Bioconcrete Market

- December, 2023

- Building & Construction, Infrastructure

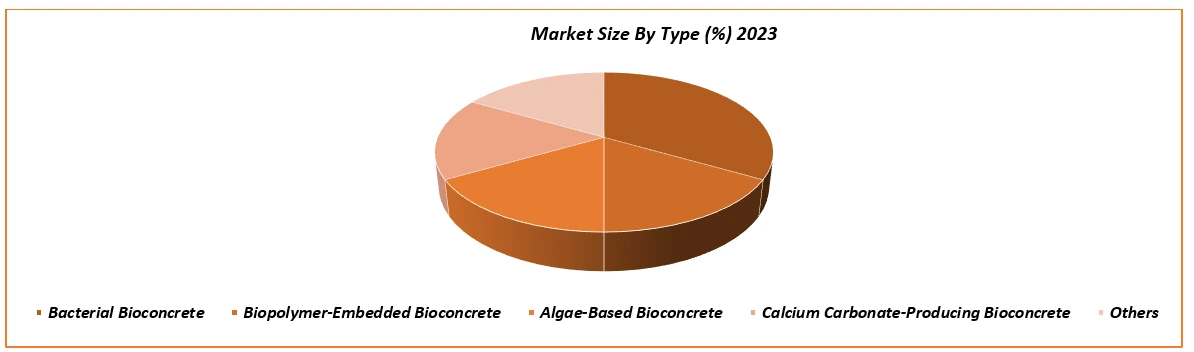

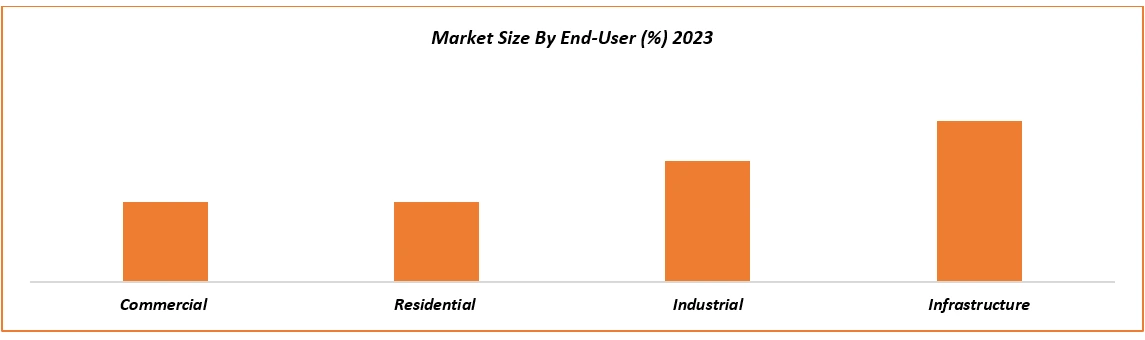

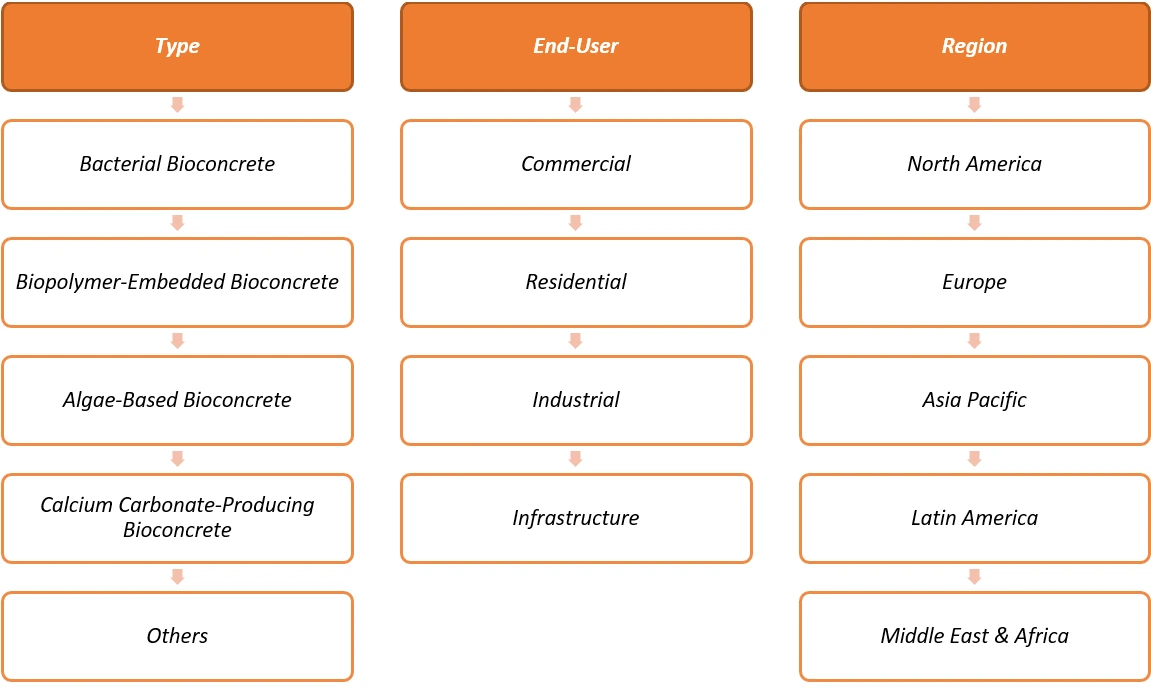

Bioconcrete Market Size Analysis by Type (Bacterial Bioconcrete, Biopolymer-Embedded Bioconcrete, Algae-Based Bioconcrete, Calcium Carbonate-Producing Bioconcrete), by End-Use Industry (Commercial, Residential, Industrial & Infrastructure) and by Region; Growth Trends & Forecasts (2024 - 2030)

As per Intent Market Research, the Bioconcrete Market size is expected to grow from USD 34 billion in 2023 to USD XX billion by 2030, at a CAGR of 28% during the forecast period (2024-2030). The bioconcrete market is segmented by type, end-use industry, and region.

Bioconcrete can heal cracks and damage by itself, the way living organisms heal wounds. It is made up of a bacterium that creates limestone, which transforms into a gel to fill in spaces when exposed to water and air. The concrete fills in fractures to reduce the risk of corrosion and shield the steel framework from outside influences. This self-healing capability improves the lifespan of structures, reduces maintenance costs, and is more sustainable. Bioconcrete is revolutionizing the construction materials industry by incorporating bacteria that can autonomously repair cracks and create more durable and sustainable structures.

Rising demand for sustainable construction materials is driving the market growth

Bioconcrete has a wide range of applications for dependable and robust construction. Its adoption is aided by its widespread application in construction for residential, commercial, industrial, and civil purposes, which is crucial for economic development. The reduced maintenance costs and extended lifespan of these structures will lead to plenty of prospects for different bioconcrete products to reach the market. Acceptance of bioconcrete is greatly influenced by the results of pilot projects being conducted worldwide. Bioconcrete market is driven by factors such as the prolonged usefulness of civil infrastructure, ease of use, and decreased maintenance costs.

Rising product costs are impeding the market growth

Bioconcrete market is hindered by the increased production costs. Traditional building materials, such as cement, mortar, lime, and stone, ensure the solidity of the building during construction. The introduction of self-maintained mortar and cement combinations increases the price of the standard material by two times as self-healing concrete technology advances, making end consumers less likely to use bioconcrete products. In the concrete matrix, challenging conditions such as high alkalinity, elevated temperature, and reduced oxygen supply impact the survival of bacteria incorporated into the concrete, a crucial factor for its function. This poses a significant challenge for the industry and has the potential to impede market growth. Various factors, including the survival elements of microbes and the provision of optimal conditions, are taken into account in the development of bacterial concrete.

Rising demand for bacterial bioconcrete in the construction sector thriving the market growth

Bacterial Bio concrete’s self-healing properties is projected to drive the bioconcrete market growth. This feature reduces repairs and enhances sustainability, making it valuable for infrastructure projects. Despite initial higher costs, the long-term savings make it an appealing option. The self-healing mechanism ensures that small cracks are swiftly sealed, preventing water and air infiltration, which can weaken the structural integrity of the concrete. This feature is particularly valuable in infrastructure projects such as bridges, tunnels, and roadways, where durability and reliability are of utmost importance.

Though the initial cost of bacterial bioconcrete is higher than traditional concrete, the long-term cost savings can be substantial. The cost savings make bacterial bioconcrete an appealing choice for projects where long-term financial considerations are crucial. Bacterial bioconcrete’s advancements and applications in real-world scenarios are driving the growth of the bioconcrete market. The combination of improved self-healing capabilities, increased durability, sustainability, and potential cost savings position bacterial bioconcrete as a promising solution for the construction industry.

Increasing demand for durable infrastructure products is responsible for the market growth

The infrastructure segment is set for significant growth, fueled by construction companies collaborating with product development firms to commercialize and expand the adoption of innovative solutions during the forecast period. This collaboration is expected to increase the demand for durable infrastructure products.

Industrial construction requires surfaces that can withstand harsh mechanical impacts, such as the carriage of heavy vehicles, operating heavy machinery, and heat treatments. As a result, bioconcrete is expected to gain popularity in industrial construction. Industrial structures need strong resistance to various physical and chemical factors to comply with technological requirements for a safe and convenient surface to carry out industrial operations.

Increasing government projects across Europe are stimulating market growth

The construction industry in Europe is expected to experience significant growth. This growth is fueled by positive indications in both private and public debt, which is expected to contribute favorably to market growth. Germany is a major contributor to the growth of the global construction industry in Western Europe. The government’s various projects and initiatives have propelled market growth, and the country has taken superior supportive measures for its economy during the pandemic, resulting in positive growth as compared to the U.K. and France.

The acquisition and product innovations by major players are key strategy adopted by players to sustain in competitive environment

The bioconcrete market is moderately competitive due to the limited presence of concrete manufacturers and less awareness about the product in the market. Some prominent players in the global bioconcrete market are BASF, Evonik, Covestro, Cemex, Acciona, Costain Group, TU Delft, IOI Oleochemicals, Koster Keunen, Aurochemicals, Berg + Schmidt, Hallstar, and Saint-Gobain.

The market growth is driven by rising mergers & acquisitions along with novel product innovations such as researchers at the University of South Australia are using bioconcrete with microcapsules to repair sewage pipes, potentially saving USD 1.4 billion in maintenance costs. In December 2021, GCP Applied Technologies was acquired by Saint-Gobain for USD 2.30 billion, and in July 2021, JP Concrete signed an agreement with Basilisk to operate its new Sensicrete compound. All these developments are driving the market growth.

Bioconcrete Market: Scope of the Report

The report provides key insights into Bioconcrete market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The analysis centers on market drivers, restraints, opportunities, and examines key players and the competitive landscape within the Bioconcrete market.

Bioconcrete is segmented by Type (Bacterial Bioconcrete, Biopolymer-Embedded Bioconcrete, Algae-Based Bioconcrete, Calcium Carbonate-Producing Bioconcrete) and by End-user (Commercial, Residential, Industrial & Infrastructure) and by Region. The report offers the market size and forecasts for the Bioconcrete market in value (USD billion) for all the above segments.

Report Scope:

Report Features | Description |

Market Size (2023-e) | USD 34 Bn |

Forecast Revenue (2030) | USD XX Bn |

CAGR (2024-2030) | 28% |

Base Year for Estimation | 2023 |

Historic Year | 2022 |

Forecast Period | 2024-2030 |

Report Coverage | Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

Segments Covered | By Type (Bacterial Bioconcrete, Biopolymer-Embedded Bioconcrete, Algae-Based Bioconcrete, Calcium Carbonate-Producing Bioconcrete) and By End-user (Commercial, Residential, Industrial & Infrastructure) and By Region (North America, Europe, Asia Pacific, Latin America & Middle East & Africa). |

Regional Analysis | North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

Competitive Landscape | BASF, Evonik, Covestro, Cemex, Acciona, Costain Group, TU Delft, IOI Oleochemicals, Koster Keunen, Aurochemicals, Berg + Schmidt, Hallstar & Saint-Gobain |

Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

Purchase Options | We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

1. Introduction |

1. 1. Study Assumptions and Bioconcrete Market Definition |

1.2. Scope of the Study |

2. Research Methodology |

3. Executive Summary |

4. Bioconcrete Market Dynamics |

4.1. Market Growth Drivers |

4.2 Market Growth Challenges |

5. Bioconcrete Market Outlook |

5.1. Regulatory landscape |

5.2 Value Chain Analysis |

5.3. Manufacturing Overview |

5.4 Opportunity Analysis |

5.5. Reimbursement & Investment Analysis 5.6 Porters Five Forces 5.7 Pestle Analysis 5.8 Patent Analysis 5.9 Production process overview 5.10 Pricing analysis |

6. Global Bioconcrete Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2030) |

6.1 Type |

6.1.1 Bacterial Bioconcrete |

6.1.2 Biopolymer-Embedded Bioconcrete |

6.1.3 Algae-Based Bioconcrete |

6.1.4 Calcium Carbonate-Producing Bioconcrete |

6.1.5 Others |

6.2 End-Use Industry |

6.2.1 Commercial |

6.2.2 Residential |

6.2.3 Industrial |

6.2.4 Infrastructure |

6.4 Region |

6.4.1 North America |

6.4.2 Europe |

6.4.3 Asia-Pacific |

6.4.4 Latin America |

6.4.5 Middle East and Africa |

7. North America Bioconcrete Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2030) |

7.1 Type |

7.1.1 Bacterial Bioconcrete |

7.1.2 Biopolymer-Embedded Bioconcrete |

7.1.3 Algae-Based Bioconcrete |

7.1.4 Calcium Carbonate-Producing Bioconcrete |

7.1.5 Others |

7.2 End-Use Industry |

7.2.1 Commercial |

7.2.2 Residential |

7.2.3 Industrial |

7.2.4 Infrastructure |

7.4 Country |

7.4.1 United States |

7.4.1.1 Type |

7.4.1.1.1 Bacterial Bioconcrete |

7.4.1.1.2 Biopolymer-Embedded Bioconcrete |

7.4.1.1.3 Algae-Based Bioconcrete |

7.4.1.1.4 Calcium Carbonate-Producing Bioconcrete |

7.4.1.1.5 Others |

7.4.1.2 End-Use Industry |

7.4.1.2.1 Commercial |

7.4.1.2.2 Residential |

7.4.1.2.3 Industrial |

7.4.1.2.4 Infrastructure |

7.4.2 Canada |

7.4.2.1 Type |

7.4.2.1.1 Bacterial Bioconcrete |

7.4.2.1.2 Biopolymer-Embedded Bioconcrete |

7.4.2.1.3 Algae-Based Bioconcrete |

7.4.2.1.4 Calcium Carbonate-Producing Bioconcrete |

7.4.2.1.5 Others |

7.4.2.2 End-Use Industry |

7.4.2.2.1 Commercial |

7.4.2.2.2 Residential |

7.4.2.2.3 Industrial |

7.4.2.2.4 Infrastructure |

8. Europe Market Bioconcrete Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2030) |

8.1 Type |

8.1.1 Bacterial Bioconcrete |

8.1.2 Biopolymer-Embedded Bioconcrete |

8.1.3 Algae-Based Bioconcrete |

8.1.4 Calcium Carbonate-Producing Bioconcrete |

8.1.5 Others |

8.2 End-Use Industry |

8.2.1 Commercial |

8.2.2 Residential |

8.2.3 Industrial |

8.2.4 Infrastructure |

8.4 Country |

8.4.1 United Kingdom |

8.4.1.1 Type |

8.4.1.1.1 Bacterial Bioconcrete |

8.4.1.1.2 Biopolymer-Embedded Bioconcrete |

8.4.1.1.3 Algae-Based Bioconcrete |

8.4.1.1.4 Calcium Carbonate-Producing Bioconcrete |

8.4.1.1.5 Others |

8.4.1.2 End-Use Industry |

8.4.1.2.1 Commercial |

8.4.1.2.2 Residential |

8.4.1.2.3 Industrial |

8.4.1.2.4 Infrastructure |

8.4.2 France |

8.4.2.1 Type |

8.4.2.1.1 Bacterial Bioconcrete |

8.4.2.1.2 Biopolymer-Embedded Bioconcrete |

8.4.2.1.3 Algae-Based Bioconcrete |

8.4.2.1.4 Calcium Carbonate-Producing Bioconcrete |

8.4.2.1.5 Others |

8.4.2.2 End-Use Industry |

8.4.2.2.1 Commercial |

8.4.2.2.2 Residential |

8.4.2.2.3 Industrial |

8.4.2.2.4 Infrastructure |

8.4.3 Germany |

8.4.3.1 Type |

8.4.3.1.1 Bacterial Bioconcrete |

8.4.3.1.2 Biopolymer-Embedded Bioconcrete |

8.4.3.1.3 Algae-Based Bioconcrete |

8.4.3.1.4 Calcium Carbonate-Producing Bioconcrete |

8.4.3.1.5 Others |

8.4.3.2 End-Use Industry |

8.4.3.2.1 Commercial |

8.4.3.2.2 Residential |

8.4.3.2.3 Industrial |

8.4.3.2.4 Infrastructure |

8.4.4 Italy |

8.4.4.1 Type |

8.4.4.1.1 Bacterial Bioconcrete |

8.4.4.1.2 Biopolymer-Embedded Bioconcrete |

8.4.4.1.3 Algae-Based Bioconcrete |

8.4.4.1.4 Calcium Carbonate-Producing Bioconcrete |

8.4.4.1.5 Others |

8.4.4.2 End-Use Industry |

8.4.4.2.1 Commercial |

8.4.4.2.2 Residential |

8.4.4.2.3 Industrial |

8.4.4.2.4 Infrastructure |

8.4.5 Rest of Europe |

8.4.5.1 Type |

8.4.5.1.1 Bacterial Bioconcrete |

8.4.5.1.2 Biopolymer-Embedded Bioconcrete |

8.4.5.1.3 Algae-Based Bioconcrete |

8.4.5.1.4 Calcium Carbonate-Producing Bioconcrete |

8.4.5.1.5 Others |

8.4.5.2 End-Use Industry |

8.4.5.2.1 Commercial |

8.4.5.2.2 Residential |

8.4.5.2.3 Industrial |

8.4.5.2.4 Infrastructure |

9. Asia Pacific Bioconcrete Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2030) |

9.1 Type |

9.1.1 Bacterial Bioconcrete |

9.1.2 Biopolymer-Embedded Bioconcrete |

9.1.3 Algae-Based Bioconcrete |

9.1.4 Calcium Carbonate-Producing Bioconcrete |

9.1.5 Others |

9.2 End-Use Industry |

9.2.1 Commercial |

9.2.2 Residential |

9.2.3 Industrial |

9.2.4 Infrastructure |

9.4 Country |

9.4.1 China |

9.4.1.1 Type |

9.4.1.1.1 Bacterial Bioconcrete |

9.4.1.1.2 Biopolymer-Embedded Bioconcrete |

9.4.1.1.3 Algae-Based Bioconcrete |

9.4.1.1.4 Calcium Carbonate-Producing Bioconcrete |

9.4.1.1.5 Others |

9.4.1.2 End-Use Industry |

9.4.1.2.1 Commercial |

9.4.1.2.2 Residential |

9.4.1.2.3 Industrial |

9.4.1.2.4 Infrastructure |

9.4.2 Japan |

9.4.2.1 Type |

9.4.2.1.1 Bacterial Bioconcrete |

9.4.2.1.2 Biopolymer-Embedded Bioconcrete |

9.4.2.1.3 Algae-Based Bioconcrete |

9.4.2.1.4 Calcium Carbonate-Producing Bioconcrete |

9.4.2.1.5 Others |

9.4.2.2 End-Use Industry |

9.4.2.2.1 Commercial |

9.4.2.2.2 Residential |

9.4.2.2.3 Industrial |

9.4.2.2.4 Infrastructure |

9.4.3 India |

9.4.3.1 Type |

9.4.3.1.1 Bacterial Bioconcrete |

9.4.3.1.2 Biopolymer-Embedded Bioconcrete |

9.4.3.1.3 Algae-Based Bioconcrete |

9.4.3.1.4 Calcium Carbonate-Producing Bioconcrete |

9.4.3.1.5 Others |

9.4.3.2 End-Use Industry |

9.4.3.2.1 Commercial |

9.4.3.2.2 Residential |

9.4.3.2.3 Industrial |

9.4.3.2.4 Infrastructure |

9.4.4 South Korea |

9.4.4.1 Type |

9.4.4.1.1 Bacterial Bioconcrete |

9.4.4.1.2 Biopolymer-Embedded Bioconcrete |

9.4.4.1.3 Algae-Based Bioconcrete |

9.4.4.1.4 Calcium Carbonate-Producing Bioconcrete |

9.4.4.1.5 Others |

9.4.4.2 End-Use Industry |

9.4.4.2.1 Commercial |

9.4.4.2.2 Residential |

9.4.4.2.3 Industrial |

9.4.4.2.4 Infrastructure |

9.4.5 Rest of Asia Pacific |

9.4.5.1 Type |

9.4.5.1.1 Bacterial Bioconcrete |

9.4.5.1.2 Biopolymer-Embedded Bioconcrete |

9.4.5.1.3 Algae-Based Bioconcrete |

9.4.5.1.4 Calcium Carbonate-Producing Bioconcrete |

9.4.5.1.5 Others |

9.4.5.2 End-Use Industry |

9.4.5.2.1 Commercial |

9.4.5.2.2 Residential |

9.4.5.2.3 Industrial |

9.4.5.2.4 Infrastructure |

10. Latin America Bioconcrete Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2030) |

10.1 Type |

10.1.1 Bacterial Bioconcrete |

10.1.2 Biopolymer-Embedded Bioconcrete |

10.1.3 Algae-Based Bioconcrete |

10.1.4 Calcium Carbonate-Producing Bioconcrete |

10.1.5 Others |

10.2 End-Use Industry |

10.2.1 Commercial |

10.2.2 Residential |

10.2.3 Industrial |

10.2.4 Infrastructure |

10.4 Country |

10.4.1 Brazil |

10.4.1.1 Type |

10.4.1.1.1 Bacterial Bioconcrete |

10.4.1.1.2 Biopolymer-Embedded Bioconcrete |

10.4.1.1.3 Algae-Based Bioconcrete |

10.4.1.1.4 Calcium Carbonate-Producing Bioconcrete |

10.4.1.1.5 Others |

10.4.1.2 End-Use Industry |

10.4.1.2.1 Commercial |

10.4.1.2.2 Residential |

10.4.1.2.3 Industrial |

10.4.1.2.4 Infrastructure |

10.4.2 Mexico |

10.4.2.1 Type |

10.4.2.1.1 Bacterial Bioconcrete |

10.4.2.1.2 Biopolymer-Embedded Bioconcrete |

10.4.2.1.3 Algae-Based Bioconcrete |

10.4.2.1.4 Calcium Carbonate-Producing Bioconcrete |

10.4.2.1.5 Others |

10.4.2.2 End-Use Industry |

10.4.2.2.1 Commercial |

10.4.2.2.2 Residential |

10.4.2.2.3 Industrial |

10.4.2.2.4 Infrastructure |

10.4.3 Argentina |

10.4.3.1 Type |

10.4.3.1.1 Bacterial Bioconcrete |

10.4.3.1.2 Biopolymer-Embedded Bioconcrete |

10.4.3.1.3 Algae-Based Bioconcrete |

10.4.3.1.4 Calcium Carbonate-Producing Bioconcrete |

10.4.3.1.5 Others |

10.4.3.2 End-Use Industry |

10.4.3.2.1 Commercial |

10.4.3.2.2 Residential |

10.4.3.2.3 Industrial |

10.4.3.2.4 Infrastructure |

10.4.4 Rest of Latin America |

10.4.4.1 Type |

10.4.4.1.1 Bacterial Bioconcrete |

10.4.4.1.2 Biopolymer-Embedded Bioconcrete |

10.4.4.1.3 Algae-Based Bioconcrete |

10.4.4.1.4 Calcium Carbonate-Producing Bioconcrete |

10.4.4.1.5 Others |

10.4.4.2 End-Use Industry |

10.4.4.2.1 Commercial |

10.4.4.2.2 Residential |

10.4.4.2.3 Industrial |

10.4.4.2.4 Infrastructure |

11. Middle East & Africa Bioconcrete Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2030) |

11.1 Type |

11.1.1 Bacterial Bioconcrete |

11.1.2 Biopolymer-Embedded Bioconcrete |

11.1.3 Algae-Based Bioconcrete |

11.1.4 Calcium Carbonate-Producing Bioconcrete |

11.1.5 Others |

11.2 End-Use Industry |

11.2.1 Commercial |

11.2.2 Residential |

11.2.3 Industrial |

11.2.4 Infrastructure |

11.4 Country |

11.4.1 United Arab Emirates |

11.4.1.1 Type |

11.4.1.1.1 Bacterial Bioconcrete |

11.4.1.1.2 Biopolymer-Embedded Bioconcrete |

11.4.1.1.3 Algae-Based Bioconcrete |

11.4.1.1.4 Calcium Carbonate-Producing Bioconcrete |

11.4.1.1.5 Others |

11.4.1.2 End-Use Industry |

11.4.1.2.1 Commercial |

11.4.1.2.2 Residential |

11.4.1.2.3 Industrial |

11.4.1.2.4 Infrastructure |

11.4.2 Saudi Arabia |

11.4.2.1 Type |

11.4.2.1.1 Bacterial Bioconcrete |

11.4.2.1.2 Biopolymer-Embedded Bioconcrete |

11.4.2.1.3 Algae-Based Bioconcrete |

11.4.2.1.4 Calcium Carbonate-Producing Bioconcrete |

11.4.2.1.5 Others |

11.4.2.2 End-Use Industry |

11.4.2.2.1 Commercial |

11.4.2.2.2 Residential |

11.4.2.2.3 Industrial |

11.4.2.2.4 Infrastructure |

11.4.3 South Africa |

11.4.3.1 Type |

11.4.3.1.1 Bacterial Bioconcrete |

11.4.3.1.2 Biopolymer-Embedded Bioconcrete |

11.4.3.1.3 Algae-Based Bioconcrete |

11.4.3.1.4 Calcium Carbonate-Producing Bioconcrete |

11.4.3.1.5 Others |

11.4.3.2 End-Use Industry |

11.4.3.2.1 Commercial |

11.4.3.2.2 Residential |

11.4.3.2.3 Industrial |

11.4.3.2.4 Infrastructure |

11.4.4 Rest of Middle East and Africa |

11.4.4.1 Type |

11.4.4.1.1 Bacterial Bioconcrete |

11.4.4.1.2 Biopolymer-Embedded Bioconcrete |

11.4.4.1.3 Algae-Based Bioconcrete |

11.4.4.1.4 Calcium Carbonate-Producing Bioconcrete |

11.4.4.1.5 Others |

11.4.4.2 End-Use Industry |

11.4.4.2.1 Commercial |

11.4.4.2.2 Residential |

11.4.4.2.3 Industrial |

11.4.4.2.4 Infrastructure |

12. Competitive Landscape |

12.1 Company Market Share Analysis |

12.2 Competitive Matrix |

12.2 Product Benchmarking |

12.3 Company Profiles (Manufacturers of Bioconcrete) |

12.3.1 Cemex |

12.3.1.1 Company Synopsis |

12.3.1.2 Company Financials |

12.3.1.3 Product/ Service Portfolio |

12.3.1.4 Recent Developments |

12.3.2 Covestro |

12.3.3 Evonik |

12.3.4 BASF |

12.3.5 Saint-Gobain |

12.3.6 Costain Group |

12.3.7 TU Delft |

12.3.8 IOI Oleochemicals |

12.3.9 Koster Keunen |

12.3.10 Aurochemicals |

12.3.11 Berg + Schmidt |

12.3.12 Hallstar |

12.4 Company Profiles (Demand Side) |

12.4.1 GCP Applied Technologies Inc. |

12.4.1.1 Company Synopsis |

12.3.1.2 Company Financials |

12.3.1.3 Product/ Service Portfolio |

12.3.1.4 Recent Developments |

12.4.2 Turner Construction |

12.4.3 Skanska |

12.4.4 Fluor Corporation |

12.4.5 Kiewit Corporation |

*List Not Exhaustive |

Disclaimer: The list of all other companies will be mentioned under client requirements |

13. Analyst Recommendations |

We specialize in providing syndicated market research reports that are highly sought after. We can also provide tailored customization to meet unique requirements. Our commitment exceeds limits as we empower clients with tactical and strategic support for well-informed business decisions and consistent success. Our experienced team continuously pushes the boundaries in market research, focusing on emerging markets with unwavering dedication. We provide comprehensive insights into global, regional, and country-level data, leaving no aspect hidden in any target market. Our market forecasts will help you:

- Grasp the market opportunity for new products and services.

- Distinguish between emerging, maturing, and declining market opportunities.

- Build your business plans and strategies on factual data, not conjecture.

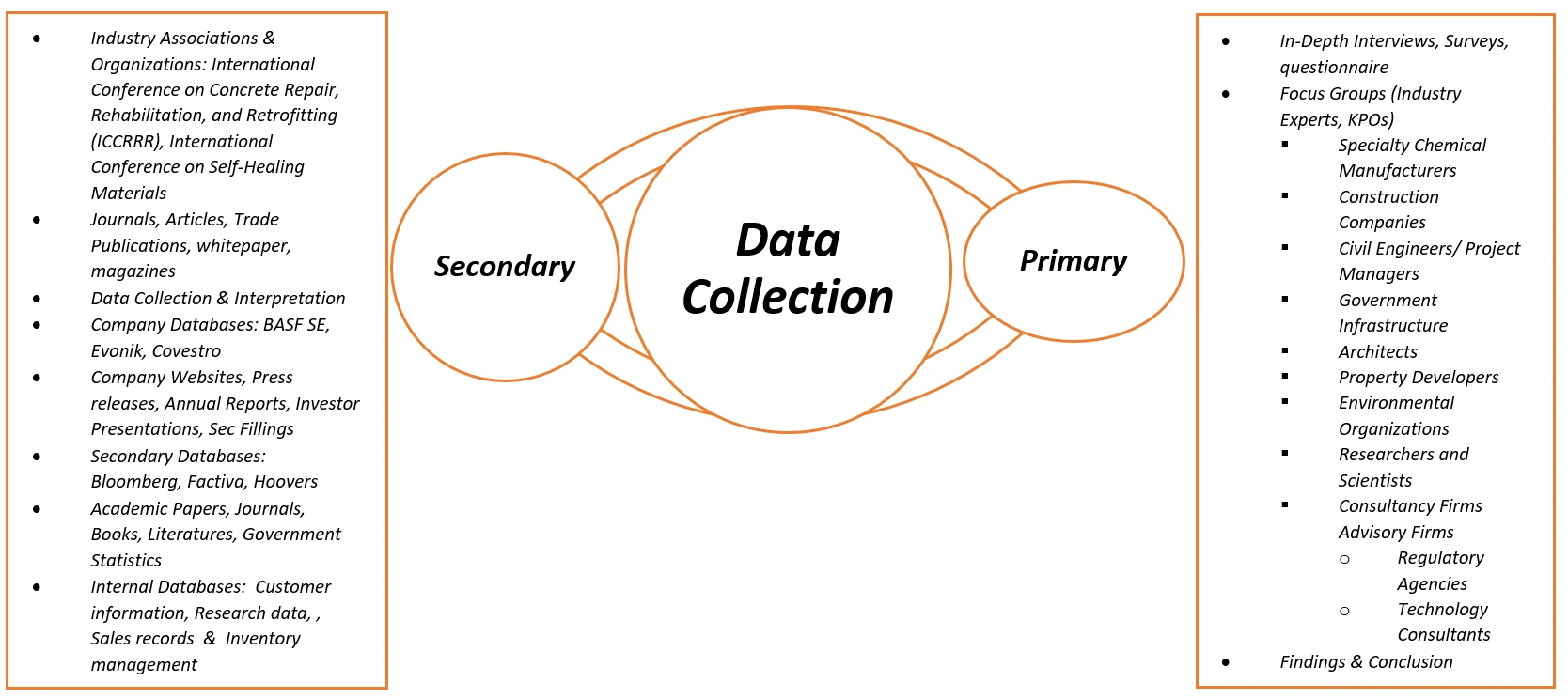

Data Collection, Analysis and Interpretation

As research analysts, we prioritize accuracy and in-depth analysis, employing diverse sources. These sources can be categorized into two main channels:

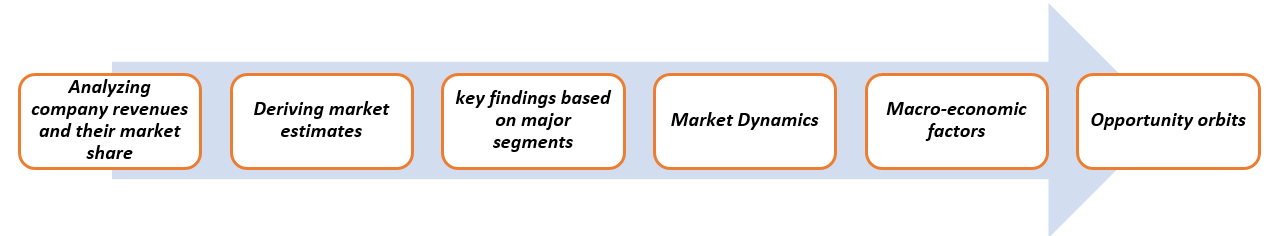

After collecting data from secondary and primary sources, we carefully examine the following to establish base numbers:

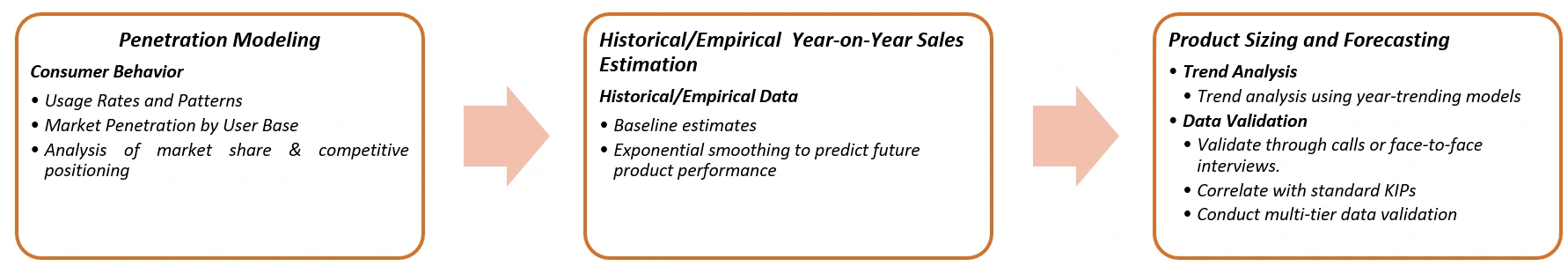

Market Sizing & Forecasting

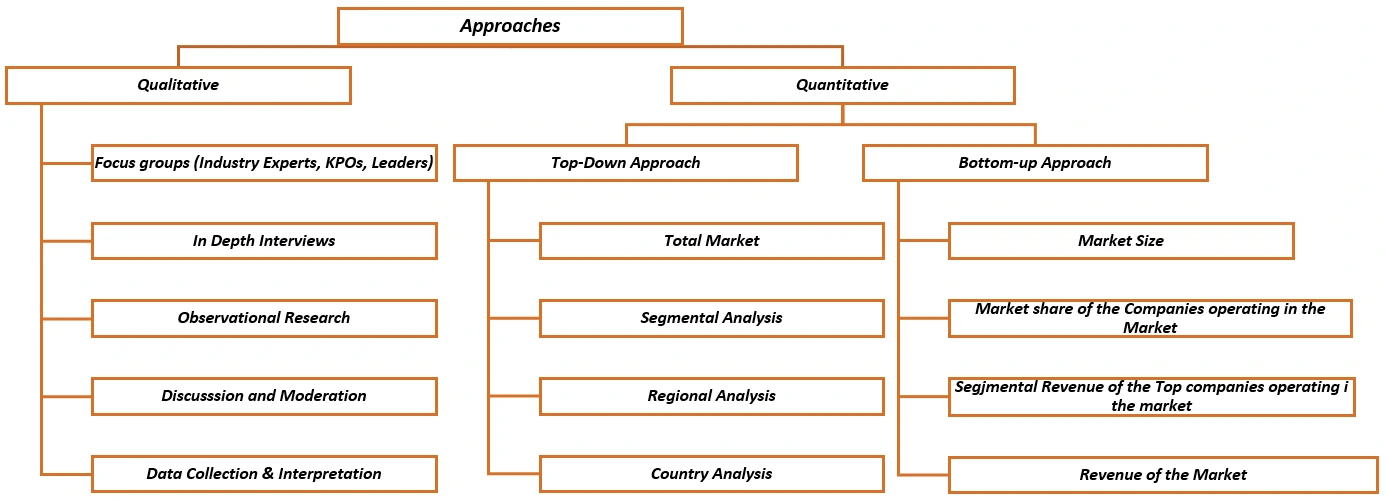

We use bottom-up and top-down approaches to segment and estimate quantitative aspects of the market. Our research reports also present data triangulation, which examines the market from TWO different perspectives.

Value Chain-Based Sizing & Forecasting:

Data Validation:

- Engage with in-house market analysts and industry experts to validate all collected data and cross-check it through calls or face-to-face interviews.

- Conduct thorough quality checks to validate the data included in the report and contact various members of our network to verify the data’s authenticity, resulting in error elimination and eradication of doubtful information.

- Correlate with standard KIPs to gain insights into future trends.

- Conduct multi-tier data validation through external thought leaders, market analysts, subject matter experts, comparative analysis, and review data collection instruments.

Continuous Monitoring: Final Report and Presentation

- Our team collaborates with industry experts such as Specialty Chemical Manufacturers, Construction Companies, Civil Engineers/ Project Managers & Government to finalize and validate data. We utilize advanced data analysis models to generate valuable insights. Our integrated report comes with robust analytics and advanced visualization capabilities to ensure consistency and efficiency. We implement a standardized content management approach, common tagging, and taxonomy structure for seamless information connectivity. We offer comprehensive market and company views to facilitate easy and accurate comparisons. Our goal is to provide our clients with exceptional analytical resources for a competitive edge. We empower them to transform data into strategic insights for innovation and growth.