3 End-Use Industry |

10.4.2.3.1 Electronics |

10.4.2.3.2 Automotive |

10.4.2.3.3 Aerospace |

10.4.3 Argentina |

10.4.3.1 Type |

10.4.3.1.1 Etchants |

10.4.3.1.2 Deposition Chemicals |

10.4.3.1.3 Photoresists |

10.4.3.1.4 Dopants |

10.4.3.1.5 Cleaning Chemicals |

10.4.3.2 Application |

10.4.3.2.1 Semiconductor Manufacturing |

10.4.3.2.2 Photovoltaics |

10.4.3.2.3 LEDs |

10.4.3.2.4 Others |

10.4.3.3 End-Use Industry |

10.4.3.3.1 Electronics |

10.4.3.3.2 Automotive |

10.4.3.3.3 Aerospace |

11. Middle East & Africa Semiconductor Chemical Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2030) |

11.1 Type |

11.1.1 Etchants |

11.1.2 Deposition Chemicals |

11.1.3 Photoresists |

11.1.4 Dopants |

11.1.5 Cleaning Chemicals |

11.2 Application |

11.2.1 Semiconductor Manufacturing |

11.2.2 Photovoltaics |

11.2.3 LEDs |

11.2.4 Others |

11.3 End-Use Industry |

11.3.1 Electronics |

11.3.2 Automotive |

11.3.3 Aerospace |

11.4 Country |

11.4.1 United Arab Emirates |

11.4.1.1 Type |

11.4.1.1.1 Etchants |

11.4.1.1.2 Deposition Chemicals |

11.4.1.1.3 Photoresists |

11.4.1.1.4 Dopants |

11.4.1.1.5 Cleaning Chemicals |

11.4.1.2 Application |

11.4.1.2.1 Semiconductor Manufacturing |

11.4.1.2.2 Photovoltaics |

11.4.1.2.3 LEDs |

11.4.1.2.4 Others |

11.4.1.3 End-Use Industry |

11.4.1.3.1 Electronics |

11.4.1.3.2 Automotive |

11.4.1.3.3 Aerospace |

11.4.2 Saudi Arabia |

11.4.2.1 Type |

11.4.2.1.1 Etchants |

11.4.2.1.2 Deposition Chemicals |

11.4.2.1.3 Photoresists |

11.4.2.1.4 Dopants |

11.4.2.1.5 Cleaning Chemicals |

11.4.2.2 Application |

11.4.2.2.1 Semiconductor Manufacturing |

11.4.2.2.2 Photovoltaics |

11.4.2.2.3 LEDs |

11.4.2.2.4 Others |

11.4.2.3 End-Use Industry |

11.4.2.3.1 Electronics |

11.4.2.3.2 Automotive |

11.4.2.3.3 Aerospace |

11.4.3 South Africa |

11.4.3.1 Type |

11.4.3.1.1 Etchants |

11.4.3.1.2 Deposition Chemicals |

11.4.3.1.3 Photoresists |

11.4.3.1.4 Dopants |

11.4.3.1.5 Cleaning Chemicals |

11.4.3.2 Application |

11.4.3.2.1 Semiconductor Manufacturing |

11.4.3.2.2 Photovoltaics |

11.4.3.2.3 LEDs |

11.4.3.2.4 Others |

11.4.3.3 End-Use Industry |

11.4.3.3.1 Electronics |

11.4.3.3.2 Automotive |

11.4.3.3.3 Aerospace |

12. Competitive Landscape |

12.1 Company Market Share Analysis |

12.2 Competitive Matrix |

12.2 Product Benchmarking |

12.3 Company Profiles (Manufacturers of Semiconductor Chemical) |

12.3.1 Dow |

12.3.1.1 Company Synopsis |

12.3.1.2 Company Financials |

12.3.1.3 Product/ Service Portfolio |

12.3.1.4 Recent Developments |

12.3.2 BASF |

12.3.3 Air Products and Chemicals |

12.3.4 Merck |

12.3.5 Linde |

12.3.6 Tokyo Ohka Kogyo |

12.3.7 JSR |

12.3.8 Cabot Microelectronics |

12.3.9 Entegris |

12.3.10 Sumitomo Chemical |

12.3.11 Avantor |

12.3.12 Eastman Chemical Company |

12.3.13 Solvay |

12.3.14 FUJIFILM |

12.3.15 Honeywell |

12.4 Company Profiles (Demand Side) |

12.4.1 Intel |

12.4.1.1 Company Synopsis |

12.3.1.2 Company Financials |

12.3.1.3 Product/ Service Portfolio |

12.3.1.4 Recent Developments |

12.4.2 Samsung Electronics |

12.4.3 Taiwan Semiconductor Manufacturing Company |

12.4.4 NVIDIA |

12.4.5 Advanced Micro Devices |

*List Not Exhaustive |

Disclaimer: The list of all other companies will be mentioned under client requirements |

13. Analyst Recommendations |

We specialize in providing syndicated market research reports that are highly sought after. We can also provide tailored customization to meet unique requirements. Our commitment exceeds limits as we empower clients with tactical and strategic support for well-informed business decisions and consistent success. Our experienced team continuously pushes the boundaries in market research, focusing on emerging markets with unwavering dedication. We provide comprehensive insights into global, regional, and country-level data, leaving no aspect hidden in any target market. Our market forecasts will help you:

- Grasp the market opportunity for new products and services.

- Distinguish between emerging, maturing, and declining market opportunities.

- Build your business plans and strategies on factual data, not conjecture.

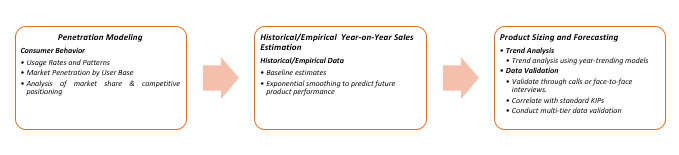

Data Collection, Analysis and Interpretation

As research analysts, we prioritize accuracy and in-depth analysis, employing diverse sources. These sources can be categorized into two main channels:

![]()

After collecting data from secondary and primary sources, we carefully examine the following to establish base numbers:

Market Sizing & Forecasting

We use bottom-up and top-down approaches to segment and estimate quantitative aspects of the market. Our research reports also present data triangulation, which examines the market from TWO different perspectives.

Value Chain-Based Sizing & Forecasting:

Data Validation:

- Engage with in-house market analysts and industry experts to validate all collected data and cross-check it through calls or face-to-face interviews.

- Conduct thorough quality checks to validate the data included in the report and contact various members of our network to verify the data’s authenticity, resulting in error elimination and eradication of doubtful information.

- Correlate with standard KIPs to gain insights into future trends.

- Conduct multi-tier data validation through external thought leaders, market analysts, subject matter experts, comparative analysis, and review data collection instruments.

Continuous Monitoring: Final Report and Presentation

- Our team collaborates with industry experts such as Electronics Industry, Telecommunications organizations experts & Aerospace and Defense experts to finalize and validate data. We utilize advanced data analysis models to generate valuable insights. Our integrated report comes with robust analytics and advanced visualization capabilities to ensure consistency and efficiency. We implement a standardized content management approach, common tagging, and taxonomy structure for seamless information connectivity. We offer comprehensive market and company views to facilitate easy and accurate comparisons. Our goal is to provide our clients with exceptional analytical resources for a competitive edge. We empower them to transform data into strategic insights for innovation and growth.