Sustainable Food Products Market

- December, 2023

- Food & Beverages

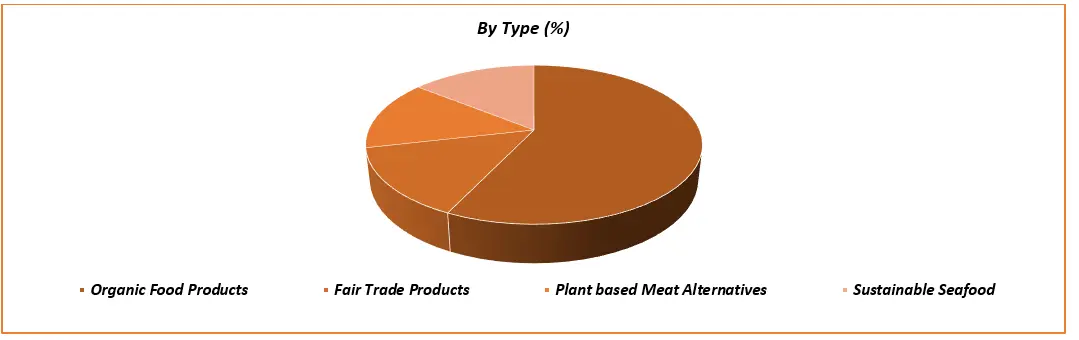

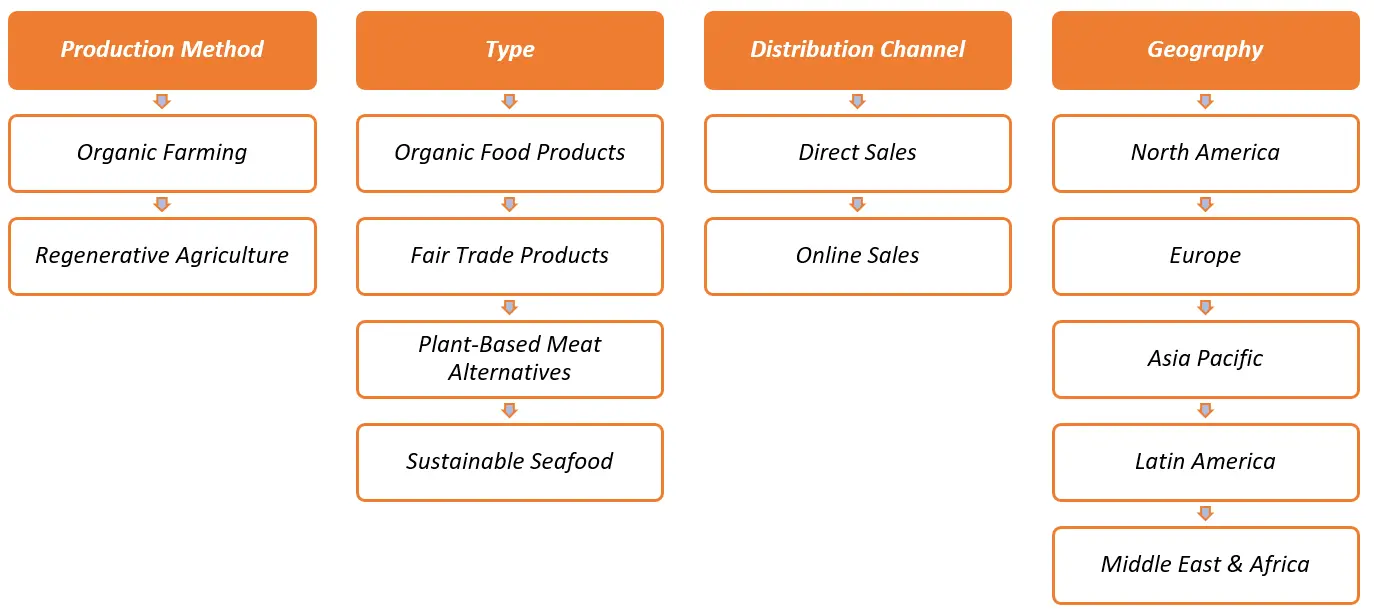

Sustainable Food Products Market Size Analysis, by Type (Organic Food Products, Fair Trade Products, Plant-Based Meat Alternatives, Sustainable Seafood), by Production Method (Organic Farming and Regenerative Agriculture), by Distribution Channel (Direct Sales and Indirect Sales) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa); Growth Trends and Forecasts (2024 - 2030)

As per Intent Market Research, the Sustainable Food Products Market size is expected to grow from USD xx billion in 2023 to USD XX billion by 2030, at a CAGR of xx% during the forecast period (2024-2030). The Sustainable Food Products Market is segmented by Type, Production method, Distribution Channel, and Region.

The world is undoubtedly shifting towards environmental sustainability, and the food industry is no exception. Sustainable food products are those produced using environmentally favorable practices with minimal environmental impact. Organic farming, a notable innovation, emphasizes natural fertilizers, crop rotation, and pest control techniques to generate healthier and more nutritious food for consumers while benefiting the environment. Industries beyond food, such as hospitality are increasingly integrating sustainable food practices, recognizing their significance.

Rising demand for organic foods is fueling the sustainable food products market growth

Consumers are becoming more conscious about their food choices and the environmental impact of their consumption patterns. There’s a growing demand for food products that are organic, locally sourced, and produced sustainably. Health concerns and an increased focus on wellness have driven the demand for organic and natural food options. Many consumers perceive sustainable foods as healthier alternatives.

Initiatives such as Amy’s Kitchen, a pizza production outlet in California to expand its business of organic food products is projected to fuel the sustainable foods market growth. Consumers prioritize products free of pesticides, synthetic fertilizers, and GMOs, and businesses must meet these demands by implementing ethical and sustainable farming practices such as regenerative agriculture, permaculture, and integrated pest management. These practices help to prevent soil erosion, improve water and air quality, promote biodiversity, and prioritize animal welfare.

Higher prices of sustainable food products are hindering sustainable food products market growth

Sustainable food products are undoubtedly beneficial for the environment and the people, however, there are some challenges that hinder their adoption. Selecting sustainable food products is challenging for consumers because they demand equitable working conditions, greater biodiversity, better soil, and higher costs. Moreover, limited availability and accessibility also restrict their expansion.

Alternative protein products are a promising substitute for traditional meat. Although replicating taste and texture remains a challenge, researchers are making significant progress in this area. Despite the challenge of cultural preferences, promoting an eco-friendly and sustainable food market is not impossible. Incorporating traditional techniques and ingredients can promote compatibility between sustainability and cultural diversity, making it more accessible for people from different backgrounds to embrace sustainable food choices.

The organic food products segment is constantly evolving due to increasing demand from customers

Organic food dominates the sustainable food products industry. It offers a range of products that are produced without synthetic pesticides, GMOs, antibiotics, or hormones, making them the ideal choice for health and environmentally-conscious consumers. The surge in demand for organic food is due to growing consumer awareness of the impact of food choices.

Emerging economies such as India, China, and Brazil are driving market growth, with consumers shifting towards healthier and eco-friendly food options. Social media and greater access to information have contributed to consumer education about organic food benefits. The growing concern about the environmental impact of conventional agriculture has further boosted demand for organic food. The organic food market is the future of sustainable food, and its dominance is set to continue during the forthcoming years.

Fairtrade products include a diverse array of goods, produced and traded in a manner that guarantees fair compensation and ethical treatment for the involved producers. Common fair trade products in the sustainable food market include coffee, tea, cocoa, chocolate, sugar, fruits, vegetables, nuts, spices, grains, and more. These products often carry fair trade certifications and labels, making it easier for consumers to identify and support ethically produced goods.

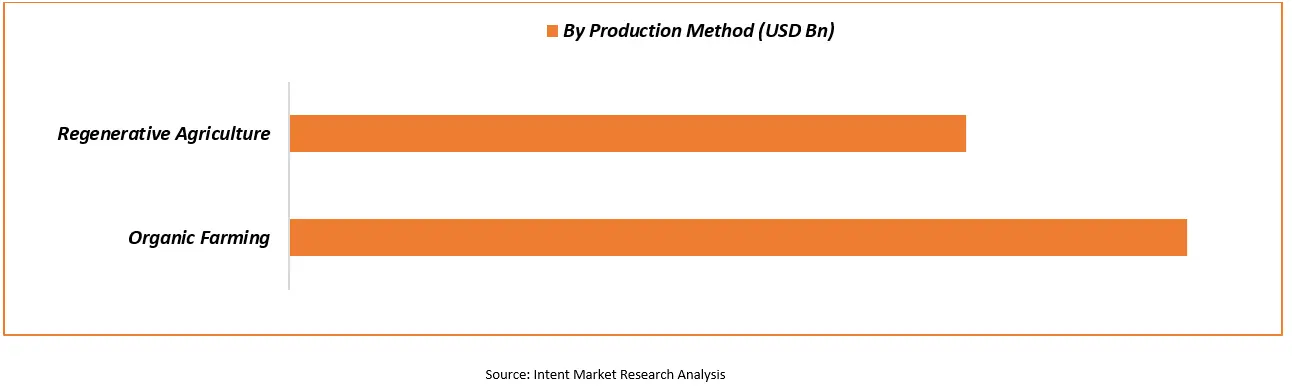

Organic farming promotes production of environmentally friendly and socially responsible food product

Organic farming is a key component of sustainable agriculture that promotes environment friendly and socially responsible food production. It drives the sustainable food products market through practices that prioritize soil health, reduce chemical use, promote biodiversity, and support local and small-scale farming. Organic farming aligns with the principles of environmental responsibility, health and nutrition, making it a significant contributor to the sustainable food products market’s growth and success.

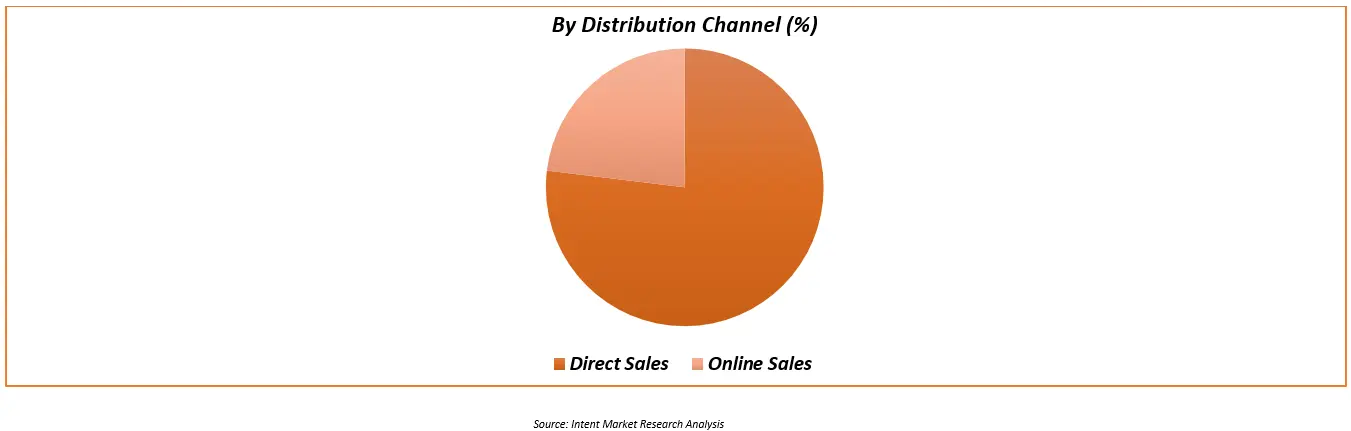

Direct sales offer extensive product ranges catering to consumers’ preferences thereby driving market growth

Direct sales dominate the distribution channels of sustainable food products. Supermarket, hypermarket, Food Cooperatives (Co-ops) offer extensive product ranges, including organic and sustainable food products, with accessibility and convenience. The dominance of emerging economies is largely influenced by their economic growth, driven by their ability to meet evolving consumer preferences and needs. Eco-friendly and sustainable food product choices, coupled with competitive pricing and special offers, broaden the appeal of these establishments to a wider consumer audience.

Increasing investments in research and development in Europe are stimulating regional growth

Europe leads the sustainable food products market due to its emphasis on organic farming, environmentally conscious approaches, and stringent regulations. With an abundance of organic farms, Europe provides a wide range of dietary options for environmentally conscious consumers. The region also encourages sustainable practices beyond agriculture, such as reducing food waste, supporting local food systems, and promoting environmentally responsible packaging solutions. To maintain its leading position, Europe invests in research and development while supporting innovative food production startups.

The Asia-Pacific region is experiencing the most rapid growth in the sustainable food products market, with India and China emerging as the primary producers. In 2021, as per APEDA India produced 3.2 million metric tons of organic products. This is due to the rising consumer awareness related to its health benefits and improvements in farming techniquesIn India, the government is backing organic agriculture through initiatives such as Paramparagat Krishi Vikas Yojana, which offers financial support and guidelines for sustainable organic farming models.

The merger & acquisition and product innovations are the key strategies adopted by major market players

The market for sustainable food products is characterized by intense competition due to the presence of numerous international and domestic players. The organic food and beverage market, in particular, is dominated by key players such as Conagra Brands, Amy’s Kitchen, Danone, General Mills, and The Hain Celestial Group. These industry leaders are primarily focused on acquiring smaller players and innovating their product lines to cater to changing consumer preferences and needs. The success of players in the sustainable food products market is heavily dependent on their ability to adapt to changing market trends and consumer preferences.

- In August 2022, Danone has acquired Happy Family which offers a range of organic products, including baby and baby food

- In July 2022, Grain Forests, a rural farm, introduced new organic products to bring their produce closer to the city. These products include sprouted ragi for babies, Health Mix for diabetics, Moringa powder for daily nutrition, and Ragi Dosa for a nutritious breakfast

- In February 2022, Valio Oy acquired Gold & Green Foods Oy which is intended to bolster Valio’s standing in the international plant-based food industry and to expand its global reach

In January 2022, ITC announced the development of plant-based meat products in India, including chicken-flavored patties and vegan burgers. This strategic move is aimed at capturing a significant share of the Indian market for meatless meat substitutes and catering to the growing demand for sustainable and ethical food choices.

Sustainable Food Products Market: Scope of the Report

The report provides key insights into the sustainable food products market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The analysis focuses on market drivers, constraints, opportunities, and other pertinent factors. It also conducts an examination of key players and the competitive landscape within the sustainable food products market.

Sustainable food products are segmented by Type (Organic Food Products, Fair Trade Products, Plant-Based and Meat Alternatives, Sustainable Seafood), By Production Method (Organic Farming and regenerative Agriculture), By Distribution Channel (Direct Sales and Indirect Sales) And Geography (North America, Europe, Asia Pacific, Latin America, Middle East and Africa). The report offers the market size and forecasts for the sustainable food products market in value (USD billion) for all the above segments.

Report Scope:

Report Scope:

| Report Features | Description |

| Market Value (2023) | USD xx Bn |

| Forecast Revenue (2030) | USD XX Bn |

| CAGR (2024-2030) | xx% |

| Base Year for Estimation | 2023 |

| Historical Period | 2022 |

| Forecast Period | 2024-2030 |

| Report Coverage | Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

| Segments Covered | By Type (Organic Food Products, Fair Trade Products, Plant-Based Meat Alternatives, Sustainable Seafood), by Production Method (Organic Farming and Regenerative Agriculture), by Distribution Channel (Direct Sales and Indirect Sales) |

| Regional Analysis | North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

| Competitive Landscape | Amy’s Kitchen, AEON CO., Unilever, Organic Valley, Conagra Brands, Hain Celestial, General Mill., Tescoplc.com, Waitrose & Partners, Kellogg NA Co., Maple Leaf Foods, Beyond Meat, Impossible Foods., The Kraft Heinz Company, REWE Group, Danone |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Purchase Options | We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

1. Introduction |

1. 1. Study Assumptions and Sustainable Food Products Market Definition |

1.2. Scope of the Study |

2. Research Methodology |

3. Executive Summary |

4. Sustainable Food Products Market Dynamics |

4.1. Market Growth Drivers |

4.2 Market Growth Challenges |

5. Sustainable Food Products Market Outlook |

5.1. Supply Chain & food Losses in the Supply Chain Overview |

5.2 Environmental Impact of Food across the world |

5.3. Impact on Inflation the food industry |

5.4 Consumer Purchasing Behaviors Analysis |

5.5. Sustainable Food Products Market Opportunity & Funding Analysis |

5.6. Regulatory Framework |

5.7. Porter’s Five Forces Analysis |

5.9. Impact of COVID-19 on the Sustainable Food Products Market 5.10 Pestle Analysis |

6. Global Sustainable Food Products Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2028) |

6.1 Production Method |

6.1.1 Organic Farming |

6.1.2 Regenerative Agriculture |

6.2 Type |

6.2.1 Organic Food Products |

6.2.2 Fair Trade Products |

6.2.3 Plant-Based Meat Alternatives |

6.2.4 Sustainable Seafood |

6.3 Distribution Channel |

6.3.1 Direct Sales |

6.1.2 Online Sales |

6.4 Geography |

6.4.1 North America |

6.4.2 Europe |

6.4.3 Asia-Pacific |

6.4.4 Latin America |

6.4.5 Middle East and Africa |

7. North America Sustainable Food Products Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2028) |

7.1 Production Method |

7.1.1 Organic Farming |

7.1.2 Regenerative Agriculture |

7.2 Type |

7.2.1 Organic Food Products |

7.2.2 Fair Trade Products |

7.2.3 Plant-Based Meat Alternatives |

7.2.4 Sustainable Seafood |

7.3 Distribution Channel |

7.3.1 Direct Sales |

7.1.2 Online Sales |

7.4 Country |

7.4.1 United States |

7.4.1.1 Production Method |

7.4.1.1.1 Organic Farming |

7.4.1.1.2 Regenerative Agriculture |

7.4.1.2 Type |

7.4.1.2.1 Organic Food Products |

7.4.1.2.2 Fair Trade Products |

7.4.1.2.3 Plant-Based Meat Alternatives |

7.4.1.2.4 Sustainable Seafood |

7.4.1.3 Distribution Channel |

7.4.1.3.1 Direct Sales |

7.4.1.3.2 Online Sales |

7.4.2 Canada |

7.4.2.1 Production Method |

7.4.2.1.1 Organic Farming |

7.4.2.1.2 Regenerative Agriculture |

7.4.2.2 Type |

7.4.2.2.1 Organic Food Products |

7.4.2.2.2 Fair Trade Products |

7.4.2.2.3 Plant-Based Meat Alternatives |

7.4.2.2.4 Sustainable Seafood |

7.4.2.3 Distribution Channel |

7.4.2.3.1 Direct Sales |

7.4.2.3.2 Online Sales |

8. Europe Sustainable Food Products Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2028) |

8.1 Production Method |

8.1.1 Organic Farming |

8.1.2 Regenerative Agriculture |

8.2 Type |

8.2.1 Organic Food Products |

8.2.2 Fair Trade Products |

8.2.3 Plant-Based Meat Alternatives |

8.2.4 Sustainable Seafood |

8.3 Distribution Channel |

8.3.1 Direct Sales |

8.1.2 Online Sales |

8.4 Country |

8.4.1 United Kingdom |

8.4.1.1 Production Method |

8.4.1.1.1 Organic Farming |

8.4.1.1.2 Regenerative Agriculture |

8.4.1.2 Type |

8.4.1.2.1 Organic Food Products |

8.4.1.2.2 Fair Trade Products |

8.4.1.2.3 Plant-Based Meat Alternatives |

8.4.1.2.4 Sustainable Seafood |

8.4.1.3 Distribution Channel |

8.4.1.3.1 Direct Sales |

8.4.1.3.2 Online Sales |

8.4.2 France |

8.4.2.1 Production Method |

8.4.2.1.1 Organic Farming |

8.4.2.1.2 Regenerative Agriculture |

8.4.2.2 Type |

8.4.2.2.1 Organic Food Products |

8.4.2.2.2 Fair Trade Products |

8.4.2.2.3 Plant-Based Meat Alternatives |

8.4.2.2.4 Sustainable Seafood |

8.4.2.3 Distribution Channel |

8.4.2.3.1 Direct Sales |

8.4.2.3.2 Online Sales |

8.4.3 Germany |

8.4.3.1 Production Method |

8.4.3.1.1 Organic Farming |

8.4.3.1.2 Regenerative Agriculture |

8.4.3.2 Type |

8.4.3.2.1 Organic Food Products |

8.4.3.2.2 Fair Trade Products |

8.4.3.2.3 Plant-Based Meat Alternatives |

8.4.3.2.4 Sustainable Seafood |

8.4.3.3 Distribution Channel |

8.4.3.3.1 Direct Sales |

8.4.3.3.2 Online Sales |

8.4.4 Italy |

8.4.4.1 Production Method |

8.4.4.1.1 Organic Farming |

8.4.4.1.2 Regenerative Agriculture |

8.4.4.2 Type |

8.4.4.2.1 Organic Food Products |

8.4.4.2.2 Fair Trade Products |

8.4.4.2.3 Plant-Based Meat Alternatives |

8.4.4.2.4 Sustainable Seafood |

8.4.4.3 Distribution Channel |

8.4.4.3.1 Direct Sales |

8.4.4.3.2 Online Sales |

8.4.5 Rest of Europe |

8.4.5.1 Production Method |

8.4.5.1.1 Organic Farming |

8.4.5.1.2 Regenerative Agriculture |

8.4.5.2 Type |

8.4.5.2.1 Organic Food Products |

8.4.5.2.2 Fair Trade Products |

8.4.5.2.3 Plant-Based Meat Alternatives |

8.4.5.2.4 Sustainable Seafood |

8.4.5.3 Distribution Channel |

8.4.5.3.1 Direct Sales |

8.4.5.3.2 Online Sales |

9. Asia Pacific Sustainable Food Products Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2028) |

9.1 Production Method |

9.1.1 Organic Farming |

9.1.2 Regenerative Agriculture |

9.2 Type |

9.2.1 Organic Food Products |

9.2.2 Fair Trade Products |

9.2.3 Plant-Based Meat Alternatives |

9.2.4 Sustainable Seafood |

9.3 Distribution Channel |

9.3.1 Direct Sales |

9.1.2 Online Sales |

9.4 Country |

9.4.1 China |

9.4.1.1 Production Method |

9.4.1.1.1 Organic Farming |

9.4.1.1.2 Regenerative Agriculture |

9.4.1.2 Type |

9.4.1.2.1 Organic Food Products |

9.4.1.2.2 Fair Trade Products |

9.4.1.2.3 Plant-Based Meat Alternatives |

9.4.1.2.4 Sustainable Seafood |

9.4.1.3 Distribution Channel |

9.4.1.3.1 Direct Sales |

9.4.1.3.2 Online Sales |

9.4.2 India |

9.4.2.1 Production Method |

9.4.2.1.1 Organic Farming |

9.4.2.1.2 Regenerative Agriculture |

9.4.2.2 Type |

9.4.2.2.1 Organic Food Products |

9.4.2.2.2 Fair Trade Products |

9.4.2.2.3 Plant-Based Meat Alternatives |

9.4.2.2.4 Sustainable Seafood |

9.4.2.3 Distribution Channel |

9.4.2.3.1 Direct Sales |

9.4.2.3.2 Online Sales |

9.4.3 Japan |

9.4.3.1 Production Method |

9.4.3.1.1 Organic Farming |

9.4.3.1.2 Regenerative Agriculture |

9.4.3.2 Type |

9.4.3.2.1 Organic Food Products |

9.4.3.2.2 Fair Trade Products |

9.4.3.2.3 Plant-Based Meat Alternatives |

9.4.3.2.4 Sustainable Seafood |

9.4.3.3 Distribution Channel |

9.4.3.3.1 Direct Sales |

9.4.3.3.2 Online Sales |

9.4.4 South Korea |

9.4.4.1 Production Method |

9.4.4.1.1 Organic Farming |

9.4.4.1.2 Regenerative Agriculture |

9.4.4.2 Type |

9.4.4.2.1 Organic Food Products |

9.4.4.2.2 Fair Trade Products |

9.4.4.2.3 Plant-Based Meat Alternatives |

9.4.4.2.4 Sustainable Seafood |

9.4.4.3 Distribution Channel |

9.4.4.3.1 Direct Sales |

9.4.4.3.2 Online Sales |

9.4.5 Rest of Asia Pacific |

9.4.5.1 Production Method |

9.4.5.1.1 Organic Farming |

9.4.5.1.2 Regenerative Agriculture |

9.4.5.2 Type |

9.4.5.2.1 Organic Food Products |

9.4.5.2.2 Fair Trade Products |

9.4.5.2.3 Plant-Based Meat Alternatives |

9.4.5.2.4 Sustainable Seafood |

9.4.5.3 Distribution Channel |

9.4.5.3.1 Direct Sales |

9.4.5.3.2 Online Sales |

10. Latin America Sustainable Food Products Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2028) |

10.1 Production Method |

10.1.1 Organic Farming |

10.1.2 Regenerative Agriculture |

10.2 Type |

10.2.1 Organic Food Products |

10.2.2 Fair Trade Products |

10.2.3 Plant-Based Meat Alternatives |

10.2.4 Sustainable Seafood |

10.3 Distribution Channel |

10.3.1 Direct Sales |

10.1.2 Online Sales |

10.4 Country |

10.4.1 Brazil |

10.4.1.1 Production Method |

10.4.1.1.1 Organic Farming |

10.4.1.1.2 Regenerative Agriculture |

10.4.1.2 Type |

10.4.1.2.1 Organic Food Products |

10.4.1.2.2 Fair Trade Products |

10.4.1.2.3 Plant-Based Meat Alternatives |

10.4.1.2.4 Sustainable Seafood |

10.4.1.3 Distribution Channel |

10.4.1.3.1 Direct Sales |

10.4.1.3.2 Online Sales |

10.4.2 Mexico |

10.4.2.1 Production Method |

10.4.2.1.1 Organic Farming |

10.4.2.1.2 Regenerative Agriculture |

10.4.2.2 Type |

10.4.2.2.1 Organic Food Products |

10.4.2.2.2 Fair Trade Products |

10.4.2.2.3 Plant-Based Meat Alternatives |

10.4.2.2.4 Sustainable Seafood |

10.4.2.3 Distribution Channel |

10.4.2.3.1 Direct Sales |

10.4.2.3.2 Online Sales |

10.4.3 Argentina |

10.4.3.1 Production Method |

10.4.3.1.1 Organic Farming |

10.4.3.1.2 Regenerative Agriculture |

10.4.3.2 Type |

10.4.3.2.1 Organic Food Products |

10.4.3.2.2 Fair Trade Products |

10.4.3.2.3 Plant-Based Meat Alternatives |

10.4.3.2.4 Sustainable Seafood |

10.4.3.3 Distribution Channel |

10.4.3.3.1 Direct Sales |

10.4.3.3.2 Online Sales |

10.4.4 Rest of Latin America |

10.4.4.1 Production Method |

10.4.4.1.1 Organic Farming |

10.4.4.1.2 Regenerative Agriculture |

10.4.4.2 Type |

10.4.4.2.1 Organic Food Products |

10.4.4.2.2 Fair Trade Products |

10.4.4.2.3 Plant-Based Meat Alternatives |

10.4.4.2.4 Sustainable Seafood |

10.4.4.3 Distribution Channel |

10.4.4.3.1 Direct Sales |

10.4.4.3.2 Online Sales |

11. Middle East & Africa Sustainable Food Products Market Segmentation (Market Size and Forecast by Value – USD billion, 2022 – 2028) |

11.1 Production Method |

11.1.1 Organic Farming |

11.1.2 Regenerative Agriculture |

11.2 Type |

11.2.1 Organic Food Products |

11.2.2 Fair Trade Products |

11.2.3 Plant-Based Meat Alternatives |

11.2.4 Sustainable Seafood |

11.2.5 Others |

11.3 Distribution Channel |

11.3.1 Direct Sales |

11.1.2 Online Sales |

11.4 Country |

11.4.1 United Arab Emirates |

11.4.1.1 Production Method |

11.4.1.1.1 Organic Farming |

11.4.1.1.2 Regenerative Agriculture |

11.4.1.2 Type |

11.4.1.2.1 Organic Food Products |

11.4.1.2.2 Fair Trade Products |

11.4.1.2.3 Plant-Based Meat Alternatives |

11.4.1.2.4 Sustainable Seafood |

11.4.1.3 Distribution Channel |

11.4.1.3.1 Direct Sales |

11.4.1.3.2 Online Sales |

11.4.2 Saudi Arabia |

11.4.2.1 Production Method |

11.4.2.1.1 Organic Farming |

11.4.2.1.2 Regenerative Agriculture |

11.4.2.2 Type |

11.4.2.2.1 Organic Food Products |

11.4.2.2.2 Fair Trade Products |

11.4.2.2.3 Plant-Based Meat Alternatives |

11.4.2.2.4 Sustainable Seafood |

11.4.2.3 Distribution Channel |

11.4.2.3.1 Direct Sales |

11.4.2.3.2 Online Sales |

11.4.3 South Africa |

11.4.3.1 Production Method |

11.4.3.1.1 Organic Farming |

11.4.3.1.2 Regenerative Agriculture |

11.4.3.2 Type |

11.4.3.2.1 Organic Food Products |

11.4.3.2.2 Fair Trade Products |

11.4.3.2.3 Plant-Based Meat Alternatives |

11.4.3.2.4 Sustainable Seafood |

11.4.3.3 Distribution Channel |

11.4.3.3.1 Direct Sales |

11.4.3.3.2 Online Sales |

11.4.4 Rest of Middle East and Africa |

11.4.4.1 Production Method |

11.4.4.1.1 Organic Farming |

11.4.4.1.2 Regenerative Agriculture |

11.4.4.2 Type |

11.4.4.2.1 Organic Food Products |

11.4.4.2.2 Fair Trade Products |

11.4.4.2.3 Plant-Based Meat Alternatives |

11.4.4.2.4 Sustainable Seafood |

11.4.4.3 Distribution Channel |

11.4.4.3.1 Direct Sales |

11.4.4.3.2 Online Sales |

12. Competitive Landscape |

12.1 Company Market Share Analysis |

12.2 Competitive Matrix |

12.3 Product Benchmarking |

12.4 Company Profiles |

12.4.1 AEON CO. 12.4.1.1 Company Synopsis 12.4.1.2 Company Financials 12.4.1.3 Product/ Service Portfolio 12.4.1.4 Recent Developments |

12.4.2 Amy’s Kitchen |

12.4.3 Beyond Meat |

12.4.4 Conagra Brands |

12.4.5 Danone |

12.4.6 General Mills |

12.4.7 Hain Celestial |

12.4.8 Impossible Foods |

12.4.9 Kellogg NA Co. |

12.4.10 Maple Leaf Foods |

12.4.11 Organic Valley |

12.4.12 Tescoplc.com |

12.4.13 The Kraft Heinz Company |

12.4.14 REWE Group |

12.4.15 Unilever |

12.4.16 Waitrose & Partners |

*List Not Exhaustive |

13. Analyst Recommendations |

We specialize in providing syndicated market research reports that are highly sought after. We can also provide tailored customization to meet unique requirements. Our commitment exceeds limits as we empower clients with tactical and strategic support for well-informed business decisions and consistent success. Our experienced team continuously pushes the boundaries in market research, focusing on emerging markets with unwavering dedication. We provide comprehensive insights into global, regional, and country-level data, leaving no aspect hidden in any target market. Our market forecasts will benefit you in the following ways:

- Grasp the market opportunity for new products and services.

- Distinguish between emerging, maturing, and declining market opportunities.

- Build your business plans and strategies on factual data, not conjecture.

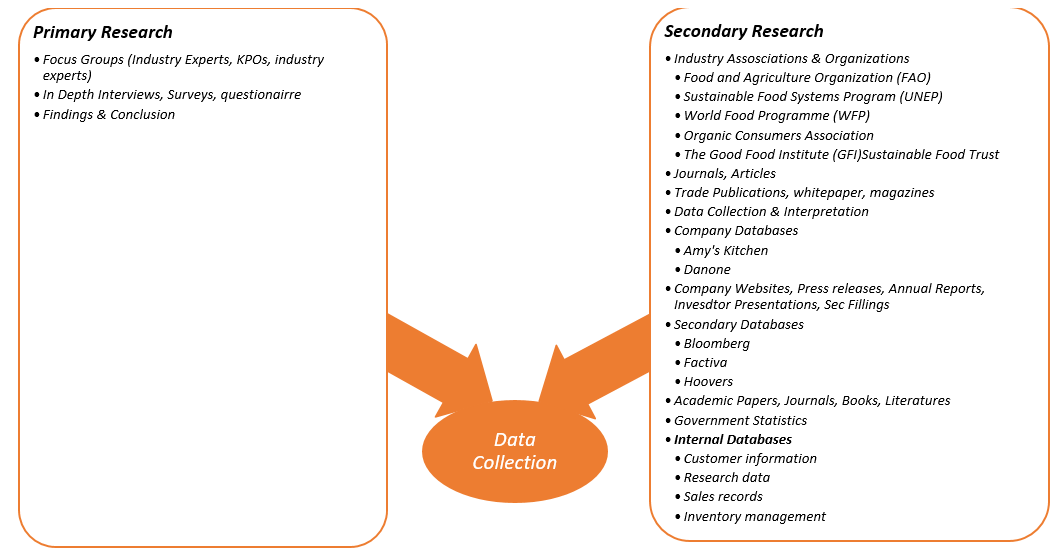

We place a strong emphasis on ensuring that each step of the research process is executed with meticulous attention to detail, aiming for minimal errors, and maintaining complete transparency throughout. We leverage multiple research methodologies to conduct our studies:

Data Collection and Interpretation

As research analysts, we prioritize accuracy and in-depth analysis, employing a diverse array of sources. These sources can be categorized into three main channels:

After collecting data from secondary and primary sources, we carefully examine the following to establish base numbers:

- Analyzing company revenues and their corresponding market share (involving the analysis of revenue data released by publicly listed manufacturers)

- Deriving market estimates by inspecting the primary market as well as its complementary markets

- Presenting key findings based on major segments and outlining top strategies by major players

- Analyzing the dynamics of the market, including drivers, opportunities, restraints, and challenges

- Assessing macro-economic factors and the regulatory framework influencing the market

- Evaluating market investment feasibility, conducting PEST and PORTER’s Five Force analyses

- Performing impact analysis of drivers and restraints, and conducting industry chain and cost structure analyses

- Creating opportunity maps, analyzing market competition scenarios, and conducting product life cycle analysis

- Identifying opportunity orbits and manufacturer intensity maps

- Analyzing major companies’ sales by value to gain comprehensive insights into the market

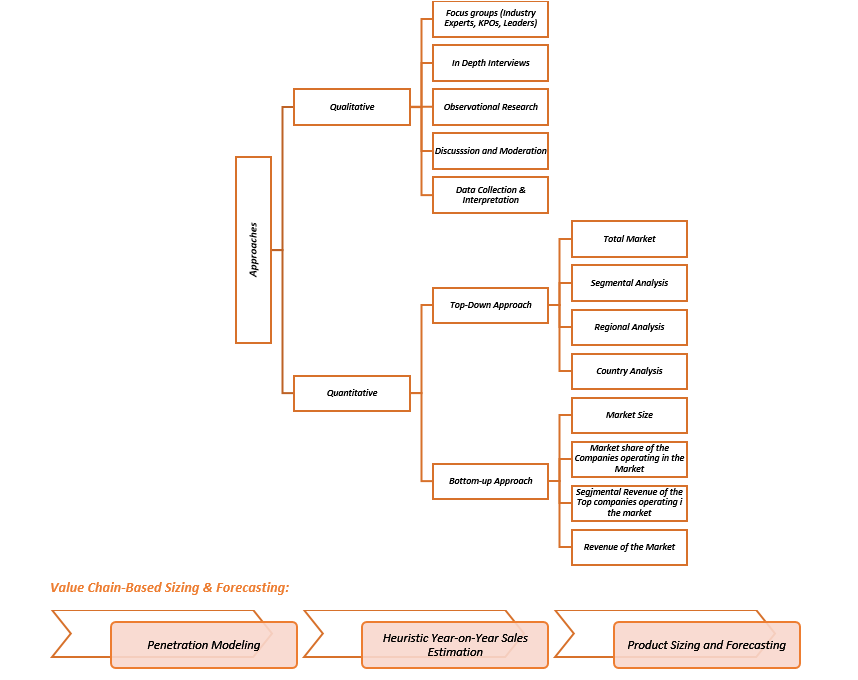

Market Sizing & Forecasting

We use both bottom-up and top-down approaches to segment and estimate quantitative aspects of the market. Our research reports also present data triangulation, which examines the market from three different perspectives.

- In the Bottom-Up Approach, we begin by collecting data at the micro-level, which includes individual data points and small samples. We aggregate and analyze the data to form broader conclusions and insights. We also include the market share of the vendors, which provides a granular view of the key players in the market, starting from the ground up. This approach is useful for industries with diverse segments and varied customer preferences. It is effective in exploratory research when we have little pre-existing knowledge and allows unexpected patterns and trends to emerge from data, leading to the creation of new theories.

- In the Top-Down Approach, we start with a macro-level view of the market, including the overall market size and industry trends. We analyze large-scale data and market indicators to make general assumptions. This approach provides a broader perspective and identifies the main market drivers and trends. We then narrow down the focus as data is scrutinized and specific segments are explored. This approach is effective for quickly assessing overall market potential and opportunities in various regions.

Consumer Behavior:

- Usage Rates and Patterns: Collect and analyze data on current product usage. It assists in product development and marketing strategies. Moreover, it also helps determine substitute rates.

- Market Penetration by User Base: Estimate the total market size and assess success in engaging potential consumers. Identify unmet needs and growth opportunities to enhance market penetration.

- Analyze market share, customer satisfaction, and preferences, providing insights into competitive positioning.

Historical/Empirical Data:

- Set initial figures to examine upcoming trends and to make well-informed decisions.

- Utilize exponential smoothing to forecast how a product might perform in the future, considering its trends and patterns over time.

Trend Analysis:

Conduct trend analysis using year-trending models to study historical data and identify patterns and trends that can influence future product penetration. This analysis aids in making proactive decisions and adapting strategies to capitalize on emerging opportunities and overcome challenges in the market.

Data Validation:

- Engage with in-house market analysts and industry experts to validate all collected data and cross-check it through calls or face-to-face interviews.

- Conduct thorough quality checks to validate the data included in the report and contact various members of our network to verify the data’s authenticity, resulting in error elimination and eradication of doubtful information.

- Correlate with standard KIPs to gain insights into future trends.

- Conduct multi-tier data validation through external thought leaders, market analysts, subject matter experts, comparative analysis, and review data collection instruments.

Continuous Monitoring: Final Report and Presentation

- Our team collaborates with industry experts to finalize and validate data. We utilize advanced data analysis models to generate valuable insights. Our integrated report comes with robust analytics and advanced visualization capabilities to ensure consistency and efficiency. We implement a standardized content management approach, common tagging, and taxonomy structure for seamless information connectivity. We offer comprehensive market and company views to facilitate easy and accurate comparisons. Our goal is to provide our clients with exceptional analytical resources for a competitive edge. We empower them to transform data into strategic insights for innovation and growth.