Game Development Services Market

- December, 2023

- Technology, Media, and Telecom

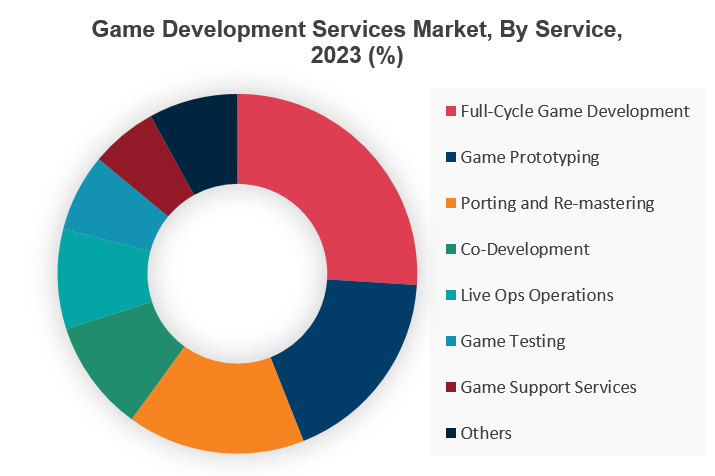

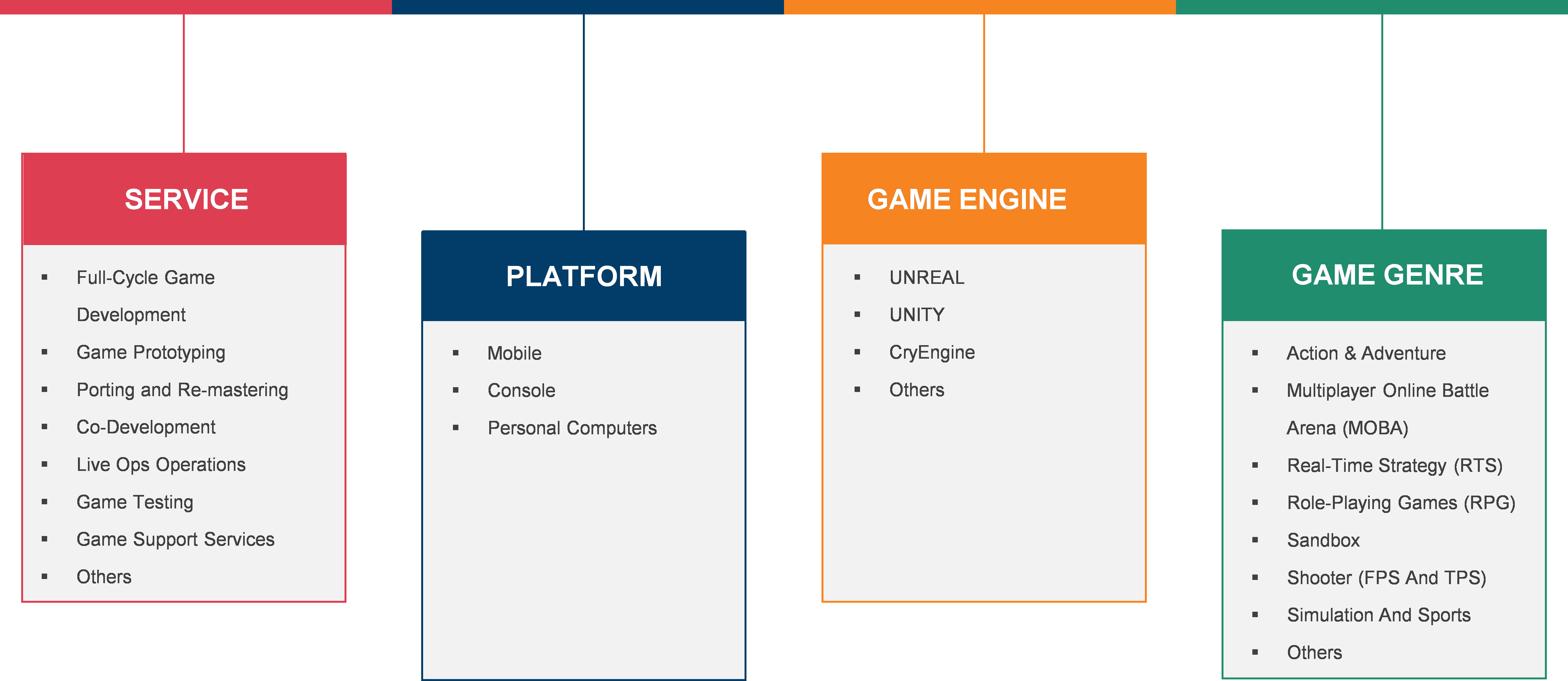

Game Development Services Market Research Report By Services (Full-Cycle Game Development, Game Prototyping, Porting and Re-mastering, Co-Development, Live Ops Operations, Game Testing, Game Support Services), By Platform (Mobile, Console, Computers), by Game Engine (UNREAL Engine, UNITY, CryEngine), By Genre (Action & Adventure, Multiplayer Online Battle Arena (MOBA), Real-Time Strategy (RTS), Role-Playing Games (RPG), Sandbox, Shooter (FPS And TPS), Simulation & Sports), and Region; Growth Trends and Forecasts (2024 – 2030)

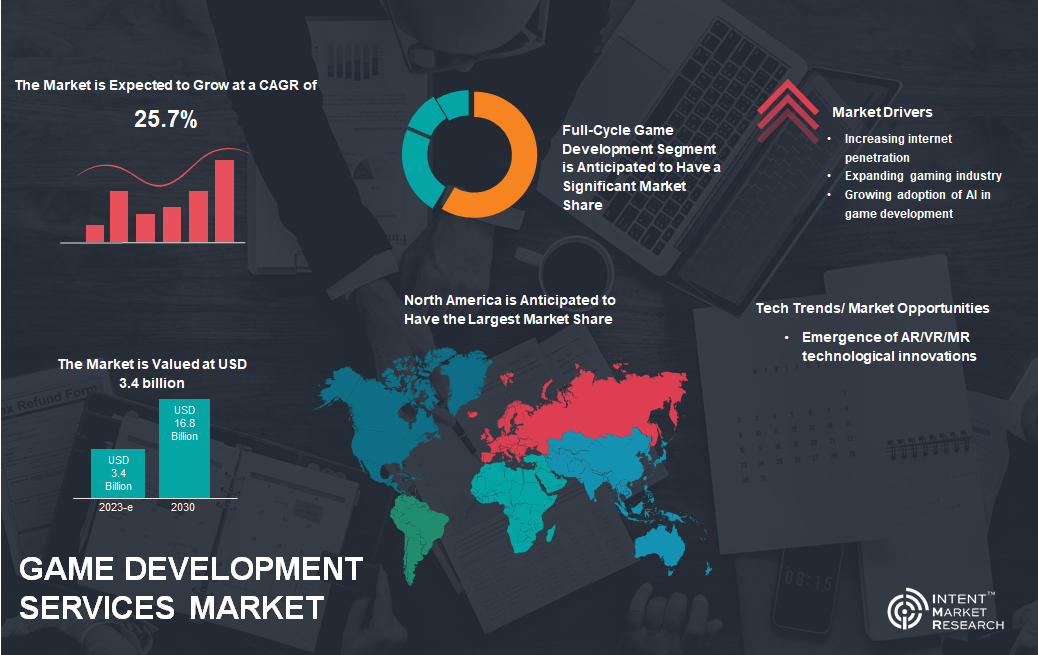

Game development services market was estimated at USD 3.4 billion in 2023 and is expected to reach USD 16.8 billion by 2030, growing at a CAGR of 25.7% during the forecast period (2024–2030). The market is experiencing momentum due to the increasing internet penetration and the expanding gaming industry. The growing adoption of AI in game development is expected to propel the market. The emergence of AR/VR/MR technological innovations are anticipated to provide significant growth opportunities for the market.

Game Development Services Market Overview

Game development services, also known as game development outsourcing, play a pivotal role in the gaming industry. Hiring external companies or individual game developers to work on video game projects is a general practice observed in the gaming industry. Game development services can be a very useful strategy for game studios and individual developers who want to create high-quality games without having to handle all of the work in-house. In recent years, there has been a significant rise in demand for these services owing to the various benefits they offer such as access to specialized skills or expertise, cost-effectiveness, and increased flexibility.

Growing Gaming Industry is Driving the Demand for Game Development Services

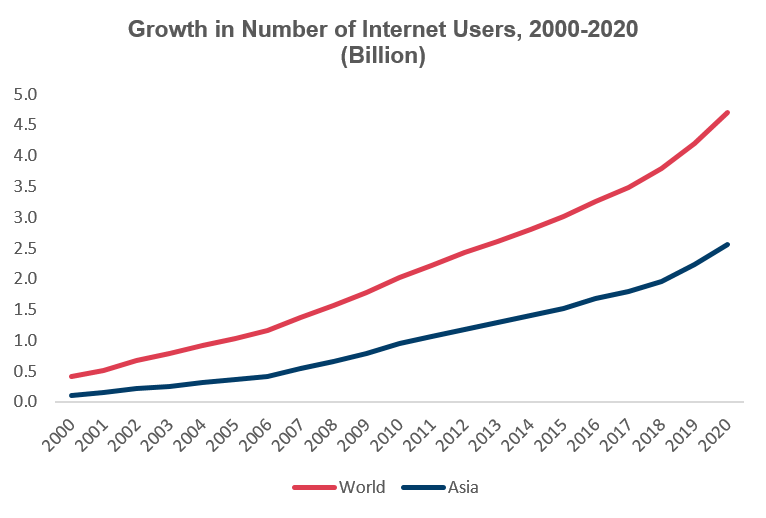

The gaming industry has experienced exponential growth in recent years owing to several factors such as the rise of mobile gaming, the popularity of eSports, and the increasing use of AR/VR technologies. Moreover, there has been a steady growth in internet penetration globally with exponential growth in emerging economies, especially Asia-Pacific. According to Our World in Data, the total number of internet users globally stood at 4.70 billion in 2020, and the total number of internet users in Asia-Pacific stood at 2.56 billion.

The growth of the gaming industry experienced a substantial boost during the COVID-19 pandemic, attributed to a massive surge in players. According to the International Trade Administration (USA), the global video game industry was valued at USD 159.3 billion in 2020 and accounted for 2.7 billion gamers worldwide. The global gaming industry experienced a surge in sales during the pandemic, with the USA recording a remarkable 31% rise in consumer spending on video gaming and subscription services. The closure of numerous development studios due to COVID-19 lockdowns disrupted the development cycle, resulting in a heightened demand for external services through outsourcing. Consequently, the pandemic increased the demand for outsourcing game development services.

Continuous technological advancements in the gaming industry are expected to offer significant growth opportunities. In recent years, the gaming industry has been notably influenced by VR and AR technologies. With ongoing evolution in technologies and platforms, the gaming industry is creating new opportunities for game development services.

A Need for Better Privacy and Cybersecurity is Driving the Demand for Full-Cycle Game Development

Game development services companies offer a wide range of services to cater to the needs of game developers and publishers. There has been a significant increase in demand for full-cycle game development in recent years owing to the growing gaming industry. Full-cycle game development refers to the entire operation involving the development of a video game, from concept and design to production, testing, and release. Full-cycle game development allows for better privacy and cybersecurity as such services often involve the signing of an NDA protecting the IPs of the clients. Thus, full-cycle game development holds a significant market share among all the services.

Mobile Segment Held the Largest Share Owing to the Rise in Smartphone Adoption

Rise in smartphone adoption is driving the mobile gaming market. According to the GSMA report, in 2022, there were about 76% of smartphone connections (about 6.4 billion) globally and it is anticipated to reach 9 billion smartphone connections by 2030, equivalent to 92% of total connections. Moreover, according to the same source, as of January 2023, there were 229 commercial 5G networks worldwide, and over 700 5G smartphone models had been launched. The surge in the adoption of smartphones and 5G connections has led to a sudden shift in demand for mobile game development. Several major game developers and publishers are increasingly opting for porting their game titles to the mobile platform with the help of game development services. Thus, mobile is the largest segment contributing in the game development services market.

Increasing Adoption of the Unreal Engine is Driving the Segment’s Growth

Unreal Engine is among the most popular engines in AAA games. It offers an open and advanced real-time 3D creation platform and is widely used to produce games in multiple genres. In April 2022 Epic Games launched Unreal Engine 5. This launch of the latest Unreal Engine has significantly led to an increase in popularity and adoption of the Unreal Engine among game developers and game development service providers. Thus, Unreal is the largest segment contributing to the game development services market.

Action & Adventure Genre Holds a Significant Market Owing to the High Game Launches of that Genre

Action & adventure games involve games in which the story is dependent upon the player character’s movement, which triggers story events and thus affects the flow of the game. Action & adventure games are among the most popular genres of games on all platforms. Some of the popular examples of action-adventure games include The Legend of Zelda, The Last of Us, and God of War, among others. Action-adventure games have also been recipients of several awards including the British Academy Games Awards (BAFTA) and D.I.C.E. Awards. Thus, the rising popularity of the action & adventure genre and an increasing number of game launches are driving the market.

Regional Analysis

Asia-Pacific is the Fastest-Growing Region Owing to the Presence of a Large Pool of Talent in the Region

Game development services are witnessing a surge in growth in Asia-Pacific, specifically in countries like China, India, Japan, and South Korea. Small indie developers and AAA gaming studios actively rely on expert game development outsourcing firms for artistic and engineering talent to secure and increase revenue. The presence of a large pool of talent in the region and reduced labor costs is one of the key drivers for the Asia-Pacific region in the game development services market.

Competitive Landscape

Several game development companies offer a wide range of services including end-to-end services across diverse platforms including mobile, desktop, and consoles. The companies also offer services in multiple game engines, including Unreal Engine, Unity, and Game Maker. The market is moderately fragmented with the presence of several key market players competing proactively. The gaming industry is constantly evolving and key companies in the game development services are constantly striving to strengthen their services to take the gaming experience to new heights. The gaming industry is undergoing increased consolidation as key companies employ acquisition strategies in response to the maturation of the market. Some of the key players in the market are BR Softech, Chetu, Cubix, iCandy Interactive, Juego Studio, Kevuru Games, Keywords Studio, N-iX Game & VR Studio, Pingle Studio, and Virtuos.

Following are the key developments in the game development services market:

- In July 2023, Kevuru Games acquired Mechachain (France). This acquisition strengthened its portfolio.

- In May 2023, Keywords Studios acquired Hardsuit Labs (US). Hardsuit has previously worked on various Call of Duty and Gears of War titles, as well as games such as State of Decay and Crash Bandicoot 4, providing services such as design and engineering support. This acquisition strengthened its portfolio.

- In February 2023, Bandai Namco Studios partnered with Arika, a Japanese video game developer and publisher, to outsource partial development of the fighting game series ‘Tekken’ to Arika

- in February 2023, Keywords Studios acquired Fortyseven Communications (USA), a PR agency for gaming companies. This acquisition has strengthened its services.

- In August 2022, Keywords Studios acquired Mighty Games (Australia).

Game Development Services Market Coverage

The report provides key insights into the game development services market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players and the competitive landscape within the market.

Table of Contents

- Introduction

- Study Assumptions and Market Definition

- Scope of the Study

- Research Methodology

- Executive Summary

- Market Dynamics

- Market Growth Drivers

- Rising Internet Penetration

- The Growing Gaming Industry

- Increase in the Adoption of AI in Game Development

- Market Growth Restraints

- Risk of Intellectual Property Theft

- Lack of Skilled Workforce

- Market Growth Opportunities

- Technological Innovations in AR/VR/MR

- Porter’s 5 Forces

- PESTLE Analysis

- Market Growth Drivers

- Market Outlook

- Gaming Industry Outlook

- Consumer Behavior Analysis in Gaming Market

- Factors Affecting Game Development Pricing

- Trend Analysis

- Key Regulation Analysis

- Impact of COVID-19 on the Game Development Services Market

- Market Segment Outlook

- Segment Synopsis

- By Services

- Full-Cycle Game Development

- Game Prototyping

- Porting and Re-mastering

- Co-Development

- Live Ops Operations

- Game Testing

- Game Support Services

- Others

- By Platform

- Mobile

- Console

- Computers

- By Game Engine

- UNREAL Engine

- UNITY

- CryEngine

- Others

- By Genre

- Action & Adventure

- Multiplayer Online Battle Arena (MOBA)

- Real-Time Strategy (RTS)

- Role-Playing Games (RPG)

- Sandbox

- Shooter (FPS and TPS)

- Simulation and Sports

- Others

- Regional Outlook

- Global Market Synopsis

- North America

- North America Game Development Services Market Outlook

- US

- US Game Development Services Market, By Service

- US Game Development Services Market, By Platform

- US Game Development Services Market, By Game Engine

- US Game Development Services Market, By Genre

*Note: Cross-segmentation by segments for each country will be covered as shown above.

- Canada

- Europe

- Europe Game Development Services Market Outlook

- Germany

- UK

- France

- Spain

- Italy

- Asia-Pacific

- Asia-Pacific Game Development Services Market Outlook

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Latin America Game Development Services Market Outlook

- Argentina

- Brazil

- Middle East & Africa

- Middle East & Africa Game Development Services Market Outlook

- Saudi Arabia

- UAE

- Türkiye

- Competitive Landscape

- Market Share Analysis

- Product/Service Benchmarking

- Company Strategy Analysis

- Competitive Matrix

- Company Profiles

- Game Development Outsource Service Provider (Supply-Side)

- Keywords Studio

- Company Synopsis

- Company Financials

- Product/Service Portfolio

- Recent Developments

- Keywords Studio

- Game Development Outsource Service Provider (Supply-Side)

*Note: All the companies in section 9.1 will cover the same sub-chapters as above.

- Kevuru Games

- Chetu

- BR Softech

- Juego Studio

- Cubix

- iCandy Interactive

- Game Ace (Program Ace)

- Riseup Labs

- ZVKY

- Key Game Developers/Publishers (Demand-Side)

- Sony

- Company Synopsis

- Company Financials

- Demand Analysis

- Recent Developments

- Sony

*Note: All the companies in section 9.2 will cover same sub-chapters as above.

- Microsoft

- Nintendo

- Tencent

- Electronic Arts

*Note: In Company Profile Chapter, we can cover more players as per requirement as a part of customization. List of additional potential companies that can be covered is provided below. The list is not exhaustive and other companies can also be profiled based on feasibility.

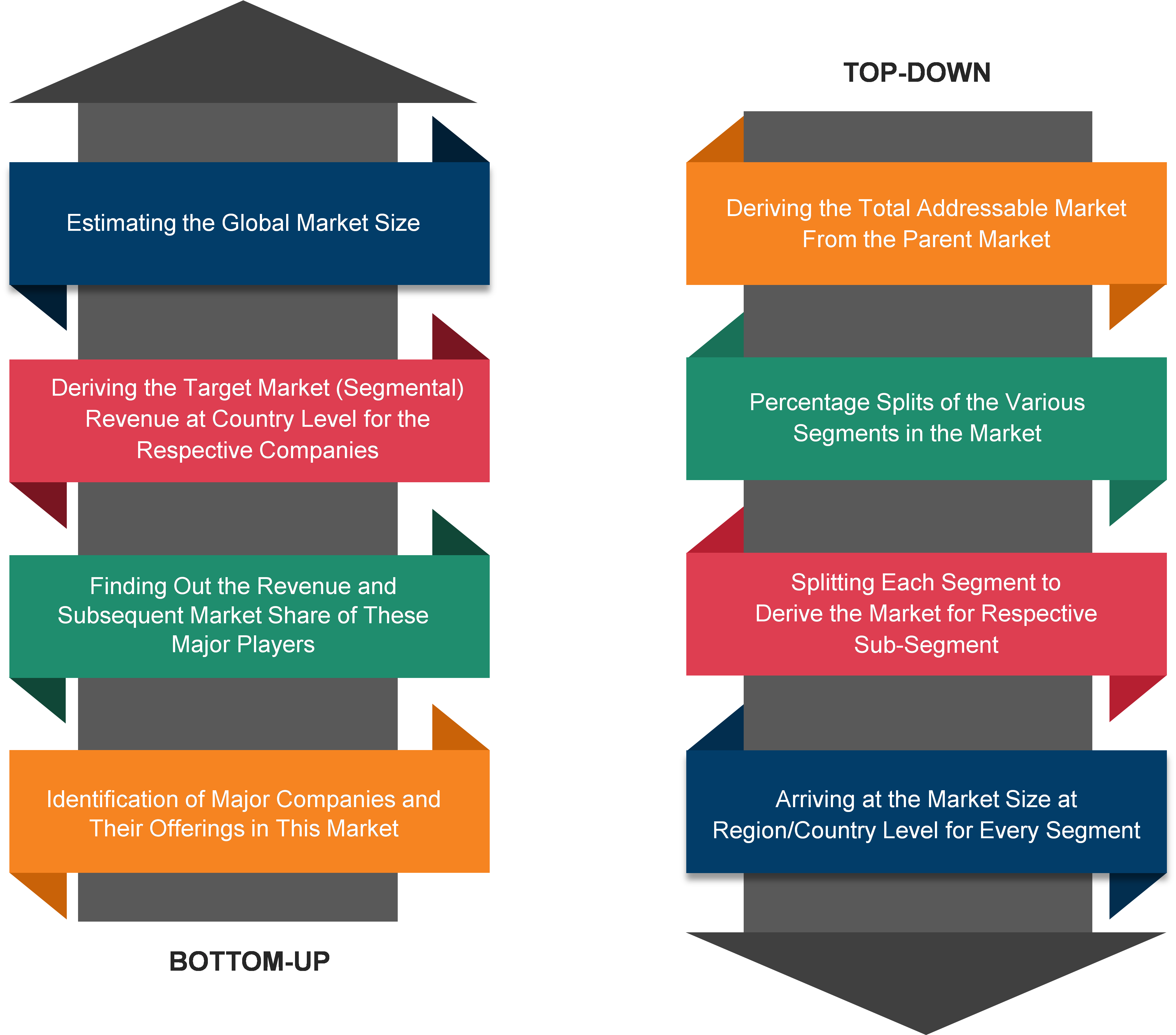

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.