Digital Health Market

- December, 2023

- Life Sciences and Healthcare

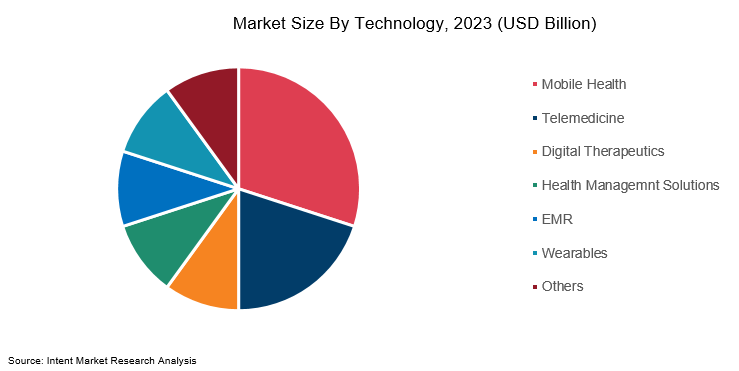

Digital Health Market Size Analysis, By Component (Hardware, Software, Services), By Product (Mobile Health, Telemedicine, Digital Therapeutics, Health Management Solutions, EMR, Wearables), By Application (Treatment & Monitoring, Diagnostics, Behavioral Health, Health & Fitness, Data, Integration & Analytics, Research & Clinical Development (Bioinformatics tools, Imaging)), By End-use (Provider, Payor, Patients) and Regions – Global Forecast to 2030

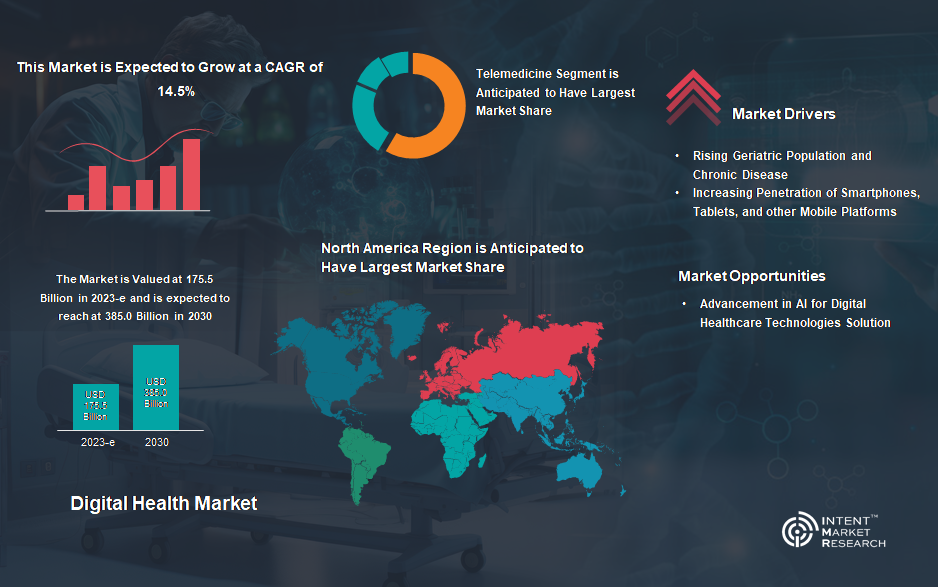

As per Intent Market Research, the digital health market size is expected to grow from USD 175.5 billion in 2023-e to USD 385.0 billion by 2030, at a CAGR of 14.5% during the forecast period (2024-2030).

Digital health encompasses the application of digital technologies in healthcare practices. Recognizing the broad spectrum of these technologies, the U.S. Food and Drug Administration (FDA) encompasses mobile health, tele-health, wearable devices, telemedicine, health information technologies, and personalized medicines under the umbrella of digital health. The influence of artificial intelligence (AI) and machine learning (ML) is notable, with applications spanning image analysis, patient monitoring, and medical device automation. These technologies enhance clinical workflows, providing invaluable support to healthcare professionals.

The digital health market is propelled by several key drivers. The aging global population and the increasing prevalence of chronic diseases are driving the demand for innovative healthcare solutions. Additionally, the widespread adoption of smartphones, tablets, and other mobile platforms is expanding the reach of digital health technologies, enabling more accessible and personalized healthcare services.

The industry is witnessing a notable shift towards patient-centric healthcare solutions, with a growing emphasis on tailoring services to individual needs. Government initiatives further contribute to the market’s momentum by creating a supportive environment and incentivizing the adoption of digital health solutions.

On the upside, the digital health market presents promising opportunities, particularly in the realm of AI advancements. The integration of AI in digital healthcare technologies opens avenues for more sophisticated diagnostic tools, personalized treatment plans, and enhanced predictive analytics. Leveraging these opportunities can result in significant advancements in the efficiency and effectiveness of digital health solutions, contributing to the overall evolution of the healthcare industry.

Digital Health Solutions were increasingly used during COVID-19 among Patients

The market saw a positive impact from the COVID-19 pandemic, driven by increased adoption of digital technologies for diagnosing and treating illnesses, along with a surge in teleconsultations. In 2020, the U.S. recorded 19 million teleconsultations, comprising a quarter of all consultations, as reported by NCBI in May 2021.

The pandemic-induced constraints on travel and movement, coupled with limitations on traditional medical services for emergencies, contributed to a pronounced rise in the use of teleconsultation platforms. Data from the Centers for Disease Control and Prevention in October 2020 revealed a 50% increase in teleconsultations in the U.S. between the beginning of March 2020 and the second week of April 2020 compared to the same period in 2019.

Market players experienced substantial revenue growth in 2020. For instance, Garmin reported a remarkable 25.8% increase in revenues from its fitness segment during the year. In 2021, the company continued to observe a 16.4% growth in revenue from its fitness segment.

Privacy concerns regarding health information and patient data can hinder the growth of digital health market

Privacy concerns regarding patient data emerge as a critical constraint hampering market growth. As healthcare data breaches affected over 40 million patient records in the U.S. in 2021, securing health data from cybercrimes has become a paramount concern. The challenge lies in finding ways to share health data among medical practitioners while safeguarding personally identifiable information. Hacking Personally Identifiable Health Information (PHI) is a growing trend, exploiting patients’ personal information and contributing to a surge in healthcare data breaches. Addressing these privacy concerns is essential for fostering trust among healthcare providers and patients and overcoming barriers to market growth.

Mobile Health dominates the digital health market with a focus on fitness and well-being

In the product-type segmentation, including Mobile Health (mHealth), healthcare analytics, digital health systems, and telehealthcare, the dominant force in 2022 was the mHealth segment. This segment secured the largest share driven by a societal focus on fitness and well-being. The mHealth segment’s growth was notably propelled by increased demand for mobile apps, driven by a heightened emphasis on personal health. Adoption of health monitoring applications has further increased due to a growing commitment to early diagnosis and routine health monitoring.

Illustratively, Fitbit Inc. responded to this trend in April 2021 with the launch of Fitbit Luxe, a fitness and wellness tracker explicitly designed for stress management and sleep tracking, thereby contributing to the promotion of mental and physical wellness.

Services Segment held the Predominant Market Share owing to its Cost-Efficiency

The services segment held the largest market share in 2023. This dominance is attributed to the relatively lower cost of teleconsultation services. The expansion initiatives by companies offering teleconsultation services have played a pivotal role in reinforcing the growth of this segment. For instance, Sesame expanded its direct-to-patient platform services into New York City and Houston in September 2020. The objective of such expansions is to enhance the accessibility, affordability, and transparency of healthcare services for patients.

Anticipated Growth in The Patient’s Segment of the Digital Health Industry

During the forecast period, the patient’s segment is poised to experience the highest CAGR within the digital health market. The market’s end-user segmentation comprises healthcare providers, Payers, and patients, with the latter projected to be the most rapidly advancing segment. This accelerated growth is primarily attributed to the increasing awareness of self-health management. The proliferation of smartphones and mHealth devices has notably contributed to the segment’s expansion by making health tracking and monitoring more accessible and convenient for individuals.

North America is Poised for Significant Market Growth in the Forecast Period

North America, led by the United States, commands the largest market share in the industry. This dominance is attributed to well-established reimbursement policies, high per capita expenditure on advanced technologies, and a growing demand for cutting-edge healthcare technologies. The introduction of the Fitbit Sense by Fitbit in August 2020 exemplifies the region’s dedication to advanced health technologies.

Key players in the market include Apple, Boston Scientific, Cerner Corporation, Fitbit (Google), J&J, Omron Healthcare, GE Healthcare, Philips, Masimo, Medtronic, Siemens Healthcare. In conclusion, the digital health market is shaped by dynamic factors such as government initiatives, technological trends, privacy concerns, and regional dynamics, with key players driving innovation and strategic collaborations to address the evolving healthcare landscape.

Digital Health Market Coverage

The report provides key insights into the digital health market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market.

Report Scope

Report Features | Description |

Market Value (2023-e) | USD 170.5 billion |

Forecast Revenue (2030) | USD 385.0 billion |

CAGR (2024-2030) | 14.5% |

Base Year for Estimation | 2023-e |

Historic Year | 2022 |

Forecast Period | 2024-2030 |

Report Coverage | Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

Segments Covered | By Offering (Hardware, Software {Annual Licensing, Subscription-Based}, Services {Subscription-Based, Pay-Per Service}), By Technology (Mobile Health {mHealth Devices [Vital Signs Monitoring, Peak Flow Meter, Fetal Monitors Equipment, Sleep Apnea Test Monitor, Neurological Monitoring Devices], mHealth Applications [Medical Applications, Fitness Applications]}, Telemedicine {Telecare [Actively Monitoring, Remote Medication Management], Telehealth [LTC Monitoring, Video Consultation]}, Digital Therapeutics {Preventive Applications, Treatment Applications}, Health Management Solutions {EMR, Wearables, E-Prescribing}, Others), By Application (Treatment & Monitoring, Diagnostics, Behavioral Health, Health & Fitness, Data, Integration & Analytics, Research & Clinical Development, Others), By End-Use (Provider {Hospitals & Clinics, Long Term Care Centers}, Payers { Public, Private}, Patients) |

Regional Analysis | North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

Competitive Landscape | Apple, Boston Scientific, Cerner Corporation, Fitbit (Google), J&J, Omron Healthcare, GE Healthcare, Philips, Masimo, Medtronic, Siemens Healthcare |

Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

Purchase Options | We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

Table of Contents

- Introduction

- Study Assumptions and Market Definition

- Scope of the Study

- Research Methodology

- Executive Summary

- Market Dynamics

- Market Drivers

- Rising geriatric population and chronic disease

- Increasing penetration of smartphones, tablets, and other mobile platforms

- Rising focus on patient-centric healthcare solutions

- Initiatives taken by the government

- Market Challenges

- Security and Privacy Concerns

- Complexity in Reimbursement

- Market Opportunities

- Advancement in AI for digital healthcare technologies solution

- Pestle Analysis

- Porter’s Five Forces Analysis

- Market Drivers

- Market Outlook

- Overview (Industry Snapshot)

- Technology Analysis

- Supply Chain Analysis

- Value Chain Analysis

- Patent Analysis

- Ecosystem Analysis

- Trade Analysis

- Key Conference and Events

- Average Selling Price

- Key Developments

- Market Segment Outlook

- Segment Synopsis

- By Offering

- Hardware

- Software

- Services

- By Technology

- Mobile Health

- Telemedicine

- Digital Therapeutics

- Health Management Solutions

- EMR

- Wearables

- Others

- By Application

- Treatment & Monitoring

- Diagnostics

- Behavioral Health

- Health & Fitness

- Data, Integration & Analytics

- Research & Clinical Development

- Others (Bioinformatics tools, Imaging)

- By End-Use

- Provider

- Payors

- Pateints

- Regional Outlook

- Global Market Synopsis

- North America

- North America Digital Health Market Outlook

- USA Digital Health Market, By Offering

- USA Digital Health Market, By Technology

- USA Digital Health Market, By Application

- USA Digital Health Market, By End-Use

- North America Digital Health Market Outlook

*Note: Cross-segmentation by segments for each country will be covered as shown above.

- Canada

- Europe

- Europe Digital Health Market Outlook

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- Asia-Pacific Digital Health Market Outlook

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

- Latin America

- Latin America Digital Health Market Outlook

- Mexico

- Brazil

- Rest of Latin America

- Middle East & Africa

- Middle East & Africa Digital Health Market Outlook

- Saudi Arabia

- UAE

- Rest of MEA

- Competitive Landscape

- Market Share Analysis

- Volume Output Analysis

- Company Strategy Analysis

- Competitive Matrix

- Company Profiles

- All scripts Healthcare

- Company Synopsis

- Company Financials

- Product/Service Portfolio

- Recent Developments

- Analyst Perception

- All scripts Healthcare

*Note: All the companies in the section 9.1 will cover same sub-chapters as above.

9.2. Boston Scientific |

9.3. Cerner Corporation |

9.4. Epic Systems Corporation |

9.5. FUJIFILM Holdings Corporation |

9.6. General Electric Company |

9.7. Koninklijke Philips |

9.8. McKesson Corporation |

9.9. Medtronic |

9.10. Siemens Healthcare |

We specialize in providing syndicated market research reports that are highly sought after. We can also provide tailored customization to meet unique requirements. Our commitment exceeds limits as we empower clients with tactical and strategic support for well-informed business decisions and consistent success. Our experienced team continuously pushes the boundaries in market research, focusing on emerging markets with unwavering dedication. We provide comprehensive insights into global, regional, and country-level data, leaving no aspect hidden in any target market. Our market forecasts will help you in the following ways:

- Grasp the market opportunity for new products and services.

- Distinguish between emerging, maturing, and declining market opportunities.

- Build your business plans and strategies on factual data, not conjecture.

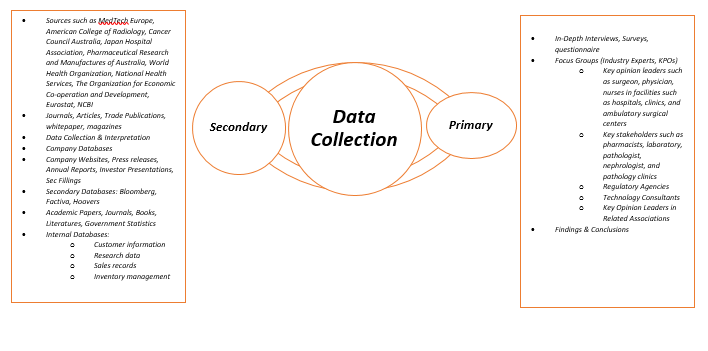

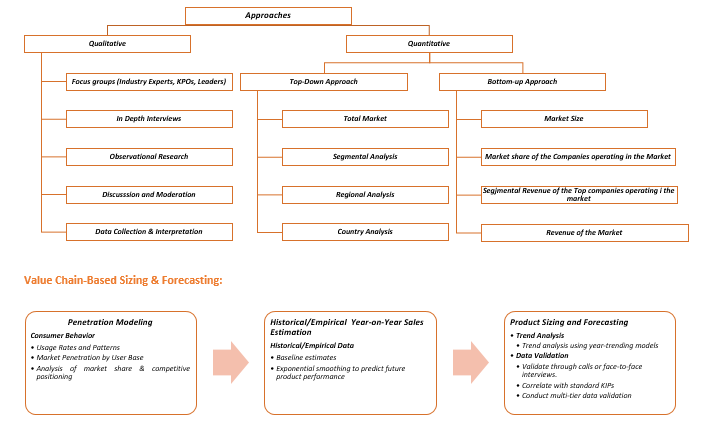

Data Collection, Analysis and Interpretation

As research analysts, we prioritize accuracy and in-depth analysis, employing diverse sources. These sources can be categorized into two main channels:

After collecting data from secondary and primary sources, we carefully examine the following to establish base numbers:

After collecting data from secondary and primary sources, we carefully examine the following to establish base numbers:

Data validation:

- Engage with in-house market analysts and industry experts to validate all collected data and cross-check it through calls or face-to-face interviews.

- Conduct thorough quality checks to validate the data included in the report and contact various members of our network to verify the data’s authenticity, resulting in error elimination and eradication of doubtful information.

- Correlate with standard KIPs to gain insights into future trends.

- Conduct multi-tier data validation through external thought leaders, market analysts, subject matter experts, comparative analysis, and review data collection instruments.

Continuous monitoring: Final report and presentation

- Our team collaborates with industry experts such as surgeons, physicians, and nurses in facilities such as hospitals, clinics, and ambulatory surgical centers, to finalize and validate data. We utilize advanced data analysis models to generate valuable insights. Our integrated report comes with robust analytics and advanced visualization capabilities to ensure consistency and efficiency. We implement a standardized content management approach, common tagging, and taxonomy structure for seamless information connectivity. We offer comprehensive market and company views to facilitate easy and accurate comparisons. Our goal is to provide our clients with exceptional analytical resources for a competitive edge. We empower them to transform data into strategic insights for innovation and growth.