Edible Cosmetics Ingredients Market

- November, 2023

- Consumer Goods

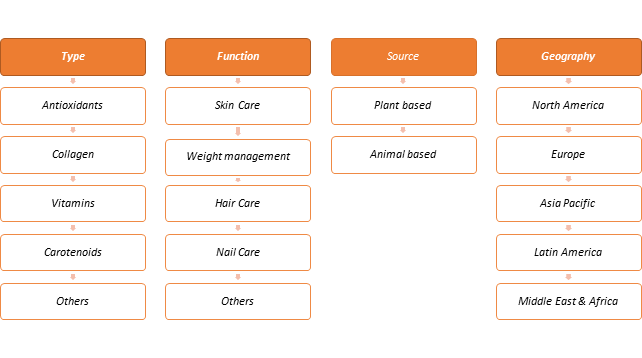

Edible Cosmetics Ingredients Market Size Analysis by Type (Antioxidants, Collagen, Vitamins, Carotenoids, and others), by Function (Skin Care, Weight Management, Hair Care, Nail Care), By Source (Plant-based, Animal based), and by Region (North America, Europe, Asia Pacific, Latin America & Middle East & Africa); Growth Trends & Forecasts (2024 - 2028)

The Edible Cosmetics Ingredients Market size is expected to grow from USD 4.15 billion in 2022 to USD XX billion by 2028, at a CAGR of 7.0% during the forecast period (2024-2030) according to the recent report by Intent Market Research, The Edible Cosmetics Ingredients Market is segmented by Type, Function, and Region.

Edible cosmetic ingredients are utilized in the production of beauty products, including formulations for skincare, hair care, nail-care nail care, and other body-related applications. These active ingredients are selected for their specific beneficial properties and are derived from natural, non-toxic, and food-grade sources such as plants, herbs, fruits, or essential oils. The term “edible” means that these ingredients are safe enough to be applied to the skin or in case ingested orally. Active ingredients are used in cosmetic products for their specific skin or hair care benefits, such as moisturizing, skin care, weight control, calming, or other targeted functions. Edible cosmetics ingredients are used in various beauty products such as serums, creams, lotions, masks, shampoos, and conditioners to achieve the desired effect.

Rising demand for natural, clean, and safe beauty products among consumers is thriving the market growth

They contain simple and recognizable ingredients that resonate well with consumers looking for transparency and safety. These ingredients nourish and protect the skin, and some contain nutrients and antioxidants that have a positive impact on skin health. Edible cosmetic ingredients, often plant-based, align with sustainable and eco-friendly practices and are used in personalized formulations that provide a unique and customized beauty experience. Wellness-focused consumers are looking to improve their overall health and appearance, and brands offer personalized solutions for various skin concerns. Brands are progressively emphasizing ingredients sourced from plant extracts that are natural, organic, and vegan, aiming to attract consumers who prefer to avoid synthetic and chemical components. With the rise of eco-conscious consumers, brands are focusing on appealing flavors, textures, and packaging that meet ethical and sustainable standards.

Consumers are increasingly researching beauty products online to find the most effective products that contain scientifically proven ingredients such as spermidine, NMN, L-cysteine, and astaxanthin that improve both beauty and health. These products not only provide skincare benefits but also promote overall well-being, adapt to different lifestyles, are convenient, and bring a sense of joy to everyday life.

Stringent Regulatory frameworks for edible cosmetics ingredients are hindering the market growth

The edible cosmetic ingredient market faces major challenges related to higher prices, regulatory compliance, labeling, safety, supply chain, and consumer perception. Compliance with various regulations is essential and labeling must be crystal clear and accurate. Ensuring the safety, stability, and quality control of edible ingredients is essential and cannot be omitted. Consistent and high-quality sourcing is a challenge to maintain product integrity. Local regulations and preferences may vary, however, it is important to customize products to meet specific requirements while maintaining their quality and safety. Overcoming skepticism and building trust is a challenge that can be overcome through clear and accurate labeling, responsible sourcing, and a focus on safety and quality control.

The collagen segment is constantly evolving due to rising demand for cosmetics

Collagen accounted for the largest share of the edible cosmetic ingredients market in 2023 and is expected to grow at a faster rate during the forecast period from 2024-2028. In November 2022, Zurvita company developed a new antioxidant collagen gel in collaboration with doctors, scientists, and researchers. Zondora is said to transform the skin and give it a healthy glow when taken orally. Gelatin helps to improve consistency, elasticity, and stability. Gelatin can also be used to normalize gut hormones in obese people. It is used to protect the skin, brighten, and prevent skin aging. It is a good product for consumers because it is used to improve skin health and control weight. The market is expanding as more are people opting for hair health. Collagen is expected to grow at the fastest rate between 2024 and 2028.

Source: Intent Market Research Analysis

The skincare function is responsible for the higher revenue generation in the Edible Cosmetics Ingredients market

The skin care function accounted for the largest share of the edible cosmetic ingredients market in 2023 and is expected to grow at a higher CAGR from 2024 to 2028. This is due to increased awareness regarding the use of edible cosmetic pills as well as the rise in skin diseases. The anti-inflammatory properties of edible cosmetic ingredients to treat various skin conditions are driving growth in the skin care functional segment. According to the Global Atopic Dermatitis Report 2022 published by the International Eczema Council, approximately 223 million people will be living with atopic dermatitis in 2023, including approximately 43 million people aged 1 to 4 years. The high prevalence and growing burden of these dermatological conditions are expected to drive the market growth. Edible cosmetic ingredients are used to help people lose weight by absorbing secretions from the tissues. The increasing use of edible cosmetic ingredients in plastic surgeries is also driving growth in this segment thereby driving the overall industry growth.

Plant-based sources are widely used in Edible Cosmetics Ingredients propelling the market growth

Plant-based ingredients are often seen as a natural and safe option for use on the skin. They appeal to consumers who prefer products with minimal synthetic additives or harsh chemicals. These ingredients are generally gentler and less likely to cause adverse reactions or irritations. Plants contain various vitamins, minerals, antioxidants, and phytonutrients that are beneficial for skin health. These compounds can provide hydration, nourishment, protection against environmental stressors, and support various skin functions. Plant-based ingredients offer versatility in skincare formulations.

Plant based ingredients are used in various forms, including extracts, oils, powders, or infusions, which allow for different applications such as moisturizers, serums, masks, and cleansers. Different plants offer specific skin benefits. For instance, aloe vera is known for its soothing and moisturizing properties, while green tea extract possesses antioxidant and anti-inflammatory properties. This diversity allows formulators to target specific skin concerns.

Increasing mergers and acquisitions by key players in North America are stimulating regional growth

North America dominated the edible cosmetic ingredients market with a major share in 2023, owing to the increasing research and development and proliferation of improved medicines. Increasing consumption of dietary supplements, increasing health benefits of edible cosmetic ingredients, rising healthcare expenditure, and improving healthcare infrastructure are driving the growth of the market in this region. For example, in June 2023, Solabia acquired Applechem, an American provider of cosmetics technology. This strengthens the company’s presence in the US market and allows it to benefit from a broader range of ingredients. This collaboration will enable the two companies to leverage their collective expertise, providing an expanded portfolio of high-performance components to a broader customer base.

Asia-Pacific is expected to experience a higher CAGR due to the growing healthcare awareness of edible cosmetics ingredients. Increasing production technologies, rising incidences of skin diseases, growing demands for functional food & beverages, and increasing healthcare expenditure are driving the market in this region. For instance, Euromonitor International data reveals that Malaysia has the highest level of beauty-related dietary supplements among all Southeast Asian markets, accounting for 17.6% of regional market, making it a leader in beauty supplements.

The merger & acquisition strategies along with the product innovations by major players are driving the market growth

The edible cosmetics ingredients market is highly competitive, with numerous international and domestic players vying for market share. Key players in this market include Cargill, BASF, Bunge, Evonik, Ajinomoto Co., DSM Nutritional, Darling Ingredients, Lonza, Clariant, IOI Oleochemicals, Berg + Schmidt, Hallstar, Auro Gums, Koster Keunen, Tarte Cosmetics, LUSH Cosmetics, Neo Australia, Aryan International, Bite Beauty, and Sugar Nail. These industry leaders are focused on continuous innovation to meet the evolving preferences and needs of consumers. The ability to adapt to changing market trends and consumer preferences is crucial for success in the sustainable food products market.

- In February 2022, Merck introduced two new cosmetic ingredients, RonaCare Baobab and RonaCare Hibiscus. These ingredients are derived from nutrient-rich superfoods, specifically the baobab fruit and the hibiscus flower. Their beneficial effects can also be utilized for skincare purposes.

- The UK edible beauty market experienced growth in September 2021 with the launch of the indie brand Manifesto.

- In February 2021, Singapore-based skincare brand Recherché entered the market with its first range of edible skincare products. The brand plans to further expand its product line to capitalize on the increasing consumer interest in ingestible beauty products.

About Us

Intent Market Research offers custom-made services and syndicated market research studies that track various industries. Our reports combine comprehensive industry analysis with forecasts and a deep understanding of critical industry factors. We have a repository of thoroughly researched syndicated market reports that will help you stay up-to-date with current trends and guide your growth. Our consulting services provide actionable insights that help clients prioritize opportunities and build business intelligence. Our team of consultants is dedicated to assisting organizations in growing their businesses, improving their operations, and enabling change. With our support, you can make informed decisions and achieve commendable growth.

Edible Cosmetics Ingredients Market: Scope of the Report

The report provides key insights into the edible cosmetics ingredients market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector analysis explores market drivers, restraints, opportunities, and other relevant factors. It also examines key players and the competitive landscape within the market for edible cosmetics ingredients.

Edible cosmetics ingredients are segmented by Type (Antioxidants, Collagen, Vitamins, Carotenoids, and others), by Function (Skin Care, Weight Management, Hair Care, Nail Care, and Others), By Source (Plant-based, Animal based & Others), and by Geography (North America, Europe, Asia Pacific, Latin America & Middle East & Africa). The report offers the market size and forecasts for the edible cosmetics ingredients market in value (USD billion) for all the above segments.

Report Scope

Report Features | Description |

Market Value (2022) | USD 4.15 Bn |

Forecast Revenue (2030) | USD XX Bn |

CAGR (2023-2030) | 7.0% |

Base Year for Estimation | 2023 |

Historical Period | 2022 |

Forecast Period | 2024-2028 |

Report Coverage | Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

Segments Covered | By Type (Antioxidants, Collagen, Vitamins, Carotenoids, and others), by Function (Skin Care, Weight Management, Hair Care, Nail Care, and Others), By Source (Plant-based, Animal based & Others), and by Geography (North America, Europe, Asia Pacific, Latin America & Middle East & Africa) |

Regional Analysis | North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

Competitive Landscape | Cargill, BASF, Bunge, Evonik, Ajinomoto Co., DSM Nutritional, Darling Ingredients, Lonza, Clariant, IOI Oleochemicals, Berg + Schmidt, Hallstar, Auro Gums, Koster Keunen, Tarte Cosmetics, LUSH Cosmetics, Neo Australia, Aryan International, Bite Beauty and Sugar Nail |

Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

Purchase Options | We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

1. Introduction | ||

1. 1. Study Assumptions and Edible Cosmetics Ingredients Market Definition | ||

1.2. Scope of the Study | ||

2. Research Methodology | ||

3. Executive Summary | ||

4. Edible Cosmetics Ingredients Market Dynamics | ||

4.1. Market Growth Drivers | ||

4.2 Market Growth Challenges | ||

5. Edible Cosmetics Ingredients Market Outlook | ||

5.1. Regulatory Landscape | ||

5.2 Technological advances and future opportunity analysis | ||

5.3. Business expansion & and product pipeline analysis | ||

5.4 Consumer Adoption Analysis | ||

5.5. Porter’s Five Forces Analysis | ||

5.6. Impact of COVID-19 on the Edible Cosmetics Ingredients Market | ||

5.7. Raw Material Analysis | ||

5.8. Value Chain Analysis | ||

5.9. Pestle Analysis | ||

6. Global Edible Cosmetics Ingredients Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2028) | ||

6.1 Type | ||

6.1.1 Antioxidants | ||

6.1.2 Hyaluronic Acid | ||

6.1.3 Peptides | ||

6.1.4 Natural Extracts | ||

6.1.5 Others | ||

6.2 Function | ||

6.2.1 Skin Care | ||

6.2.2 Weight management | ||

6.2.3 Hair Care | ||

6.2.4 Nail Care | ||

6.2.5 Others | ||

6.3 Source | ||

6.3.1 Plant based | ||

6.3.2 Animal based | ||

6.3.3 Others | ||

6.4 Geography | ||

6.4.1 North America | ||

6.4.2 Europe | ||

6.4.3 Asia-Pacific | ||

6.4.4 Latin America | ||

6.4.5 Middle East and Africa | ||

7. North America Edible Cosmetics Ingredients Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2028) | ||

7.1 Type | ||

7.1.1 Antioxidants | ||

7.1.2 Hyaluronic Acid | ||

7.1.3 Peptides | ||

7.1.4 Natural Extracts | ||

7.1.5 Others | ||

7.2 Function | ||

7.2.1 Skin Care | ||

7.2.2 Weight management | ||

7.2.3 Hair Care | ||

7.2.4 Nail Care | ||

7.2.5 Others | ||

7.3 Source | ||

7.3.1 Plant based | ||

7.3.2 Animal based | ||

7.3.3 Others | ||

7.4 Country | ||

7.4.1 United States | ||

7.4.1.1 Type | ||

7.4.1.1.1 Antioxidants | ||

7.4.1.1.2 Hyaluronic Acid | ||

7.4.1.1.3 Peptides | ||

7.4.1.1.4 Natural Extracts | ||

7.4.1.1.5 Others | ||

7.4.1.2 Function | ||

7.4.1.2.1 Skin Care | ||

7.4.1.2.2 Weight management | ||

7.4.1.2.3 Hair Care | ||

7.4.1.2.4 Soothing & Calming | ||

7.4.1.2.5 Others | ||

7.4.1.3 Source | ||

7.4.1.3.1 Plant based | ||

7.4.1.3.2 Animal based | ||

7.4.1.3.3 Others | ||

7.4.2 Canada | ||

7.4.2.1 Type | ||

7.4.2.1.1 Antioxidants | ||

7.4.2.1.2 Hyaluronic Acid | ||

7.4.2.1.3 Peptides | ||

7.4.2.1.4 Natural Extracts | ||

7.4.2.1.5 Others | ||

7.4.2.2 Function | ||

7.4.2.2.1 Skin Care | ||

7.4.2.2.2 Weight management | ||

7.4.2.2.3 Hair Care | ||

7.4.2.2.4 Soothing & Calming | ||

7.4.2.2.5 Others | ||

7.4.2.3 Source | ||

7.4.2.3.1 Plant based | ||

7.4.2.3.2 Animal based | ||

7.4.2.3.3 Others | ||

8. Europe Market Edible Cosmetics Ingredients Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2028) | ||

8.1 Type | ||

8.1.1 Antioxidants | ||

8.1.2 Hyaluronic Acid | ||

8.1.3 Peptides | ||

8.1.4 Natural Extracts | ||

8.1.5 Others | ||

8.2 Function | ||

8.2.1 Skin Care | ||

8.2.2 Weight management | ||

8.2.3 Hair Care | ||

8.2.4 Nail Care | ||

8.2.5 Others | ||

8.3 Source | ||

8.3.1 Plant based | ||

8.3.2 Animal based | ||

8.3.3 Others | ||

8.4 Country | ||

8.4.1 United Kingdom | ||

8.4.1.1 Type | ||

8.4.1.1.1 Antioxidants | ||

8.4.1.1.2 Hyaluronic Acid | ||

8.4.1.1.3 Peptides | ||

8.4.1.1.4 Natural Extracts | ||

8.4.1.1.5 Others | ||

8.4.1.2 Function | ||

8.4.1.2.1 Skin Care | ||

8.4.1.2.2 Weight management | ||

8.4.1.2.3 Hair Care | ||

8.4.1.2.4 Soothing & Calming | ||

8.4.1.2.5 Others | ||

8.4.1.3 Source | ||

8.4.1.3.1 Plant based | ||

8.4.1.3.2 Animal based | ||

8.4.1.3.3 Others | ||

8.4.2 France | ||

8.4.2.1 Type | ||

8.4.2.1.1 Antioxidants | ||

8.4.2.1.2 Hyaluronic Acid | ||

8.4.2.1.3 Peptides | ||

8.4.2.1.4 Natural Extracts | ||

8.4.2.1.5 Others | ||

8.4.2.2 Function | ||

8.4.2.2.1 Skin Care | ||

8.4.2.2.2 Weight management | ||

8.4.2.2.3 Hair Care | ||

8.4.2.2.4 Soothing & Calming | ||

8.4.2.2.5 Others | ||

8.4.2.3 Source | ||

8.4.2.3.1 Plant based | ||

8.4.2.3.2 Animal based | ||

8.4.2.3.3 Others | ||

8.4.3 Germany | ||

8.4.3.1 Type | ||

8.4.3.1.1 Antioxidants | ||

8.4.3.1.2 Hyaluronic Acid | ||

8.4.3.1.3 Peptides | ||

8.4.3.1.4 Natural Extracts | ||

8.4.3.1.5 Others | ||

8.4.3.2 Function | ||

8.4.3.2.1 Skin Care | ||

8.4.3.2.2 Weight management | ||

8.4.3.2.3 Hair Care | ||

8.4.3.2.4 Soothing & Calming | ||

8.4.3.2.5 Others | ||

8.4.3.3 Source | ||

8.4.3.3.1 Plant based | ||

8.4.3.3.2 Animal based | ||

8.4.3.3.3 Others | ||

8.4.4 Italy | ||

8.4.4.1 Type | ||

8.4.4.1.1 Antioxidants | ||

8.4.4.1.2 Hyaluronic Acid | ||

8.4.4.1.3 Peptides | ||

8.4.4.1.4 Natural Extracts | ||

8.4.4.1.5 Others | ||

8.4.4.2 Function | ||

8.4.4.2.1 Skin Care | ||

8.4.4.2.2 Weight management | ||

8.4.4.2.3 Hair Care | ||

8.4.4.2.4 Soothing & Calming | ||

8.4.4.2.5 Others | ||

8.4.4.3 Source | ||

8.4.4.3.1 Plant based | ||

8.4.4.3.2 Animal based | ||

8.4.4.3.3 Others | ||

9. Asia Pacific Edible Cosmetics Ingredients Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2028) | ||

9.1 Type | ||

9.1.1 Antioxidants | ||

9.1.2 Hyaluronic Acid | ||

9.1.3 Peptides | ||

9.1.4 Natural Extracts | ||

9.1.5 Others | ||

9.2 Function | ||

9.2.1 Skin Care | ||

9.2.2 Weight management | ||

9.2.3 Hair Care | ||

9.2.4 Nail Care | ||

9.2.5 Others | ||

9.3 Source | ||

9.3.1 Plant based | ||

9.3.2 Animal based | ||

9.3.3 Others | ||

9.4 Country | ||

9.4.1 China | ||

9.4.1.1 Type | ||

9.4.1.1.1 Antioxidants | ||

9.4.1.1.2 Hyaluronic Acid | ||

9.4.1.1.3 Peptides | ||

9.4.1.1.4 Natural Extracts | ||

9.4.1.1.5 Others | ||

9.4.1.2 Function | ||

9.4.1.2.1 Skin Care | ||

9.4.1.2.2 Weight management | ||

9.4.1.2.3 Hair Care | ||

9.4.1.2.4 Soothing & Calming | ||

9.4.1.2.5 Others | ||

9.4.1.3 Source | ||

9.4.1.3.1 Plant based | ||

9.4.1.3.2 Animal based | ||

9.4.1.3.3 Others | ||

9.4.2 Japan | ||

9.4.2.1 Type | ||

9.4.2.1.1 Antioxidants | ||

9.4.2.1.2 Hyaluronic Acid | ||

9.4.2.1.3 Peptides | ||

9.4.2.1.4 Natural Extracts | ||

9.4.2.1.5 Others | ||

9.4.2.2 Function | ||

9.4.2.2.1 Skin Care | ||

9.4.2.2.2 Weight management | ||

9.4.2.2.3 Hair Care | ||

9.4.2.2.4 Soothing & Calming | ||

9.4.2.2.5 Others | ||

9.4.2.3 Source | ||

9.4.2.3.1 Plant based | ||

9.4.2.3.2 Animal based | ||

9.4.2.3.3 Others | ||

9.4.3 India | ||

9.4.3.1 Type | ||

9.4.3.1.1 Antioxidants | ||

9.4.3.1.2 Hyaluronic Acid | ||

9.4.3.1.3 Peptides | ||

9.4.3.1.4 Natural Extracts | ||

9.4.3.1.5 Others | ||

9.4.3.2 Function | ||

9.4.3.2.1 Skin Care | ||

9.4.3.2.2 Weight management | ||

9.4.3.2.3 Hair Care | ||

9.4.3.2.4 Soothing & Calming | ||

9.4.3.2.5 Others | ||

9.4.3.3 Source | ||

9.4.3.3.1 Plant based | ||

9.4.3.3.2 Animal based | ||

9.4.3.3.3 Others | ||

9.4.4 South Korea | ||

9.4.4.1 Type | ||

9.4.4.1.1 Antioxidants | ||

9.4.4.1.2 Hyaluronic Acid | ||

9.4.4.1.3 Peptides | ||

9.4.4.1.4 Natural Extracts | ||

9.4.4.1.5 Others | ||

9.4.4.2 Function | ||

9.4.4.2.1 Skin Care | ||

9.4.4.2.2 Weight management | ||

9.4.4.2.3 Hair Care | ||

9.4.4.2.4 Soothing & Calming | ||

9.4.4.2.5 Others | ||

9.4.4.3 Source | ||

9.4.4.3.1 Plant based | ||

9.4.4.3.2 Animal based | ||

9.4.4.3.3 Others | ||

10. Latin America Edible Cosmetics Ingredients Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2028) | ||

10.1 Type | ||

10.1.1 Antioxidants | ||

10.1.2 Hyaluronic Acid | ||

10.1.3 Peptides | ||

10.1.4 Natural Extracts | ||

10.1.5 Others | ||

10.2 Function | ||

10.2.1 Skin Care | ||

10.2.2 Weight management | ||

10.2.3 Hair Care | ||

10.2.4 Nail Care | ||

10.2.5 Others | ||

10.3 Source | ||

10.3.1 Plant based | ||

10.3.2 Animal based | ||

10.3.3 Others | ||

10.4 Country | ||

10.4.1 Brazil | ||

10.4.1.1 Type | ||

10.4.1.1.1 Antioxidants | ||

10.4.1.1.2 Hyaluronic Acid | ||

10.4.1.1.3 Peptides | ||

10.4.1.1.4 Natural Extracts | ||

10.4.1.1.5 Others | ||

10.4.1.2 Function | ||

10.4.1.2.1 Skin Care | ||

10.4.1.2.2 Weight management | ||

10.4.1.2.3 Hair Care | ||

10.4.1.2.4 Soothing & Calming | ||

10.4.1.2.5 Others | ||

10.4.1.3 Source | ||

10.4.1.3.1 Plant based | ||

10.4.1.3.2 Animal based | ||

10.4.1.3.3 Others | ||

10.4.2 Mexico | ||

10.4.2.1 Type | ||

10.4.2.1.1 Antioxidants | ||

10.4.2.1.2 Hyaluronic Acid | ||

10.4.2.1.3 Peptides | ||

10.4.2.1.4 Natural Extracts | ||

10.4.2.1.5 Others | ||

10.4.2.2 Function | ||

10.4.2.2.1 Skin Care | ||

10.4.2.2.2 Weight management | ||

10.4.2.2.3 Hair Care | ||

10.4.2.2.4 Soothing & Calming | ||

10.4.2.2.5 Others | ||

10.4.2.3 Source | ||

10.4.2.3.1 Plant based | ||

10.4.2.3.2 Animal based | ||

10.4.2.3.3 Others | ||

10.4.3 Argentina | ||

10.4.3.1 Type | ||

10.4.3.1.1 Antioxidants | ||

10.4.3.1.2 Hyaluronic Acid | ||

10.4.3.1.3 Peptides | ||

10.4.3.1.4 Natural Extracts | ||

10.4.3.1.5 Others | ||

10.4.3.2 Function | ||

10.4.3.2.1 Skin Care | ||

10.4.3.2.2 Weight management | ||

10.4.3.2.3 Hair Care | ||

10.4.3.2.4 Soothing & Calming | ||

10.4.3.2.5 Others | ||

10.4.3.3 Source | ||

10.4.3.3.1 Plant based | ||

10.4.3.3.2 Animal based | ||

10.4.3.3.3 Others | ||

11. Middle East & Africa Edible Cosmetics Ingredients Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2028) | ||

11.1 Type | ||

11.1.1 Antioxidants | ||

11.1.2 Hyaluronic Acid | ||

11.1.3 Peptides | ||

11.1.4 Natural Extracts | ||

11.1.5 Others | ||

11.2 Function | ||

11.2.1 Skin Care | ||

11.2.2 Weight management | ||

11.2.3 Hair Care | ||

11.2.4 Nail Care | ||

11.2.5 Others | ||

11.3 Source | ||

11.3.1 Plant based | ||

11.3.2 Animal based | ||

11.3.3 Others | ||

11.4 Country | ||

11.4.1 United Arab Emirates | ||

11.4.1.1 Type | ||

11.4.1.1.1 Antioxidants | ||

11.4.1.1.2 Hyaluronic Acid | ||

11.4.1.1.3 Peptides | ||

11.4.1.1.4 Natural Extracts | ||

11.4.1.1.5 Others | ||

11.4.1.2 Function | ||

11.4.1.2.1 Skin Care | ||

11.4.1.2.2 Weight management | ||

11.4.1.2.3 Hair Care | ||

11.4.1.2.4 Soothing & Calming | ||

11.4.1.2.5 Others | ||

11.4.1.3 Source | ||

11.4.1.3.1 Plant based | ||

11.4.1.3.2 Animal based | ||

11.4.1.3.3 Others | ||

11.4.2 Saudi Arabia | ||

11.4.2.1 Type | ||

11.4.2.1.1 Antioxidants | ||

11.4.2.1.2 Hyaluronic Acid | ||

11.4.2.1.3 Peptides | ||

11.4.2.1.4 Natural Extracts | ||

11.4.2.1.5 Others | ||

11.4.2.2 Function | ||

11.4.2.2.1 Skin Care | ||

11.4.2.2.2 Weight management | ||

11.4.2.2.3 Hair Care | ||

11.4.2.2.4 Soothing & Calming | ||

11.4.2.2.5 Others | ||

11.4.2.3 Source | ||

11.4.2.3.1 Plant based | ||

11.4.2.3.2 Animal based | ||

11.4.2.3.3 Others | ||

11.4.3 South Africa | ||

11.4.3.1 Type | ||

11.4.3.1.1 Antioxidants | ||

11.4.3.1.2 Hyaluronic Acid | ||

11.4.3.1.3 Peptides | ||

11.4.3.1.4 Natural Extracts | ||

11.4.3.1.5 Others | ||

11.4.3.2 Function | ||

11.4.3.2.1 Skin Care | ||

11.4.3.2.2 Weight management | ||

11.4.3.2.3 Hair Care | ||

11.4.3.2.4 Soothing & Calming | ||

11.4.3.2.5 Others | ||

11.4.3.3 Source | ||

11.4.3.3.1 Plant based | ||

11.4.3.3.2 Animal based | ||

11.4.3.3.3 Others | ||

12. Competitive Landscape | ||

12.1 Company Market Share Analysis | ||

12.2 Competitive Matrix | ||

12.2 Product Benchmarking | ||

12.3 Company Profiles (Manufacturers of Edible Cosmetics Ingredients) | ||

12.3.1 Cargill | ||

12.3.1.1 Company Synopsis | ||

12.3.1.2 Company Financials | ||

12.3.1.3 Product/ Service Portfolio | ||

12.3.1.4 Recent Developments | ||

12.3.2 BASF | ||

12.3.3 Bunge | ||

12.3.4 Evonik | ||

12.3.5 Ajinomoto Co. | ||

12.3.6 DSM Nutritional | ||

12.3.7 Darling Ingredients | ||

12.3.8 Lonza | ||

12.3.9 Clariant | ||

12.3.10 IOI Oleochemicals | ||

12.3.11 Berg + Schmidt | ||

12.3.12 Hallstar | ||

12.3.13 Auro Gums | ||

12.3.14 Koster Keunen | ||

12.3.15 Tarte Cosmetics | ||

12.3.16 LUSH Cosmetics | ||

12.3.17 Neo Australia | ||

12.3.18 Aryan International | ||

12.3.19 Bite Beauty | ||

12.3.20 Sugar Nail | ||

12.4 Company Profiles (Demand Side) | ||

12.4.1 L’Oréal | ||

12.4.1.1 Company Synopsis | ||

12.3.1.2 Company Financials | ||

12.3.1.3 Product/ Service Portfolio | ||

12.3.1.4 Recent Developments | ||

12.4.2 Estée Lauder | ||

12.4.3 P&G | ||

12.4.4 Maybelline | ||

12.4.5 Kylie Cosmetics | ||

*List Not Exhaustive | ||

Disclaimer: The list of all other companies will be mentioned under client requirements | ||

13. Analyst Recommendations | ||

We specialize in providing syndicated market research reports that are highly sought after. We can also provide tailored customization to meet unique requirements. Our commitment exceeds limits as we empower clients with tactical and strategic support for well-informed business decisions and consistent success. Our experienced team continuously pushes the boundaries in market research, focusing on emerging markets with unwavering dedication. We provide comprehensive insights into global, regional, and country-level data, leaving no aspect hidden in any target market. Our market forecasts will help you:

- Grasp the market opportunity for new products and services.

- Distinguish between emerging, maturing, and declining market opportunities.

- Build your business plans and strategies on factual data, not conjecture.

We place a strong emphasis on ensuring that each step of the research process is executed with meticulous attention to detail, aiming for minimal errors, and maintaining complete transparency throughout. We leverage multiple research methodologies to conduct our studies:

Data Collection and Interpretation

As research analysts, we prioritize accuracy and in-depth analysis, employing a diverse array of sources. These sources can be categorized into three main channels:

After collecting data from secondary and primary sources, we carefully examine the following to establish base numbers:

- Analyzing company revenues and their corresponding market share (involving the analysis of revenue data released by publicly listed manufacturers)

- Deriving market estimates by inspecting the primary market as well as its complementary markets

- Presenting key findings based on major segments and outlining top strategies by major players

- Analyzing the dynamics of the market, including drivers, opportunities, restraints, and challenges

- Assessing macro-economic factors and the regulatory framework influencing the market

- Evaluating market investment feasibility, conducting PEST and PORTER’s Five Force analyses

- Performing impact analysis of drivers and restraints, and conducting industry chain and cost structure analyses

- Creating opportunity maps, analyzing market competition scenarios, and conducting product life cycle analysis

- Identifying opportunity orbits and manufacturer intensity maps

- Analyzing major companies’ sales by value to gain comprehensive insights into the market

Market Sizing & Forecasting

We use both bottom-up and top-down approaches to segment and estimate quantitative aspects of the market. Our research reports also present data triangulation, which examines the market from three different perspectives.

- In the Bottom-Up Approach, we begin by collecting data at the micro-level, which includes individual data points and small samples. We aggregate and analyze the data to form broader conclusions and insights. We also include the market share of the vendors, which provides a granular view of the key players in the market, starting from the ground up. This approach is useful for industries with diverse segments and varied customer preferences. It is effective in exploratory research when we have little pre-existing knowledge and allows unexpected patterns and trends to emerge from data, leading to the creation of new theories.

- In the Top-Down Approach, we start with a macro-level view of the market, including the overall market size and industry trends. We analyze large-scale data and market indicators to make general assumptions. This approach provides a broader perspective and identifies the main market drivers and trends. We then narrow down the focus as data is scrutinized and specific segments are explored. This approach is effective for quickly assessing overall market potential and opportunities in various regions.

Value Chain-Based Sizing & Forecasting:

Consumer Behavior:

- Usage Rates and Patterns: Collect and analyze data on current product usage. It assists in product development and marketing strategies. Moreover, it also helps determine substitute rates.

- Market Penetration by User Base: Estimate the total market size and assess success in engaging potential consumers. Identify unmet needs and growth opportunities to enhance market penetration.

- Analyze market share, customer satisfaction, and preferences, providing insights into competitive positioning.

Historical/Empirical Data:

- Establish baseline estimates for analyzing future trends and making informed decisions.

- Use exponential smoothing to predict future product performance by accounting for trends and patterns over time.

Trend Analysis:

Conduct trend analysis using year-trending models to study historical data and identify patterns and trends that can influence future product penetration. This analysis aids in making proactive decisions and adapting strategies to capitalize on emerging opportunities and overcome challenges in the market.

Data Validation:

- Engage with in-house market analysts and industry experts to validate all collected data and cross-check it through calls or face-to-face interviews.

- Conduct thorough quality checks to validate the data included in the report and contact various members of our network to verify the data’s authenticity, resulting in error elimination and eradication of doubtful information.

- Correlate with standard KIPs to gain insights into future trends.

- Conduct multi-tier data validation through external thought leaders, market analysts, subject matter experts, comparative analysis, and review data collection instruments.

Continuous Monitoring: Final Report and Presentation

- Our team collaborates with industry experts to finalize and validate data. We utilize advanced data analysis models to generate valuable insights. Our integrated report comes with robust analytics and advanced visualization capabilities to ensure consistency and efficiency. We implement a standardized content management approach, common tagging, and taxonomy structure for seamless information connectivity. We offer comprehensive market and company views to facilitate easy and accurate comparisons. Our goal is to provide our clients with exceptional analytical resources for a competitive edge. We empower them to transform data into strategic insights for innovation and growth.